AI Stocks Show Diverging Paths: SoundHound AI vs. Twilio in 2024

SoundHound AI (NASDAQ: SOUN) and Twilio (NYSE: TWLO) have experienced very different trends on the stock market so far this year. Their contrasting results are closely linked to their financial performance and the markets they serve.

SoundHound AI has seen remarkable stock growth of 120% in 2024, albeit with some volatility. In contrast, Twilio’s stock has declined by 11%. SoundHound AI, known for its voice AI solutions, saw a significant boost in its stock price early this year after Nvidia made a small investment in the company.

Twilio, however, is facing challenges with slow growth. Despite these struggles, it is increasingly focusing on AI solutions for cloud communications and aims to become a competitor of SoundHound AI.

Given these situations, which of the two AI stocks is a better choice for investors today? Let’s explore.

Why SoundHound AI is Gaining Momentum

As a specialist in voice AI solutions, SoundHound AI has attracted a growing customer base, which is reflected in its strong financial results.

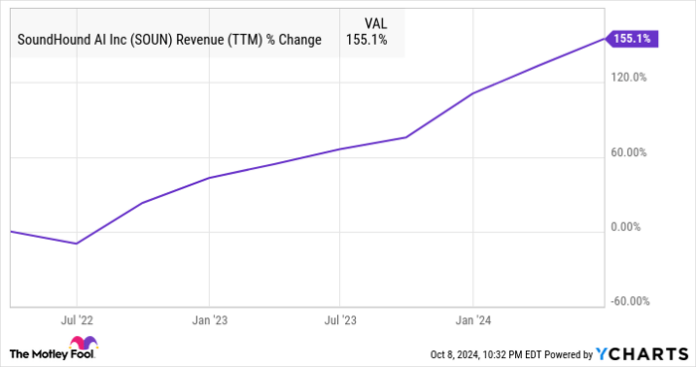

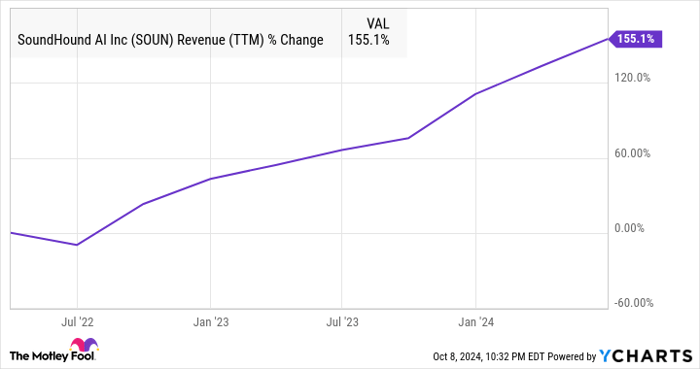

SOUN Revenue (TTM) data by YCharts.

In the second quarter of 2024, SoundHound AI reported revenue that surged 54% year-over-year, reaching $13.5 million. As a small company, its guidance for the full year and 2025 suggests it’s positioned to capitalize on a massive market opportunity.

SoundHound forecasts at least $80 million in revenue this year, a major increase from its $46 million in 2023. Moreover, the company anticipates revenue could exceed $150 million by 2025, signaling acceleration in growth. This is partly due to its recent acquisition of Amelia, a provider of enterprise AI software, which SoundHound believes will strengthen its presence in customer service.

Having spent $80 million on Amelia, SoundHound expects it to contribute $45 million in annual recurring AI software revenue, alongside additional revenue sources like agent fees and professional services. The company is building a diverse customer base that includes Stellantis, electric vehicle companies, and quick-service restaurants. The acquisition of Amelia is expected to enhance SoundHound’s foothold in a market valued at $140 billion.

Notably, SoundHound AI’s cumulative subscriptions and bookings backlog is $723 million, nearly doubling year-over-year in the last quarter. This potential revenue pipeline bodes well for sustained growth beyond next year, indicating that SoundHound could remain a strong AI investment moving forward.

Challenges and Opportunities for Twilio

Twilio operates in the communications platform-as-a-service (CPaaS) market, equipping customers with cloud-based solutions to connect with their audience through various channels like voice, video, text, and email. Essentially, Twilio’s APIs enable businesses to transition from traditional contact centers to modern, cloud-based alternatives.

Historically, Twilio thrived amid a swift shift to cloud communications, experiencing top-line growth of 74% in 2019 and 55% in 2020. Growth remained robust through 2021 and 2022 as well, with increases of 61% and 34%, respectively, driven partly by multiple acquisitions from 2018 to 2021.

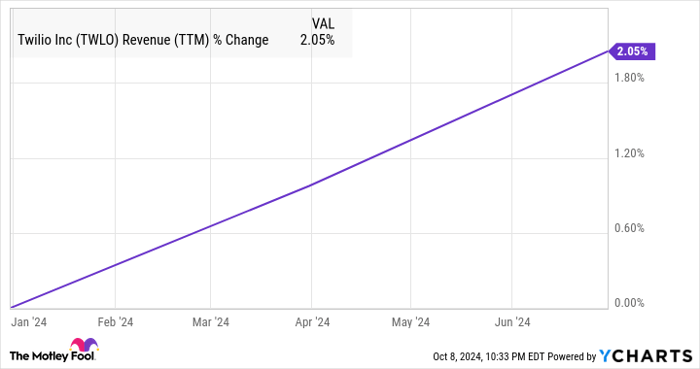

Nevertheless, as shown in the chart below, Twilio’s growth has not been consistent.

TWLO Revenue (TTM) data by YCharts.

Now, the company is working to integrate AI solutions to bolster its customer service offerings. Twilio recently launched Customer AI, which combines real-time data and AI to enhance customer engagement. Additionally, it plans to incorporate OpenAI’s Realtime API into its platform for building conversational AI assistants.

With around 316,000 active customer accounts, Twilio is in a solid position to expand its AI product offerings. Management highlighted an uptick in demand for AI solutions during its August earnings call, as they noted success with new higher-margin software products that leverage AI.

In the quarter, we started to see success with our newer higher-margin software products. These are products that leverage AI such as Verify and Voice Intelligence, as well as platform innovations that natively embed AI and machine learning to drive greater deliverability and better customer engagement.

Twilio’s revenue is projected to grow by 5% to $4.37 billion in 2024, followed by a 7% increase in 2025. There is potential for better growth in the long run as AI initiatives bear fruit.

Final Thoughts: Which Stock Should Investors Choose?

The evidence shows that SoundHound AI is currently outpacing Twilio in growth, while Twilio seeks to revitalize its performance through AI integration. SoundHound stands out due to its smaller size and vast market potential, enabling it to post impressive growth figures. However, investing in SoundHound AI comes with a high price-to-sales ratio of 23.

In contrast, Twilio offers a more affordable option with a price-to-sales ratio under 3. This lower valuation reflects its sluggish growth. Consequently, the choice between these two AI stocks ultimately depends on an investor’s risk tolerance. Conservative investors may prefer Twilio for its lower cost and potential for growth, while those willing to take on more risk might find SoundHound’s strong growth prospects appealing.

Seize another chance at investment success

Have you ever felt like you missed out on buying top-performing stocks? Here’s your chance.

Our team of analysts has issued a rare “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you feared you missed your opportunity, now is the time to invest before prices climb again. Consider these past success stories:

- Amazon: Investing $1,000 back in 2010 would have grown to $21,266!*

- Apple: A $1,000 investment in 2008 would now be worth $43,047!*

- Netflix: An investment of $1,000 in 2004 would have skyrocketed to $389,794!*

We are currently issuing “Double Down” alerts for three remarkable companies, and you may not find another opportunity like this soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Twilio. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.