Tesla Faces Challenge Amid EV Sales Slump and Rising Competition

Tesla (NASDAQ: TSLA) has seen its stock drop 12% in 2024, while the S&P 500 has soared by 23% this year. This downturn comes as the company struggles with sluggish electric vehicle (EV) sales due to increasing competition and a dip in consumer demand across the sector.

Last Thursday, during the “We, Robot” event, Tesla showcased its much-anticipated Cybercab robotaxi, which will operate fully on full-self driving (FSD) technology. According to Dan Ives from Wedbush Securities, this advancement in autonomous driving could open a $1 trillion market for Tesla in the long run.

Tesla’s Core Business Faces Tough Times

In 2023, Tesla reported delivering a record 1.8 million passenger EVs, a 38% increase from the previous year. Despite this achievement, CEO Elon Musk has set ambitious goals, aiming for an average production increase of 50% annually. Currently, however, this goal seems at risk as delivery figures falter.

During the first three quarters of this year, Tesla delivered 1.3 million EVs, reflecting a year-over-year decline of 2.3%. This marked the first anticipated annual drop since the launch of the Model S in 2011.

General demand for EVs has weakened as consumers prioritize cheaper gas-powered cars amid economic pressures, including rising interest rates. Moreover, Tesla faces stiff competition from traditional car manufacturers and emerging low-cost EV brands, particularly from China.

To counter this trend, Tesla plans to introduce a low-cost model next year, priced at around $25,000, which could help revive sales growth.

Currently, EV sales contribute to 78% of Tesla’s total revenue. While analysts such as Dan Ives focus on long-term opportunities like FSD and the Cybercab, investors are naturally concerned about the recent downturn in the company’s primary operations.

Image source: Tesla.

Launch of the Cybercab Faces Uncertainty

FSD technology is a crucial part of Tesla’s AI strategy. The company has announced plans to invest $10 billion this year in data centers needed to train its FSD software, utilizing the same processing chips that power AI systems like ChatGPT.

Dan Ives isn’t alone in believing that FSD represents a potential trillion-dollar market for Tesla. Cathie Wood’s Ark Investment Management estimates that Tesla could achieve $1.2 trillion in annual revenue by 2029, with 63% of that coming from FSD and the Cybercab.

Tesla may monetize FSD through three main channels:

- Offering the software as a subscription service to Tesla owners.

- Licensing the software to other automotive manufacturers.

- Building an autonomous ride-hailing service, similar to Uber, with Cybercabs providing 24/7 transport.

Additionally, Tesla plans to sell Cybercabs to the public for around $30,000, potentially allowing individuals to establish their own ride-hailing operations.

However, the future of FSD remains uncertain. It is currently in beta; users must monitor the software and be prepared to take control at any moment. Musk indicated that an unsupervised version could be ready by next year, a promise he has made multiple times over the past decade. Significant regulatory challenges also loom before Cybercabs can operate freely in the U.S. streets, and production is expected to start by 2027, tightening the timeline for FSD readiness.

Better AI Stock Investments Exist Than Tesla

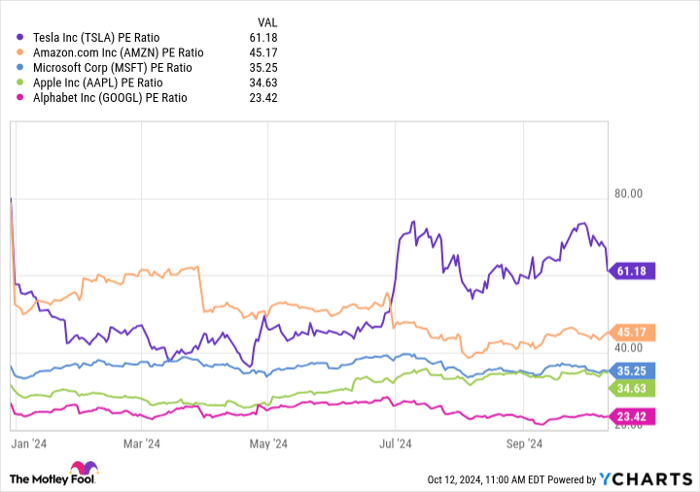

Tesla has reported $3.56 in trailing-12-month earnings per share. With the stock currently priced at $217.80, this translates to a price-to-earnings (P/E) ratio of 61.2, nearly double that of the Nasdaq-100, which stands at 32.1.

This P/E ratio aligns with that of Nvidia. While analysts predict Nvidia’s earnings will grow by 139% in the current fiscal year, Tesla’s earnings are projected to decline by 27% in 2024. Consequently, Tesla’s stock could be seen as overvalued compared to Nvidia, especially given the current forecasts.

Tesla’s valuation also exceeds that of leading AI stocks such as Amazon, Microsoft, Apple, and Alphabet.

Data by YCharts.

Considering these factors, it’s difficult to agree with Dan Ives’ claim that Tesla is the most undervalued AI stock. The various challenges facing FSD, including regulatory issues and competition from firms like Waymo, leave uncertainty in predicting Tesla’s long-term financial landscape.

This uncertainty is echoed by Tesla’s stock, which fell 8% immediately following the Cybercab announcement. If the company fails to generate excitement among investors soon, there’s a risk that its stock may decline further, aligning its valuation closer to that of the Nasdaq-100 and other notable AI firms.

Should You Invest $1,000 in Tesla Now?

Before incorporating Tesla into your portfolio, consider this:

The Motley Fool Stock Advisor analyst team recently identified their top ten stocks for investment, and Tesla failed to make the list. The selected stocks are believed to be positioned for significant returns in the coming years.

For context, consider this: when Nvidia was featured on April 15, 2005, a $1,000 investment then would be worth $826,069 today!

Stock Advisor provides a straightforward guide for investors, including tips for portfolio construction, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500, achieving returns more than four times greater.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, now an Amazon subsidiary, serves on The Motley Fool’s board. Suzanne Frey, an executive at Alphabet, is also on the board. Anthony Di Pizio does not hold shares in any of the mentioned stocks. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, Nvidia, Tesla, and Uber Technologies, along with specific options on Microsoft. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.