Investing

Figuring out how to invest your money to generate consistent returns can seem daunting, especially if you don’t have extensive financial knowledge. Our investing section provides novice investors with the key strategies and tips for how to invest money wisely. We deliver actionable advice to help you build wealth steadily over time.

Simply put, investing as a beginner can look confusing initially. But sticking to proven, time-tested investing principles can help you avoid costly mistakes and accumulate real returns. We believe successful investing doesn’t require taking excessive risk. By learning how to assess risk vs reward and allocating capital prudently, regular investors can steadily build wealth over the long run.

From setting investment goals and building a diversified portfolio to rebalancing and maximizing returns, we cover the essential investing basics. You’ll learn timeless wisdom from legendary investors like Warren Buffett and Peter Lynch that can guide your own investment decisions. We explain key terms and concepts clearly, so you can grasp investing fundamentals quickly.

While investing always involves some degree of risk, going in with the right knowledge helps tilt the odds in your favor. We believe the average individual has the ability to invest successfully on their own and grow significant wealth over time. By teaching you how to invest money wisely, we aim to empower our readers to take control of their financial futures.

Ready to start growing your money? Browse our investing for beginners articles covering stocks, mutual funds, ETFs, real estate, and alternative assets. Learn how to open a brokerage account, build a portfolio, and invest with a long-term mindset. Sign up for our free investing newsletter to get simple money tips delivered to your inbox daily.

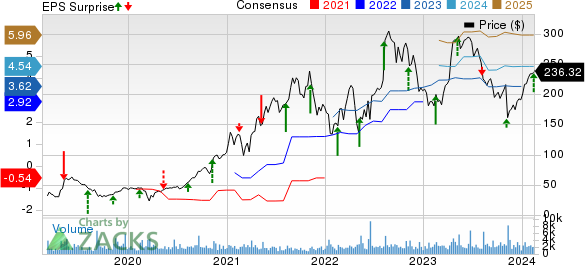

Shockwave Medical, Inc. Surpasses Q4 Earnings Expectations, Reports Strong Revenue Surge

Shockwave Medical, Inc. exceeded expectations by reporting an earnings per share (EPS) of $1.16 for the fourth quarter of 2023, surpassing the Zacks Consensus ...

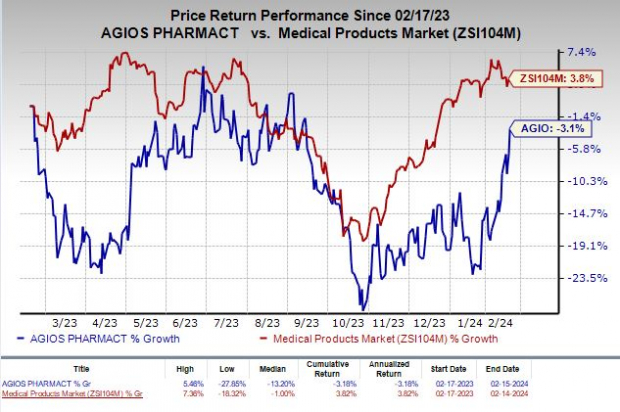

Agios Falls Short of Estimates

Agios (AGIO) Falls Short of Estimates in Q4 Earnings and Revenues

Agios Pharmaceuticals, Inc. (AGIO) reported a loss of $1.72 per share in the fourth quarter of 2023, wider than the Zacks Consensus Estimate of ...

Realty Income Anticipates Earnings Beat

Why Earnings Season Could Be Great for Realty Income (O)

The looming earnings season often feels like a high-stakes game of chance. Investors scan the market for stocks that appear to be gearing up ...

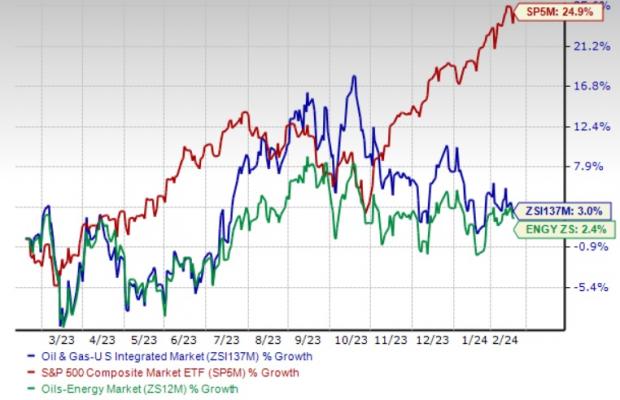

3 Integrated Energy Stocks Thriving Against the Odds

Determined Companies Stand Strong The volatile nature of upstream business in the integrated energy sector often means susceptibility to oil and gas price fluctuations. ...

Orchestra BioMed’s Upcoming Earnings Report

Orchestra BioMed’s Impending Earnings Surprise

Investors are constantly on the lookout for stocks that are poised to outperform during earnings season, and Orchestra BioMed Holdings, Inc. (OBIO) may be ...

Keysight Technologies Q1 Earnings Preview

Keysight Technologies Braces for Q1 Earnings Amid Revenue Contraction

Keysight Technologies, Inc. KEYS is set to disclose its first-quarter fiscal 2024 results on Feb 20 after market close, following an impressive trailing four-quarter ...

Trinity Industries to Report Q4 Earnings: What to Expect??

Trinity Industries to Report Q4 Earnings: What’s in the Cards??

Trinity Industries TRN is gearing up to announce its fourth-quarter 2023 results on Feb 22, before the market opens. Trinity has had an underwhelming ...

A Divergent Portfolio Oasis: Low-Beta High-Yielding Stocks to Navigate Market Turbulence

The stock market has experienced dynamic swings early in 2024 following an exceptional leap in 2023. The allure bordering technology stocks gradually dissolved as ...

Liberty Global: Navigating a Tempestuous Sea of Financial Data

Liberty Global: Navigating a Tempestuous Sea of Financial Data

Liberty Global‘s LBTYA loss from continuing operations in Q4 2023 amounted to $3.471 billion, up 25.9% year over year. Revenues increased 4.3% year over ...

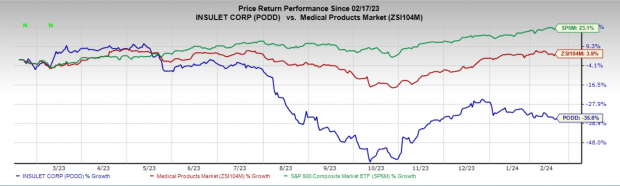

Insulet Corporation (PODD): Navigating the Future with Omnipod 5

Insulet Corporation’s relentless rally, propelled by its groundbreaking Omnipod 5 Automated Insulin Delivery (“AID”) system, stands out as a strong contender in the burgeoning ...