DuPont de Nemours, Inc. DD and Menatek Defense Technologies have joined forces to revolutionize the realm of bearings with the cutting-edge NAZ Bearings. These self-lubricating marvels, birthed from the collaborative efforts, require no maintenance, offering a beacon of innovation in the industry.

This groundbreaking alliance amalgamates DuPont’s knack for tailored material solutions, encompassing wear and friction resistance, reliability in extreme conditions, and lightweighting, with Menatek’s prowess in design and manufacturing. The product of this synergy is an extraordinary bearing capable of delivering unparalleled performance under hefty static and dynamic loads. Marking a leap forward, the bearing liner technology developed by the Menatek group, in conjunction with DuPont, not only eradicates the need for regular maintenance but also significantly prolongs the bearing’s lifespan.

Through this strategic partnership, DuPont fortifies its foothold as an industry leader, poised to offer enhanced value to its global clientele. This collaboration empowers both entities to cater to a broad consumer base spanning the defense, aerospace, high-speed train, tram, metro, wind turbine, and industrial sectors. Engaged in joint research & development endeavors and astute marketing campaigns, both firms stand committed to offering clients state-of-the-art bearing technologies for the future.

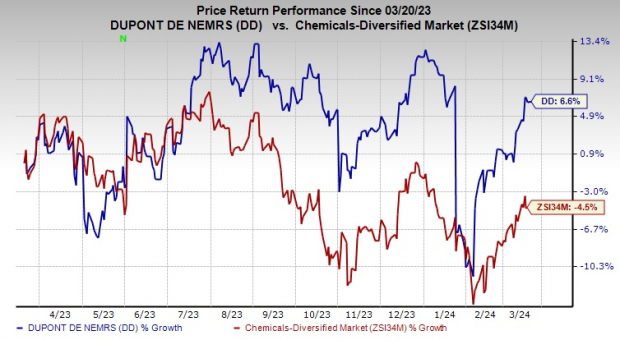

Shares of DuPont have surged by 6.6% over the past year, shining bright amidst a 4.5% decline experienced by its industry.

Image Source: Zacks Investment Research

DuPont’s Strategic Outlook and Projections

During its fourth-quarter call, the company disclosed its anticipation of net sales ranging between $11,900 million and $12,300 million for 2024. Adjusted earnings per share for the same period are forecasted to fall within the $3.25-$3.65 bracket.

For the first quarter of 2024, DuPont foresees net sales hovering around $2,800 million, with adjusted earnings per share expected to be in the range of 63-65 cents. An impending sequential decline in sales and earnings in the initial quarter is attributed to further de-stocking activities within its industrial-based divisions and a persisting subdued demand in China.

DuPont de Nemours, Inc. Price and Consensus Visualized

DuPont de Nemours, Inc. price-consensus-chart | DuPont de Nemours, Inc. Quote

Zacks Rank & Key Picks in the Industry

Currently, DuPont holds a Zacks Rank #4 (Sell).

Noteworthy stock options in the basic materials domain include Denison Mines Corp. DNN, Carpenter Technology Corporation CRS, and Hawkins, Inc. HWKN.

Denison Mines, boasting a Zacks Rank #1 (Strong Buy), has surpassed the Zacks Consensus Estimate in the past four quarters, with an impressive average earnings surprise of 300%. The company’s stock has soared by 85.3% over the preceding year. For a full list of today’s Zacks #1 Rank stocks, one can explore here.

Carpenter Technology, presently holding a Zacks Rank #1, outperformed the Zacks Consensus Estimate in three of the last four quarters while aligning with it once, delivering an average earnings surprise of 12.2%. The company’s shares have ascended by 63.1% over the bygone year.

The Zacks Consensus Estimate propels Hawkins towards an expected earnings per share of $3.61 for the current fiscal year, reflecting a year-over-year upswing of 26.2%. Over the past 30 days, the Zacks Consensus Estimate for HWKN’s current-year earnings witnessed a 4.3% upward revision. Positioned as a Zacks Rank #2 (Buy), HWKN has outshined the consensus estimate in each of the last four quarters, boasting an average earnings surprise of 30.6%. The company’s stock has rallied by approximately 81.3% in the last year.

The views and opinions articulated in this piece represent the author’s standpoint and do not necessarily mirror the views of Nasdaq, Inc.