The Ensign Group, Inc. ENSG is benefiting on the back of solid segmental contributions, acquisitions of healthcare facilities and a robust financial position. A positive business outlook for 2024 reinforces investors’ confidence in the stock.

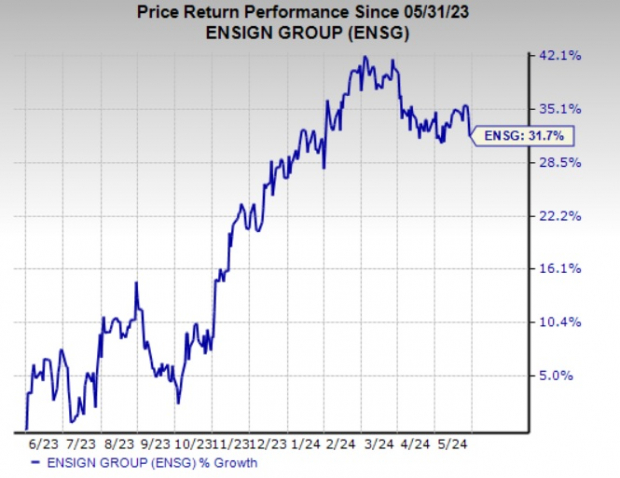

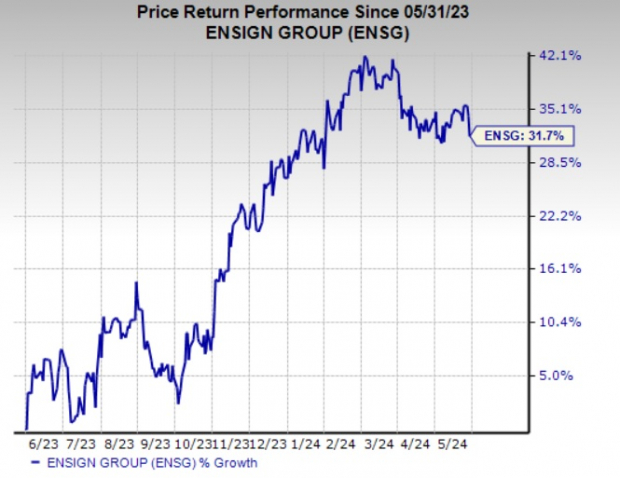

Zacks Rank & Price Performance

Ensign Group carries a Zacks Rank #3 (Hold), at present.

The stock has gained 31.7% in the past year.

Image Source: Zacks Investment Research

Robust Growth Prospects

The Zacks Consensus Estimate for Ensign Group’s 2024 earnings is pegged at $5.39 per share, indicating an improvement of 13% from the year-earlier reading, while the same for revenues is $4.1 billion, implying an 11% increase from the prior year actual.

The consensus mark for 2025 earnings is pegged at $5.91 per share, suggesting 9.6% growth from the 2024 estimate. The same for revenues is $4.5 billion, which indicates a rise of 9.4% from the 2024 estimate.

Northbound Estimate Revision

The Zacks Consensus Estimate for 2024 earnings has been revised 0.2% upward in the past 30 days.

Impressive Surprise History

ENSG’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 1.25%.

Solid Return on Equity

Ensign Group’s efficiency in utilizing shareholders’ funds can be substantiated by its return on equity of 19.1% against the industry’s negative return of 13.8%.

A Favorable 2024 Outlook

ENSG projects revenues within the range of $4.13-$4.17 billion in 2024, the midpoint of which indicates 11.3% growth from the 2023 reported figure.

Adjusted earnings per share are anticipated to lie between $5.29 and $5.47. The midpoint of the outlook suggests 13% growth from the 2023 reported figure.

Key Business Tailwinds

Over the past decade, Ensign Group has witnessed a CAGR of 16.3% in its top line. In the first quarter, the metric improved 13.9% year over year, driven by increased service revenues.

Ensign Group’s Skilled Services segment offers skilled nursing, senior living services, physical, occupational, and speech therapies, along with other rehabilitative and healthcare services. The aging U.S. population is expected to sustain the high demand for senior living services, while the need for effective rehabilitation services, which help individuals resume daily activities, provides a strong growth opportunity for ENSG.

In addition to the contributions from the Skilled Services unit, the Standard Bearer segment represents the growing real estate portfolio of Ensign Group. This unit engages in triple-net lease arrangements with healthcare operators for post-acute care properties acquired by ENSG.

Ensign Group actively pursues an inorganic growth strategy, primarily through facility acquisitions. Each acquisition enhances the company’s capabilities and expands its nationwide presence. These acquisitions also enable ENSG to collaborate closely with skilled caregivers at each facility, gaining valuable insights into various U.S. communities.

These expansion efforts have significantly broadened Ensign Group’s healthcare portfolio, which presently includes 310 healthcare operations across 13 states, with 29 senior living operations. It also owns 119 real estate assets.

Maintaining a solid financial position is crucial for supporting ongoing growth investments. Ensign Group has growing cash reserves and sound cash-generating abilities. This robust financial foundation allows the company to invest in its business strategically, as well as engage in share buybacks and dividend payments. ENSG has consistently paid dividends for more than two decades. Its dividend yield of 0.21% compares favorably with the industry’s figure of 0.17%.

Ensign Group also benefits from an improving leverage ratio. Its total debt-to-total capital of 8.6% at the end of the first quarter is significantly lower than the industry average of 82.3%.

Stocks to Consider

Some better-ranked stocks in the Medical space are Tenet Healthcare Corporation THC, Alcon Inc. ALC and LeMaitre Vascular, Inc. LMAT. While Tenet Healthcare sports a Zacks Rank #1 (Strong Buy), Alcon and LeMaitre Vascular carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Tenet Healthcare’s earnings surpassed estimates in each of the last four quarters, the average surprise being 56.50%. The Zacks Consensus Estimate for THC’s 2024 earnings indicates a 20.6% rise from the prior-year tally. The consensus mark for THC’s 2024 earnings has moved 36.9% north in the past 30 days.

The bottom line of Alcon outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 5.27%. The Zacks Consensus Estimate for ALC’s 2024 earnings indicates an 11.3% rise, while the consensus mark for revenues suggests an improvement of 6.2% from the respective prior-year figures. The consensus mark for ALC’s 2024 earnings has moved 0.3% north in the past 60 days.

LeMaitre Vascular’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 10.12%. The Zacks Consensus Estimate for LMAT’s 2024 earnings indicates a 28.2% rise, while the same for revenues suggests an improvement of 11.3% from the respective prior-year tallies. The consensus mark for LMAT’s 2024 earnings has moved up 5.5% in the past 30 days.

Shares of Tenet Healthcare, Alcon and LeMaitre Vascular have gained 91.4%, 13.2% and 27.8%, respectively, in the past year.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Alcon (ALC) : Free Stock Analysis Report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

LeMaitre Vascular, Inc. (LMAT) : Free Stock Analysis Report

The Ensign Group, Inc. (ENSG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.