Enphase Energy Faces a Pivotal Quarter Amid Stock Struggles ENPH is set to release its third-quarter earnings report after the market closes on Tuesday. Analysts predict earnings of 77 cents per share and revenue of $391.98 million.

Despite this optimistic forecast, investor sentiment appears cautious. The solar energy company’s stock has plummeted 31.10% year-to-date and has declined 6.10% over the past year. Remarkably, a 22.72% drop in the past month highlights growing concerns as the earnings announcement approaches.

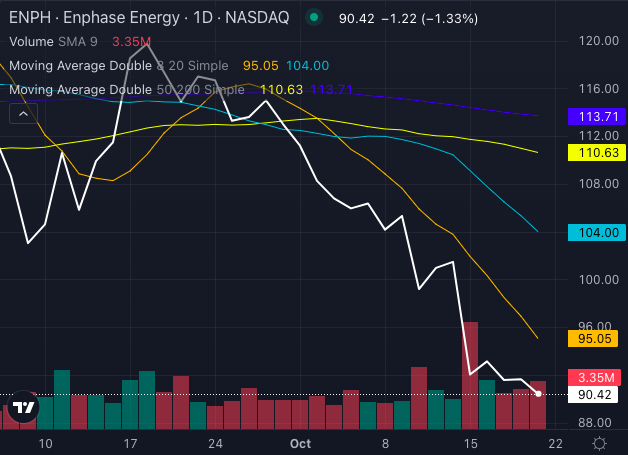

Technical Analysis Reveals Weakness in Enphase Stock

As Enphase Energy prepares to unveil its quarterly results, the technical charts indicate potential difficulties for its stock.

Chart created using Benzinga Pro

Currently trading at $90.42, the stock is well below its eight-day, 20-day, and 50-day simple moving averages, indicating a consistent downward trend. In addition, the price is significantly under its 200-day moving average of $113.71, reflecting the considerable challenges the stock is facing despite some intermittent buying pressure.

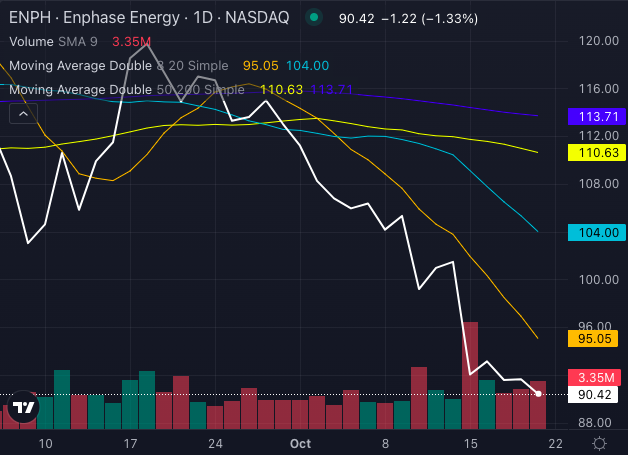

Momentum Indicators Highlight Ongoing Challenges

Chart created using Benzinga Pro

Momentum indicators further contribute to the stock’s bleak outlook. The Moving Average Convergence Divergence (MACD) stands at a negative 5.67, signaling persistent selling pressure. Furthermore, the Relative Strength Index (RSI) is at 28.06, indicating that the stock is oversold, which might suggest a short-term recovery. Nevertheless, such oversold conditions may not suffice to counter the predominant negative trend. Enphase is also trading near the bottom of its Bollinger Bands, which fluctuate between $88.09 and $125.32, reflecting significant pressure as earnings draw near.

Read Also: Goldman Sachs Highlights 20 Top Short-Squeeze Opportunities For Q3 Earnings Season

Analysts Downgrade Expectations for Enphase

Market analysts are also adjusting their price targets for Enphase Energy. Recently, Citi reduced its target from $114 to $99, maintaining a Neutral rating. Piper Sandler followed by lowering its target from $115 to $105, while Royal Bank of Canada downgraded the stock from outperform to sector perform, adjusting its target from $125 to $100.

The overall consensus rating remains neutral, reflecting a cautious approach from market participants as they await the forthcoming earnings announcement.

Can Earnings Bring Relief to Enphase?

As of now, Enphase Energy is trading at $90.20, significantly lower than its recent highs and key technical thresholds. With bearish signals prevailing and reduced expectations from analysts, investors are hoping that the upcoming third-quarter results can provide some much-needed support.

Until the earnings report is released, the company’s prospects seem uncertain.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs