Note: This excerpt is taken from this week’s Earnings Trends report. For access to the complete report containing detailed historical data and estimates for current and future periods, please click here>>>

Highlights of the Report:

- The Q3 earnings season is off to a strong start, with results exceeding estimates and suggesting positive economic trends.

- Among the 48 S&P 500 companies that have reported Q3 results, total earnings increased by +5.2% and revenues rose by +4.9%. Additionally, 81.3% surpassed EPS estimates while 72.9% exceeded revenue estimates—marking a higher “beats” percentage compared to recent periods.

- The Tech sector is experiencing its fifth consecutive quarter of double-digit earnings growth, measuring at +11.4%. Excluding Tech’s contributions, Q3 earnings for the remaining companies in the index would only rise by +0.6%.

- Earnings growth is forecasted to pick up speed beyond Q3, with double-digit earnings growth projected for three of the next four quarters.

Promising Q3 Results Indicate Stable Economy

The Q3 earnings season has begun impressively. Early results, particularly from banks, are not only beating expectations, but they also paint a reassuring picture of the overall economy.

Market observers have been questioning whether the Federal Reserve’s easing cycle can guide the economy toward a gentle slowdown, known as a soft landing.

Bank results have been particularly insightful, with JPMorgan JPM indicating that economic growth is already underway. Similarly, Bank of America BAC forecasts GDP growth between +1% and 2% for the near future, hinting at a no-landing scenario.

This optimistic view is echoed by many in the banking sector, as they report stable consumer spending and no significant concerns regarding loan portfolios or broader economic issues.

For context, the earnings of these banks have been limited over the past few quarters. In Q3, JPMorgan saw a decline of -1.9% in year-over-year earnings, while Bank of America reported an -11.6% drop.

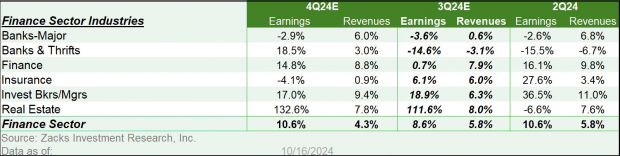

Overall, the Zacks Major Banks industry, which includes both JPMorgan and Bank of America, anticipates a -3.6% decline in Q3 earnings compared to last year, despite a slight revenue increase of +0.6%. The table below illustrates this blended earnings outlook for the Zacks Finance sector, combining reported and projected results.

Image Source: Zacks Investment Research

Notably, positive growth is primarily coming from the insurance and brokerage/asset management fields. Yet, the outlook for the insurance sector has been negatively influenced by the recent uptick in storm activity.

Overview of Earnings Trends

When looking at Q3 as a whole, the actual results combined with estimates for upcoming reports suggest total earnings for the S&P 500 index will increase by +3.6% from last year, with revenues rising by +4.6%.

The earnings growth rate could improve to +5.8% without the drag from the Energy sector, which is projected to decline by -24.2%. Conversely, excluding the significant contributions from the Tech sector would reduce the overall earnings growth to just +0.6%.

The earnings growth trajectory appears set for improvement as we move into the next quarter, as shown in the chart below depicting quarterly earnings trends.

Image Source: Zacks Investment Research

The annual earnings picture is also evident in the following chart.

Image Source: Zacks Investment Research

This year’s projected earnings growth of +7.7% appears notable, especially given a modest revenue increase of only +1.8%, which reflects weakness in the Finance sector. When the Finance sector is excluded, expected earnings growth rises to +6.9%, with revenue growth improving to +4.2%. This indicates that nearly half of the current earnings growth stems from revenue increases, with the other half driven by margin enhancements.

Zacks Identifies #1 Semiconductor Stock

Our latest top chip stock is significantly smaller than NVIDIA, which has seen over +800% growth since our recommendation. While NVIDIA remains robust, our new pick has ample potential for growth.

Positioned to meet the rising demand in Artificial Intelligence, Machine Learning, and the Internet of Things, this company is well-placed as global semiconductor manufacturing is expected to surge from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Bank of America Corporation (BAC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

To read the full article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.