Comparing AI Titans: Palantir vs. C3.ai for Future Investments

Artificial intelligence (AI) presents vast opportunities across various sectors, often considered a major technological shift since the onset of the internet.

Many companies are aiming to benefit from the secular trend of AI. Notably, Palantir Technologies (NYSE: PLTR) and C3.ai (NYSE: AI) stand out. Palantir utilizes AI to extract insights from data, while C3.ai offers AI software for varied organizational needs.

The AI industry is anticipated to grow from $184 billion in 2023 to $827 billion by 2030. Given this potential, is it wiser to invest in Palantir or C3.ai for the long term? Let’s dissect each company to assess which might offer better returns.

Exploring Palantir’s Strengths

Since 2003, Palantir has assisted the U.S. government with data analysis and unveiled its artificial intelligence platform (AIP) in 2023. The introduction of AIP has significantly boosted Palantir’s commercial sector growth.

In the second quarter, Palantir achieved a remarkable 33% year-over-year sales increase within its commercial division, reaching $307 million. This spike helped increase total revenue for Q2 to $678 million, a 27% rise from the previous year.

Beyond revenue growth, Palantir’s financial situation is robust. At the end of Q2, the company reported a net income of $135.6 million, up from $27.9 million in 2022. Moreover, adjusted free cash flow (FCF) was recorded at $149 million, climbing from $96 million year-over-year.

The AIP’s success in drawing in commercial clients stems from its rapid implementation capabilities, allowing businesses to transition from AI theory to practice within mere days—a feat noted as a significant market opportunity by Palantir’s CTO, Shyam Sankar.

Building off AIP’s momentum, Palantir has introduced Warp Speed, a new product aimed at improving manufacturing efficiency by addressing supply chain challenges using AI. Tapping into the massive manufacturing market, valued at nearly $3 trillion in U.S. GDP last year, could drastically shift Palantir’s performance.

The Journey of C3.ai

Founded in 2009, C3.ai initially focused on energy management before shifting to AI software in 2019. This foundation led to a joint venture with Baker Hughes, granting C3.ai access to major players like Shell and ExxonMobil in the oil and gas sector.

C3.ai’s platform serves a multitude of functions, including fraud detection in banking. In its 2025 fiscal Q1, the company derived 84% of its revenue from subscriptions, with the rest coming from services such as customer training and support.

Thanks to heightened demand for AI solutions, C3.ai reported sales of $87.2 million in fiscal Q1, up 21% from the prior year. The company also enjoyed significant growth in the 2024 fiscal year, with total sales reaching $310.6 million—a 16% increase year-over-year.

Additionally, C3.ai’s Q1 FCF stood at $7.1 million, significantly better than the negative FCF of $8.9 million in the previous year. However, the company still faced profitability challenges, reporting a net loss of $62.8 million for Q1.

Looking forward, C3.ai’s partnership with Baker Hughes—vital for its revenue stream—is set to conclude in April 2025, raising concerns. Estimates suggest that this partnership generates over a third of C3.ai’s revenue.

Making the Investment Choice

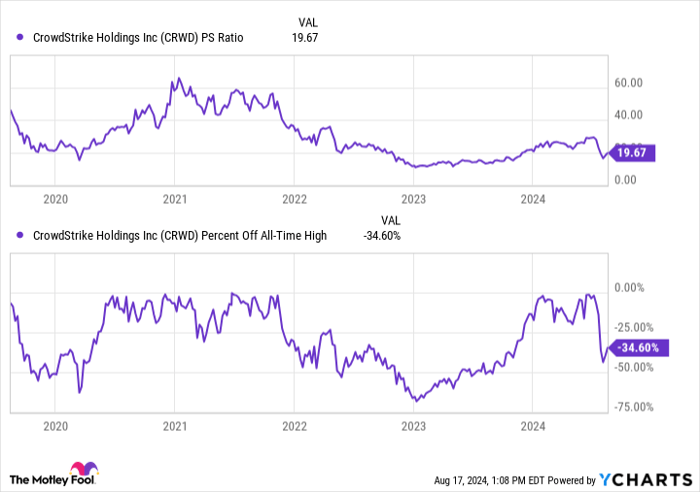

Determining whether to invest in Palantir or C3.ai presents complexities. While both companies demonstrate strong revenue growth, C3.ai’s lack of profitability suggests that Palantir could be the preferred investment choice. Palantir’s success has also been reflected in its stock price, which has surged more than 150% over the past year.

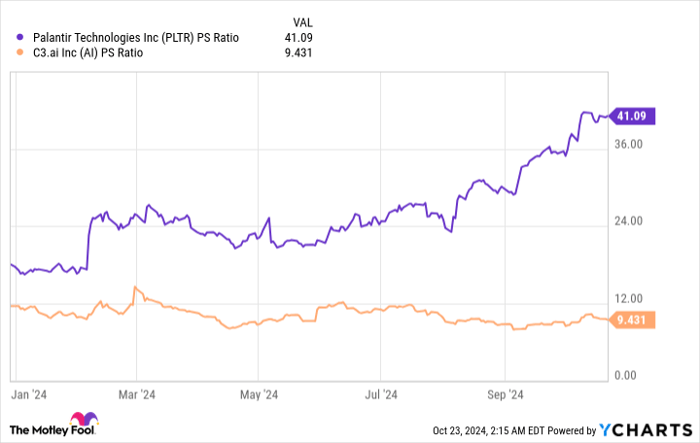

Nonetheless, Palantir’s stock now appears quite expensive; comparisons of price-to-sales (P/S) ratios indicate it currently commands a higher premium than C3.ai. The P/S ratio serves as a measurement of how much investors will pay for each dollar of revenue.

Data by YCharts. PS Ratio = price-to-sales ratio.

Wall Street analysts have a consensus “hold” rating for Palantir, with a median price target of $28. Trading around $43 currently, this suggests analysts believe the stock might be overvalued.

On the other hand, C3.ai does not come out as a favorable option either. Wall Street’s consensus also rates C3.ai as a “hold,” with a median price target of $22. Given the uncertainties surrounding the renewal of its critical partnership with Baker Hughes, prospective investors may wish to postpone any buying decisions related to C3.ai.

If it weren’t for Palantir’s inflated valuation, the company would likely be a more appealing investment over C3.ai based on its better financial health and potential for future growth with products like AIP and Warp Speed. Nonetheless, it may be prudent to wait for a more favorable price point for Palantir stock before making any moves.

Seize the Opportunity Before It’s Too Late

Ever worry that you might have missed an opportunity to invest in top-performing stocks? Now is your chance.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies primed for growth. If you think you’ve missed your chance, now may be the right moment to invest before it passes.

- Amazon: Invest $1,000 when we doubled down in 2010, and you’d have $21,154!

- Apple: Invest $1,000 when we doubled down in 2008, and you’d have $43,777!

- Netflix: Invest $1,000 when we doubled down in 2004, and you’d have $406,992!

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity might not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Robert Izquierdo has positions in Palantir Technologies. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.