Nu Holdings: A Hidden Gem for Investors Eyeing Latin America’s Online Banking Boom

Ever heard of Nu Holdings (NYSE: NU)? If you haven’t, you’re not alone. While it has gained traction among some investors, most U.S. consumers are still unaware of the company. This is largely because Nu operates exclusively in Latin America.

For domestic investors with an interest in foreign markets, Nu Holdings presents a compelling opportunity. It might just transform your financial future.

Seizing the Moment

As the saying goes, timing is crucial in investing. While quality stocks are always a good addition, there are specific moments that make certain stocks particularly appealing. Right now is a prime time to invest in Nu Holdings.

Latin America is where North America was two decades ago in terms of technology adoption. Back then, cell phones existed, but the iPhone had not yet started a technological revolution. Surprisingly, more households in the U.S. were still using dial-up connections than broadband. The rapid evolution of mobile and internet technology that we have witnessed has taken only a couple of decades.

Latin America is not experiencing an identical journey, but broadband connectivity is only recently becoming widespread. Currently, about 60% of people in the region have access to fixed broadband service, compared to 80% to 90% in more developed regions. Meanwhile, GSMA estimates that about two-thirds of Latin Americans use mobile internet, a substantial increase from just a few years ago.

This growth sets the stage for online banking to flourish. Mordor Intelligence estimates Latin America’s online banking market will reach $2.1 billion this year, potentially growing to $3.3 billion by 2029.

Nu Holdings is well-positioned to capture a significant share of this expanding market.

Nu Holdings: Positioned for Success

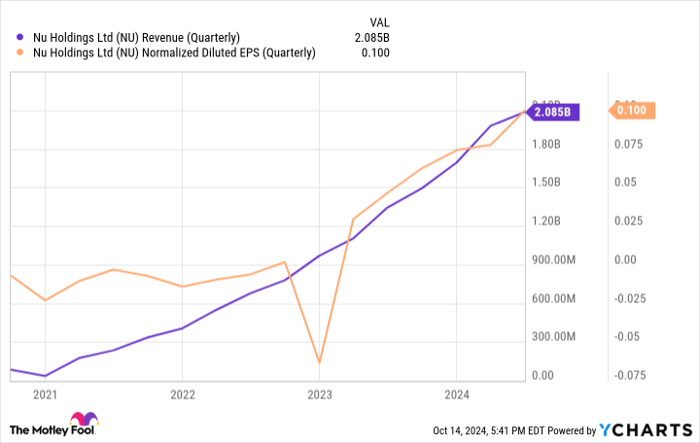

Recent quarter results lend support to this optimism. In the three months ending June, Nu generated $2.8 billion in revenue, resulting in a net income of $562 million. This remarkable performance marks over a 65% year-over-year growth in revenue, and deposit growth is keeping pace with that surge.

NU Revenue (Quarterly) data by YCharts

The driving force behind this growth? Consumer adoption. According to data from AMU Analysis, Nu is now Brazil’s top online bank, commanding about one-fourth of the local market. The company is likely seeing similar success in other regions where it operates.

However, a significant part of Nu’s opportunity lies in the untapped markets it has yet to serve. To date, Nu has established operations in Brazil, Mexico, and Colombia and currently serves approximately 105 million customers. This is just a small portion of Latin America’s total population of around 660 million, which leaves ample room for growth.

Notably, Nu just entered the Mexican market last year, initially offering basic banking services, and is continuously enhancing its offerings, including personal loans. By August, it had attracted 8 million customers and secured $3.3 billion in deposits in Mexico.

Simultaneously, the company is expanding its suite of services in Brazil and Colombia to include credit cards, insurance, and investment solutions. Analysts expect growth through geographic expansion and new product offerings to continue for the foreseeable future.

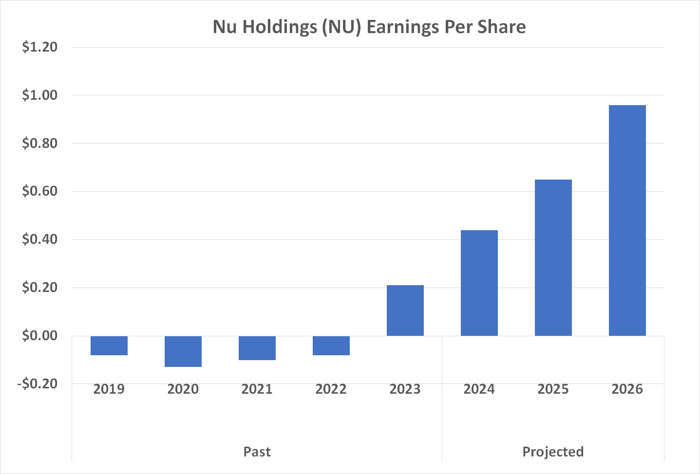

Data source: StockAnalysis.com. Chart by author.

Importantly, unlike many newer companies in this field, Nu Holdings is already profitable, and its profitability is on an upward trajectory.

Investment Considerations

Investors should approach with caution. While there is inherent risk, it’s primarily due to market volatility rather than the risk of the company failing. Thus, Nu may not be the ideal foundational investment for everyone’s portfolio. The current share price aligns closely with the analysts’ average price target of $14.46, which could slightly temper investment enthusiasm.

However, potential investors should not overly focus on these downsides. Analysts may increase their targets if Nu continues its positive growth trajectory. This stock is better suited for the aggressive-growth segment of an investment portfolio.

Ultimately, the narrative surrounding Nu—its growth prospects—may speak louder than its current valuation or financial results. The online bank is likely to see significant growth in size and earnings over the next few years. This progress might just tap into its full potential for generating substantial returns.

Is Now the Time to Invest $1,000 in Nu Holdings?

Before making an investment in Nu Holdings, keep this in mind:

The Motley Fool Stock Advisor analyst team has recently highlighted what they consider to be the 10 best stocks for investors looking to buy now, and Nu Holdings did not make that list. The selected stocks are expected to deliver significant returns in the coming years.

For context, consider that when Nvidia made the list on April 15, 2005, an investment of $1,000 would now be worth $806,459!*

Stock Advisor offers a straightforward strategy for success, including help with portfolio building, expert updates, and two new stock picks each month. It has significantly outperformed the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.