STERIS plc Set to Announce Earnings for Fiscal Q2 2025

Analysts Predict Continued Growth as STERIS Reports Financial Performance

Based in Mentor, Ohio, STERIS plc (STE) specializes in products and services aimed at infection prevention. With a market cap of $22.3 billion, the company’s offerings include sterilizers, washers, surgical tables, lights, equipment management systems, and endoscopy accessories. Investors and analysts are looking forward to the company’s fiscal second-quarter earnings announcement, scheduled for Tuesday, Nov. 5.

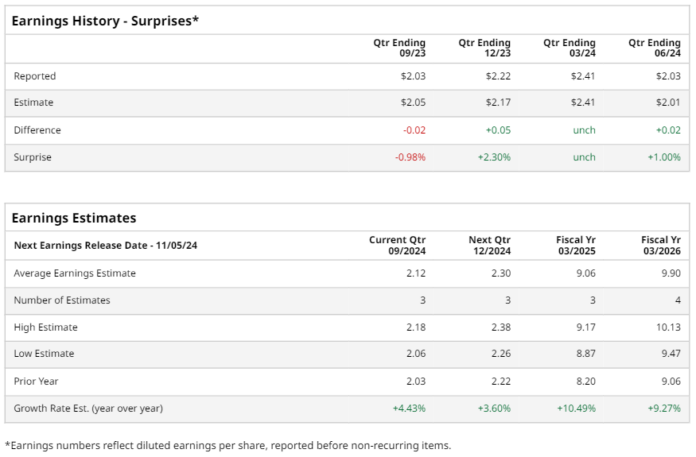

Before this event, expectations are high, with analysts forecasting a profit of $2.12 per share, which is a 4.4% increase from the $2.03 per share reported in the same quarter last year. STE has performed well recently, beating or matching consensus estimates in three of the last four quarters, although it did miss on one occasion.

Looking ahead to the full fiscal year, analysts predict STE will report an earnings per share (EPS) of $9.06, reflecting a 10.5% rise from last year’s $8.20. This growth is expected to continue, with EPS forecasted to reach $9.90 in fiscal 2026, a year-over-year increase of 9.3%.

However, STE’s stock has not kept pace with the broader market. Year to date, shares have gained only 2.3%, trailing behind the S&P 500, which has risen by 22.5%, as well as the Health Care Select Sector SPDR Fund’s (XLV) 11.7% increase.

This underperformance may be attributed to a decline in adjusted operating margins, significantly driven by increased costs in selling, general, and administrative expenses.

On Aug. 6, shares of STE experienced a slight increase after the company reported its Q1 results. The company’s revenue reached $1.3 billion, marking an 8.1% improvement from the previous year. Adjusted EPS also rose by 10.3% year over year to $2.03. For fiscal 2025, STERIS anticipates revenue growth of 6.5% to 7.5%, with adjusted EPS expected between $9.05 and $9.25.

Overall, analysts view STE stock positively, assigning it a “Moderate Buy” rating. Out of seven analysts covering the stock, four recommend a “Strong Buy,” while three suggest a “Hold.” The average price target among analysts sits at $250, which indicates a potential upside of 11.1% from current price levels.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.