Alibaba’s Growth Forecast Adjusted Amidst Competitive Challenges

Alibaba (NYSE:BABA) remains a dominant player in the tech industry, but challenges from competitors and slow consumer spending in China are raising concerns about its recovery.

Recent data from China’s National Bureau of Statistics (NBS) indicates that online sales of physical goods experienced slight growth in Q3, estimated at 3-5%. This marks an improvement compared to Q2, when sales declined by 3-5%. However, growth started to slow as the quarter progressed, dropping from low-double-digit increases in July to nearly flat in August and September.

Following this information, Baird analyst Colin Sebastian, who ranks in the top 3% of Wall Street stock professionals, has revised his revenue estimates for Alibaba downward. For FY2025, he now forecasts revenue of ¥1 trillion, reflecting a 6.4% year-over-year increase, down from a previous estimate of ¥1.01 trillion. His projections for FY2026 also dropped, from ¥1.09 trillion to ¥1.07 trillion, indicating a 6.8% growth. Nevertheless, Sebastian has raised his EBITA margin predictions for FY2025 and FY2026 from 16.4% and 16.3% to 16.9% and 16.7%, respectively.

“We recognize the macro situation in China is fluid, and scenarios exist where government stimulus could enhance consumer spending, especially during major shopping events,” Sebastian mentioned. He added that there are signs pointing to a “positive early start” for Singles’ Day, although this may be temporary or result from “spending pulled forward.”

Alarming or not, Alibaba is undergoing significant changes, according to Sebastian. The company’s core China commerce segment is stabilizing, while its international and cross-border operations continue to grow. Additionally, cloud services are expanding swiftly, partly fueled by advancements in Generative AI. “Moreover,” Sebastian stated, “we believe management is effectively balancing platform improvements and profitability.”

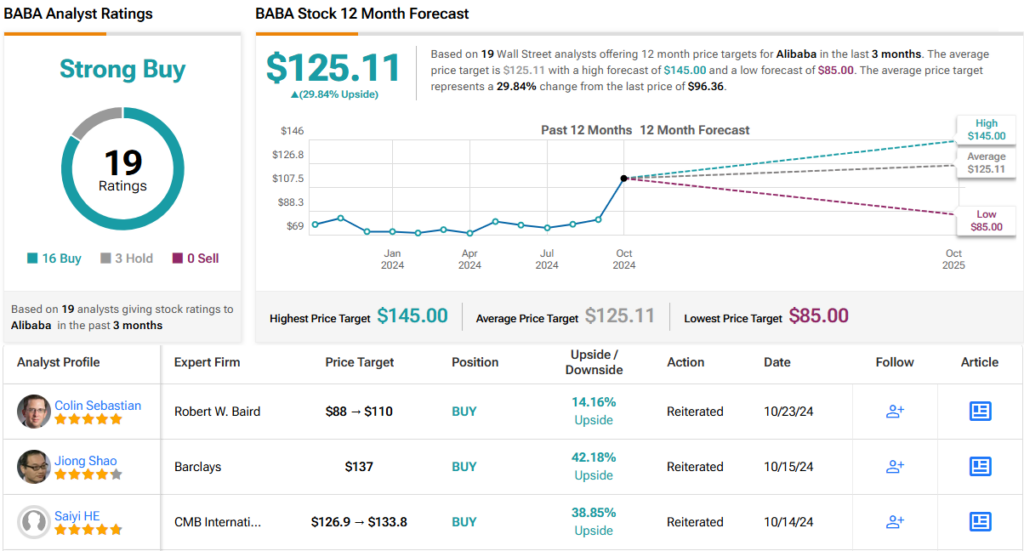

Ultimately, Sebastian rates BABA shares as Outperform (Buy), raising his price target from $88 to $110. This new target suggests a potential one-year upside of 14%. (To view Sebastian’s track record, click here)

Many experts on Wall Street share this positive outlook. With 16 Buy ratings versus 3 Holds, the analyst consensus assigns BABA stock a Strong Buy rating. The average price target is notably more optimistic than Sebastian’s, set at $125.11, which points to about 30% potential returns over the next year. (See Alibaba stock forecast)

For more insights into investment opportunities, check out TipRanks’ Best Stocks to Buy, which aggregates comprehensive equity analyses.

Disclaimer: The views represented in this article belong to the featured analyst and are intended for informational purposes only. Conduct your own research before making any investment decisions.

The opinions expressed here are those of the author and do not necessarily reflect the views of Nasdaq, Inc.