Centene’s New Michigan Plan Aims to Enhance Care for Dual Medicare and Medicaid Recipients

Centene Corporation (CNC) announced that its Michigan subsidiary, Meridian Health Plan of Michigan, has been selected by the Michigan Department of Health and Human Services (MDHHS) to provide integrated services for residents eligible for both Medicare and Medicaid. This will be accomplished through a new program called the Highly Integrated Dual Eligible Special Needs Plan (HIDE SNP).

Transition from Health Link to HIDE SNP

Begining on Jan. 1, 2026, this initiative will replace Michigan’s current Health Link pilot program, which serves adults aged 21 and older who participate in both Medicare and Medicaid. Collaboration with the Centers for Medicare and Medicaid Services will help facilitate this transition from a Medicare-Medicaid Plan (MMP) to the new MI Coordinated Health plan.

Enhanced Community Support

Meridian’s strong ties within Michigan’s community, providers, and local health organizations will enable it to better understand the diverse healthcare needs of residents. This insight is expected to help in delivering improved whole-person care and better health outcomes for the dually eligible individuals in Michigan.

Membership Footprint in Michigan

Currently, Meridian provides care for over 540,000 members in Michigan, including approximately 6,000 MMP members and more than 13,500 Medicare Dual Eligible Special Needs members. The unit is one of nine managed care organizations chosen to offer enhanced services through the new HIDE SNP program.

Recent Contract Win

In April 2024, Centene’s Michigan subsidiary was awarded a Medicaid contract by the MDHHS, allowing it to continue offering Medicaid health plans throughout the state as part of the Comprehensive Health Care Program.

How Contract Wins Impact Centene

Such contract wins are significant for health insurers, enabling them to attract new members and retain current ones. For Centene, a growing customer base typically leads to increased premiums, significantly contributing to the company’s revenue. As of June 30, 2024, Centene had a total membership of 28.5 million, with premiums rising 4.6% year-over-year in the first half of 2024. Centene consistently works to improve its health plans through provider collaborations and investments.

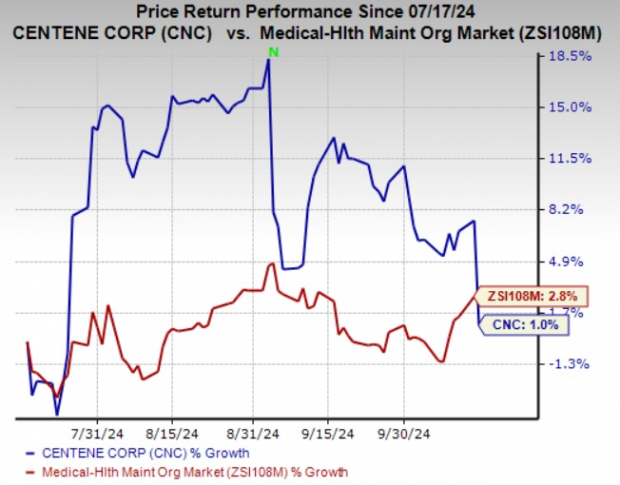

Centene’s shares have grown 1% over the past three months, trailing behind the industry’s overall gain of 2.8%. Currently, Centene holds a Zacks Rank of #4 (Sell).

Stocks Worth Considering

Other stocks within the Medical sector that are ranked higher include Addus HomeCare Corporation (ADUS), DaVita Inc. (DVA), and Encompass Health Corporation (EHC). Addus HomeCare is rated #1 (Strong Buy), while DaVita and Encompass Health have a score of #2 (Buy).

Addus HomeCare has consistently exceeded analyst earnings estimates, with an average surprise of 11.45%. Analysts expect earnings and revenue growth of 13.5% and 8.1%, respectively, for 2024 compared to 2023 figures. Its stock has risen 9.8% in the past three months.

DaVita also reported earnings exceeding estimates with an average surprise of 24.24%. The 2024 earnings and revenue estimates forecast an improvement of 18% and 5.4% over 2023 figures. DaVita’s stock has seen a 20.3% increase in the last three months.

Encompass Health has similarly outperformed, with an average earnings surprise of 14.12%. Analysts predict a 14.8% and 10.6% increase in earnings and revenues for 2024 compared to 2023. Its shares have risen by 13.1% in the last three months.

Zacks Highlights Top Semiconductor Stock

In the world of investments, a new semiconductor stock is drawing attention for its potential. Despite being significantly smaller than NVIDIA—a stock that has surged over 800% since a recommendation—this new semiconductor company holds promise for growth driven by demand in Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is projected to grow from $452 billion in 2021 to $803 billion by 2028.

For the latest recommendations from Zacks Investment Research, consider downloading the list of 5 Stocks Set to Double. To read more about companies like DaVita Inc. (DVA), Centene Corporation (CNC), Addus HomeCare Corporation (ADUS), and Encompass Health Corporation (EHC), visit Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.