Tech Titans Super Micro Computer and Palantir Technologies Shine Amid AI Boom

Super Micro Computer (NASDAQ: SMCI) and Palantir Technologies (NYSE: PLTR) have both provided impressive returns to investors this year. Supermicro’s stock surged 188% in the first half, even outperforming industry giant Nvidia. While it has since retraced some of those gains, it’s still on track for a 60% increase this year and a staggering 2,100% rise over the past five years. Meanwhile, Palantir is set to achieve nearly 150% growth this year and is trading at an all-time high.

Both companies have demonstrated notable financial strength, driven largely by their involvement in the booming field of artificial intelligence (AI). Supermicro recently reported quarterly revenue that exceeded its total revenue from all of 2021. In addition, Palantir has achieved its highest quarterly profit to date.

These companies have been around for a while, with Supermicro established over 30 years ago and Palantir approximately 20 years old. Throughout their histories, both have shown a consistent growth trajectory. However, they have recently experienced rapid advancements due to the AI explosion. Should investors consider buying shares of Supermicro or Palantir? Let’s explore each company further and what Wall Street analysts recommend.

Image source: Getty Images.

Why Super Micro Computer Is Gaining Traction

Supermicro operates quietly yet effectively behind the scenes in the AI sector. The company produces essential machinery for data centers, including servers and workstations. By using standardized components, Supermicro can efficiently deliver customized equipment to its clients. Collaborating closely with leading chip manufacturers allows Supermicro to quickly incorporate cutting-edge developments into its products.

This strategic approach has resulted in Supermicro achieving a growth rate five times faster than the industry average over the past year. Two significant growth opportunities lie ahead: direct liquid cooling (DLC) development for data centers and a new production facility located in Malaysia.

DLC addresses a major challenge within AI data centers—heat management. Supermicro forecasts that 25% to 30% of new data centers will adopt DLC within the next 12 months, positioning the company to potentially lead this market. Additionally, the Malaysian plant should enhance Supermicro’s profit margins by increasing production volume at a lower cost.

What has caused a recent decline in the stock? In August, a short seller’s report raised concerns about the company, and soon after, The Wall Street Journal disclosed that the Justice Department is investigating Supermicro. While the company dismissed the short report’s claims as “false or inaccurate,” it refrained from commenting on the article from the WSJ. Until these issues are fully resolved, they may continue to hinder stock performance.

Palantir Technologies: A Rising Star in Data

Palantir specializes in data analytics. The software company helps clients consolidate and optimize their data, often leading to transformative improvements in efficiency and innovation.

Historically, Palantir was well-known for its government contracts; however, recent growth has come from commercial customers. While government revenue grew by 23% last quarter, U.S. commercial revenue skyrocketed by 55%. Notably, the number of U.S. commercial customers has surged to nearly 300, a dramatic increase from just 14 four years ago.

More clients are turning to Palantir for its Artificial Intelligence Platform (AIP), which was launched last year to help transform data into valuable insights. The company’s approach includes offering boot camps to showcase the service, leading to contract signings shortly after these events.

With its recent AIP launch stirring significant demand, Palantir could be at the inception of an impressive growth story, despite being established for many years.

Wall Street’s Perspective: Invest or Hold?

Currently, Wall Street has differing recommendations for these two top stocks. Analysts rate Supermicro as a “buy” with an average 12-month price target indicating a potential 69% upside.

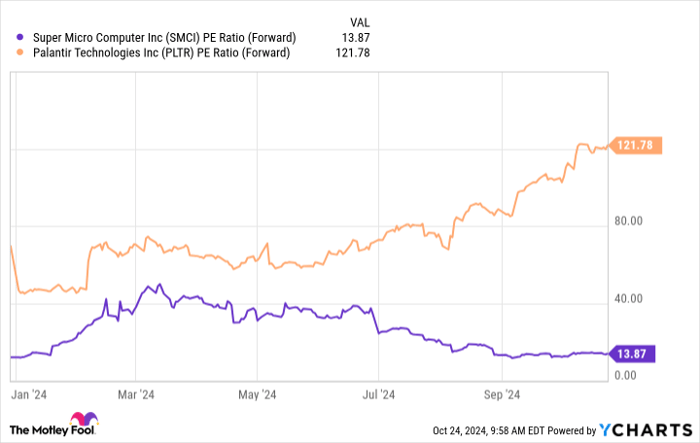

In contrast, Palantir is rated as a “hold,” with expectations of a 32% decline over the next year. Valuation plays a significant role in these recommendations, as Supermicro trades at a much lower valuation compared to Palantir’s high price relative to its future earnings potential.

SMCI PE Ratio (Forward) data by YCharts

Should you invest in Supermicro over Palantir? It’s not a simple choice. Both stocks may be appealing long-term investments, but your decision should be based on your risk tolerance. Given its current challenges, Supermicro may be more suitable for aggressive investors at this time.

On the other hand, while Palantir is costly, it could still be a wise investment for those willing to hold for several years, as both earnings and share prices have the potential for growth over the long term.

Seize This Opportunity Before It’s Too Late

Do you ever feel like you missed your chance to invest in top-performing stocks? This may be your moment.

Occasionally, our expert analysts unveil a “Double Down” stock recommendation for companies they believe are poised for substantial growth. If you think you’ve missed out, now might be the best time to invest before it’s too late. The following figures illustrate the potential:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,154!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,777!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $406,992!*

Currently, we are providing “Double Down” alerts for three exceptional companies, and this could be one of your last chances to invest.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.