Two Years of Bull Market: Lessons in Building a Winning Stock Portfolio

Celebrating Growth through Strategic Investing

This past weekend marked the second anniversary of the current bull market. It serves as a prime example of how to construct a diversified portfolio that can lead to substantial wealth accumulation.

Investing in high-quality businesses allows the advantages of compounding to elevate portfolio performance. You don’t need a lot of money to start investing; even small amounts can grow rapidly over time.

Strategies for a Successful Investment Portfolio

My preference is for a focused portfolio containing fewer stocks. Including 40 to 50 stocks often hinders the potential for outperforming the market because standout performers won’t significantly impact the overall returns.

Why focus on individual stocks? The goal is to invest in the best companies and exceed market performance.

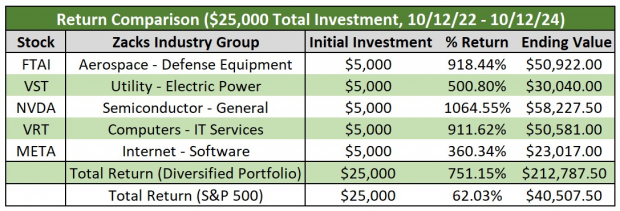

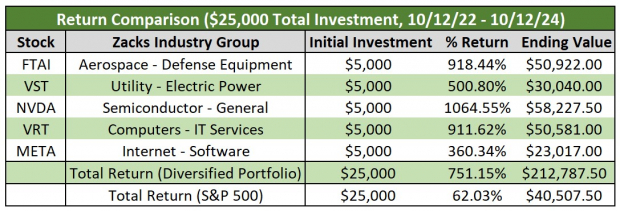

For illustration, we can consider a portfolio of five stocks: FTAI Aviation FTAI, Vistra Energy VST, Nvidia NVDA, Vertiv Holdings VRT, and the parent company of Facebook, Meta Platforms META. This selection leans towards technology, which has been a wise choice due to the prevailing bullish sentiment surrounding artificial intelligence.

The returns highlighted here span from mid-October 2022, the previous market low, to the two-year anniversary.

Image Source: Zacks Investment Research

Over this period, a $25,000 investment grew to approximately $212,787, significantly outperforming the S&P 500, which saw a 62% increase to just over $40,500. It’s important to note that these figures do not include the use of leverage or margin.

Building a well-diversified portfolio doesn’t need to be overly complex. In fact, over-diversification can dilute returns. In my view, simplicity often yields better results in both investing and life. This journey requires a long-term perspective to achieve success.

This example illustrates that fantastic returns don’t necessitate speculative stocks; focusing on quality pays off.

Finding Stocks with Strong Profit Potential

There are countless stocks that may be strong candidates for investment at any moment. To refine our selection, we employ the Zacks Rank system.

Corporate earnings are key drivers of stock market trends, making earnings expectations essential. Our research indicates that earnings estimate revisions—changes in analysts’ earnings expectations—are a significant factor influencing stock prices.

After identifying a stock’s trend, the Zacks Rank system highlights those with positive earnings estimate revisions. We further analyze these stocks using a mix of fundamental and technical analysis to pinpoint those poised for substantial growth.

Only $1 to See All Zacks’ Buys and Sells

We’re serious.

A few years ago, we surprised our members by offering 30-day access to all of our stock picks for just $1, with no further obligations.

Thousands took advantage of this offer, while many hesitated, suspecting a catch. We aim for you to experience our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and others, which collectively closed 228 positions with double- and triple-digit gains in 2023 alone.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report:

NVIDIA Corporation (NVDA): Free Stock Analysis Report

FTAI Aviation Ltd. (FTAI): Free Stock Analysis Report

Vistra Corp. (VST): Free Stock Analysis Report

Vertiv Holdings Co. (VRT): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

For the full article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.