Netflix: Strong Q3 Results Leave Questions on Future Growth

Streaming leader Netflix (NFLX) experienced a significant rise in shares after releasing its better-than-expected third-quarter financial results. However, some analysts, like Citi’s Jason Bazinet, remain cautious about whether this marks a true rebirth for the company. Despite skepticism, investors responded positively, pushing shares up nearly 10% during Friday afternoon’s trading.

Analyst Skepticism Amid Positive Results

Even with a solid performance in Q3 and what Bazinet described as “really good” fundamentals, he has chosen to maintain a Neutral rating on Netflix stock. This decision may seem puzzling, so he elaborated on his reasoning.

Bazinet highlighted a “shifting bull case” for Netflix, emphasizing that the targets for the company are becoming increasingly ambitious. As Netflix’s valuation multiple expands, he cautioned that this trend could become unsustainable. Notably, he mentioned that an “accelerating top line” is typically essential for multiple expansion, yet Netflix’s growth appears to be decelerating.

New Price Increases on the Horizon

Netflix is already facing challenges as it seeks to maintain its revenue boost from the password-sharing crackdown, which has mostly been factored into current valuations. In search of additional revenue, the company is implementing price hikes in select regions.

Recently, prices in the Middle East and Africa increased, and reports from BBC indicate that prices in Japan and parts of Europe will soon follow. While Netflix anticipates that advertising will contribute to future growth, the company cautioned that it is still “early days,” with significant growth not expected until next year.

Current Market Sentiment on Netflix Stock

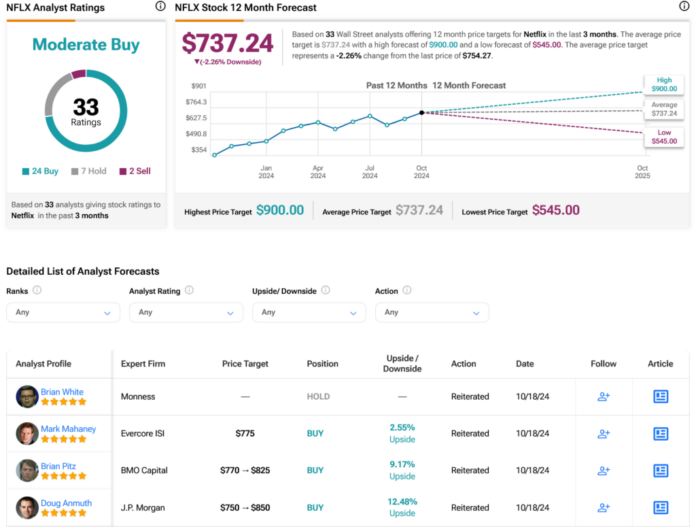

Market analysts are currently advising a Moderate Buy for NFLX stock, reflecting a consensus based on 24 Buys, seven Holds, and two Sells issued over the past three months. After a remarkable 88.17% increase in its share price over the past year, the average price target for NFLX stands at $737.24 per share, suggesting a slight downside risk of 2.26%.

See more NFLX analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.