Dow Inc. DOW has teamed up with Carbice to create a new thermal interface material (TIM) for high-performance electronics across various sectors, including mobility, industrial, consumer markets, and semiconductors.

Dow Partners with Carbice to Enhance Thermal Management Solutions

The partnership, revealed at The Battery Show North America, merges Dow’s expertise in silicone with Carbice’s carbon nanotube (CNT) technology. This innovative collaboration aims to deliver advanced thermal management products that meet the growing demand for reliable solutions in thermal interfaces.

This initiative supports Dow’s commitment to MobilityScience, focusing on transforming the future of mobility through innovative material developments.

By joining forces, DOW and Carbice are poised to elevate customer service through improved heat management solutions that combine liquid silicones with solid pads. This partnership offers notable advantages to the industry.

Dow’s silicones, known for their excellent wetting properties and accurate dispensing, work effectively with Carbice’s durable CNTs. Together, they create an interface that minimizes stress transfer, providing trusted performance in diverse environments. By leveraging Carbice’s technical expertise alongside Dow’s material knowledge, customers can develop tailored thermal management materials featuring minimal bondlines.

From the onset of the design process, customers will gain quick access to extensive modeling capabilities, promoting more predictable outcomes. This strategy not only leads to cost-effective design improvements but also promotes efficient manufacturing, particularly in specialized applications. Continuous joint research and development (R&D) efforts will ensure the ongoing release of innovative liquid and solid heat management solutions.

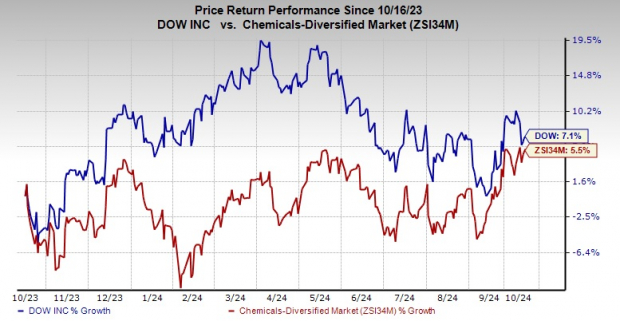

Over the past year, DOW’s shares have risen by 7.1%, outperforming a 5.5% gain within its industry.

Image Source: Zacks Investment Research

Recently, Dow revised its third-quarter 2024 forecast, anticipating revenues of about $10.6 billion with operating earnings before interest, taxes, depreciation, and amortization (EBITDA) nearing $1.3 billion. This updated outlook follows a significant unexpected incident in late July at one of its ethylene crackers located in Texas, along with rising input costs and margin challenges in Europe.

For the upcoming fourth quarter, Dow predicts that demand will follow typical seasonal patterns. Expected advantages include reduced turnaround costs, increased operating rates as the Texas cracker comes back online, and fewer weather-related disruptions in the U.S. Gulf Coast region. Dow is steadfast in its dedication to maintaining strong operational and financial discipline while focusing on long-term growth strategies.

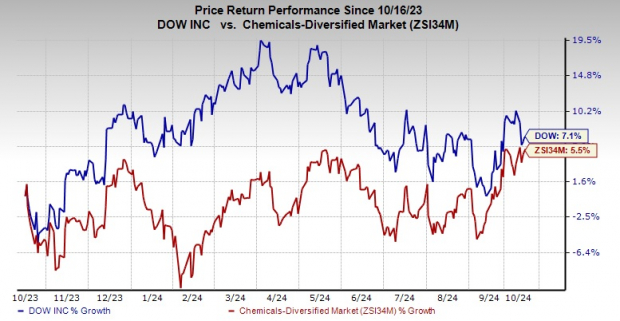

Dow Inc. Price and Consensus

Dow Inc. price-consensus-chart | Dow Inc. Quote

Zacks Rank & Noteworthy Stock Picks

Currently, DOW holds a Zacks Rank of #5 (Strong Sell).

Highlighted alternatives in the basic materials sector include Carpenter Technology Corporation CRS, IAMGOLD Corporation IAG, and Centrus Energy Corp. LEU.

Carpenter Technology enjoys a Zacks Rank of #1 (Strong Buy) and has surpassed the Zacks Consensus Estimate in each of the last four quarters, with an average earnings surprise of 15.9%. In the past year, the company’s shares have surged by 149.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for IAG’s current-year earnings stands at 49 cents, reflecting a year-over-year increase of 444.4%. This estimate has improved over the past month. IAG, also a Zacks Rank #1 stock, has beaten the consensus estimate in every recent quarter, with an average earnings surprise of 200%. Its shares have climbed approximately 110.9% within the last year.

For Centrus, the Zacks Consensus Estimate for current-year earnings is $3.06 per share. LEU, classified as a Zacks Rank #1 stock, has exceeded the consensus estimate in three out of the last four quarters while missing once, boasting an average earnings surprise of 107.1%. LEU’s shares have risen around 12.5% in the past year.

7 Best Stocks for the Next 30 Days

Recently released: Experts have selected 7 exceptional stocks from a pool of 220 Zacks Rank #1 Strong Buys, marking them as “Most Likely for Early Price Pops.”

Since 1988, this comprehensive list has outperformed the market by more than 2X, achieving an annual average gain of +23.7%. Don’t miss the chance to consider these carefully chosen 7 stocks.

See them now >>

Looking for the latest analysis from Zacks Investment Research? Download 5 Stocks Set to Double for free.

Dow Inc. (DOW) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Iamgold Corporation (IAG) : Free Stock Analysis Report

Centrus Energy Corp. (LEU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.