Nio’s Stock Rally: A Closer Look at Recent Performance and Market Position

Chinese luxury electric vehicle maker Nio stock (NYSE:NIO) has surged about 45% since late August, in line with its competitors Xpeng (NYSE:XPEV) and Li Auto (NASDAQ:LI). While general market trends and recent Chinese government monetary stimulus have fueled this increase, specific developments at Nio have also played a significant role. Analysts believe the stock holds the potential for considerable growth, possibly doubling from its current levels.

Strong Deliveries Signal Steady Demand

Nio displayed solid performance in September, with vehicle deliveries climbing 35% from last year to 21,181 units. Though this growth lags behind Xpeng, which delivered 21,352 vehicles (up 39.5% year-on-year), and Li Auto, which led the market with 53,709 deliveries, Nio has consistently surpassed 20,000 units for five consecutive months. This makes it clear that demand for Nio’s vehicles remains strong despite increasing competition.

Expansion Through New Sub-Brands

The recent introduction of Nio’s affordable sub-brand, Onvo, is another important development. Deliveries began in September, with 832 units sold. The Onvo L60 ranges from RMB 200,000 ($28,000) to RMB 300,000 ($42,000) and is anticipated to enhance Nio’s presence in the mass market as it ramps up production. Additionally, Nio plans to launch another brand called Firefly by year’s end, focusing on lower price points with its first model being a blend of small and compact SUVs. This expansion comes at a time when China’s new energy vehicle (NEV) market is flourishing, as evidenced by a record 1.3 million NEV sales, accounting for 46% of the 2.81 million vehicles sold in the country in September 2024.

Resilient Margins Amid Competitive Pressure

Pricing pressures from rivals like Tesla and Li Auto have not significantly hampered Nio’s margins. In Q2 2024, the company’s vehicle gross profit margins increased to 12.2%, a rise from 9.2% in Q1 and 6.2% in Q2 2023. This improvement stemmed from both higher delivery volumes and improved supply chain conditions, despite a 10% drop in average selling prices. Total revenue reached $2.4 billion, nearly doubling year-over-year, while losses per share narrowed from $0.45 a year ago to $0.30.

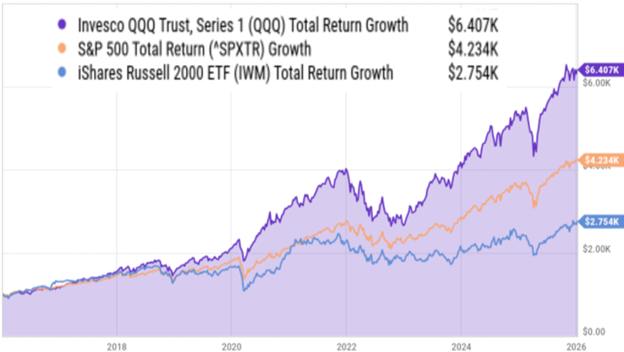

Past Performance Raises Questions Going Forward

Historically, NIO stock has underperformed compared to broader market indices. Returns for NIO were -35% in 2021, -69% in 2022, and -7% in 2023. In contrast, the Trefis High Quality (HQ) Portfolio, made up of 30 stable stocks, has consistently outperformed the S&P 500 during the same period. The current economic landscape, marked by uncertainty around interest rates and geopolitical tensions, raises questions about whether Nio may continue to lag or potentially rebound in the next year.

Attractive Valuation Offers Potential Upside

Nio’s valuation appears appealing as it trades at about $5 per share, roughly 1x the consensus forecast for 2024 revenues. Market experts expect revenues to grow over 20% this year and by more than 35% next year. By contrast, Tesla is trading at about 7x forward revenue, even as its revenue remains mostly flat this year. If Nio’s investors assign a more favorable valuation of about 2x forward earnings based on its anticipated growth and improving profit margins, a significant price increase could be on the horizon. For an in-depth analysis, see our comparison of Nio, Xpeng & Li Auto: How Do Chinese EV Stocks Compare?.

| Returns | Oct 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| NIO Return | -21% | -42% | -18% |

| S&P 500 Return | 1% | 22% | 161% |

| Trefis Reinforced Value Portfolio | 3% | 18% | 789% |

[1] Returns as of 10/20/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.