Chart Industries, Inc. GTLS recently secured an order from Repsol to provide its advanced Howden hydrogen compression solutions for the expansion project of Repsol’s Sines industrial complex in Portugal.

GTLS’ shares decreased 1.5% yesterday, ending the trading session at $152.86.

Headquartered in Madrid, Spain, Repsol is a leading manufacturer and distributor of various petrochemical products that ranges from basic petrochemicals to derivatives. This includes several types of recyclable polyolefins, with a high degree of differentiation.

Inside the Headlines

Repsol’s expansion project at its Sines industrial complex involves the construction of two polypropylene and polyethylene plants with an investment of €657m. These plants will use solar-powered green electrolytic hydrogen to produce polymeric materials. Notably, the polymeric materials will be 100% recyclable and used in pharmaceutical, food and automotive industries.

Per the deal, Chart Industries will supply two diaphragm compressors that will ensure consistent delivery of high-pressure hydrogen for the production of polymeric materials.

Other Notable Deals

In April 2024, Chart Industries joined forces with GasLog LNG Services to explore the feasibility of a commercial-scale liquid hydrogen (LH2) supply chain. The two companies will collaborate to facilitate the worldwide supply of LH2 by utilizing GasLog LNG Services’ liquid hydrogen vessel, and Chart Industries’ expertise in cryogenics and large-scale liquefaction solutions.

In March 2024, this Zacks Rank #3 (Hold) company secured an order from Element Resources for its California-based green hydrogen production facility, Lancaster Clean Energy Center. Per the deal, GTLS will supply hydrogen liquefaction system, liquid hydrogen storage tanks, trailer loadout bays, transport, ISO containers and hydrogen compression to the facility.

Price Performance

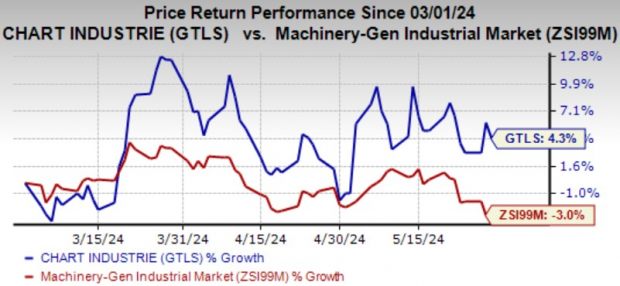

In the past three months, GTLS stock has gained 4.3% against the industry’s decline of 3%.

Image Source: Zacks Investment Research

The company is poised to benefit from solid orders and backlog as well as investments in growth opportunities. Headwinds from supply-chain constraints and a hike in raw materials might be concerning.

Stocks to Consider

Some better-ranked stocks from the same space are discussed below.

Luxfer Holdings LXFR presently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter average earnings surprise of 122.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for LXFR’s 2024 earnings has increased 13.5% in the past 60 days.

Crane Company CR presently carries a Zacks Rank of 2. It delivered a trailing four-quarter average earnings surprise of 15.2%.

In the past 60 days, the Zacks Consensus Estimate for CR’s 2024 earnings has risen 3.1%.

Tennant Company TNC currently carries a Zacks Rank of 2. TNC delivered a trailing four-quarter average earnings surprise of 38%.

In the past 60 days, the Zacks Consensus Estimate for its 2024 earnings has inched up 1.9%.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Crane Company (CR) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

Luxfer Holdings PLC (LXFR) : Free Stock Analysis Report

Tennant Company (TNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.