Top Stocks to Watch as Earnings Season Approaches

This week, earnings reports from major banks are making headlines. However, several stocks from different sectors are drawing attention for their strong potential, ranking in the top 40% of over 250 Zacks industries.

With a Zacks Rank #2 (Buy), here are three standout stocks to consider as they prepare for Q3 results on Wednesday, October 16.

Abbott Laboratories (ABT)

Category: Medical Products

Abbott Laboratories is a key player in the pharmaceutical and medical device industries. The company provides a range of products from diagnostics to nutrition, which supports steady growth in sales.

For Q3, Abbott is expected to report sales of $10.56 billion, a 4% increase, and earnings of $1.20 per share, a 5% rise. Abbott has met or exceeded the Zacks EPS Consensus for 13 consecutive quarters since July 2021.

Looking ahead to fiscal years 2024 and 2025, Abbott is poised for continued growth. The company’s annual dividend yield stands at a healthy 1.89%, surpassing the S&P 500 average of 1.23% and is attractive compared to many industry peers.

Image Source: Zacks Investment Research

Equifax (EFX)

Category: Financial Transaction Services

Equifax operates as a major player in data analytics and technology within the financial services sector. The company provides essential information solutions and outsourcing services.

Q3 sales for Equifax are projected to surge 9% to reach $1.44 billion, with earnings expected to increase 4% to $1.84 per share. This year, their bottom line may grow by 9%, with further high-double-digit earnings growth projected for FY25.

Image Source: Zacks Investment Research

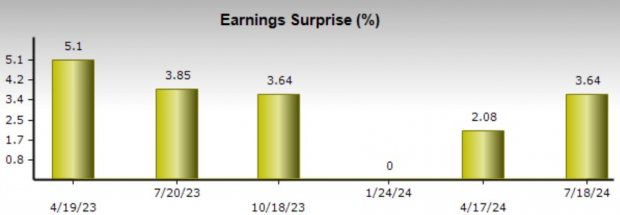

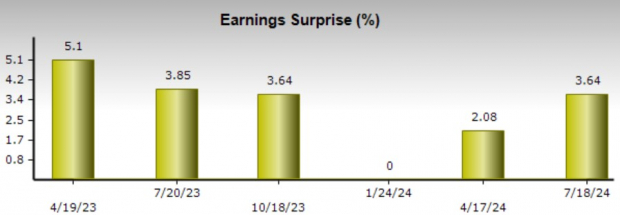

Additionally, the Zacks ESP (Expected Surprise Prediction) indicates that Equifax may go beyond earnings forecasts, as the Most Accurate Estimate for Q3 EPS is $1.88, 2% higher than the Zacks Consensus. The company has exceeded expectations in three of its last four quarterly earnings reports, with an average surprise of 3.22%.

Image Source: Zacks Investment Research

SL Green Realty (SLG)

Category: REIT and Equity Trust-Other

SL Green Realty focuses on commercial and residential real estate in New York, positioning itself as a noteworthy REIT. The company’s Q3 sales are forecasted to rise 4% to $136.66 million.

Interestingly, SL Green is currently viewed as undervalued, trading at 8.9X forward earnings, despite an expected 5% decline in Q3 EPS to $1.20.

However, the Zacks ESP hints that SL Green might surpass earnings forecasts, with the Most Accurate Estimate at $1.23, which is 2% above the Zacks Consensus.

Image Source: Zacks Investment Research

Looking ahead, SL Green’s annual earnings are expected to jump 54% in FY24 to $7.61 per share compared to $4.94 in 2023, though FY25 EPS may decrease to $5.20 after such a notable year. The company’s annual dividend of 4.42% is likely to attract investors. SL Green has beaten the Zacks EPS Consensus in two of its last four quarterly earnings reports, averaging a surprise of 9.98%.

Image Source: Zacks Investment Research

Conclusion

As they prepare to report Q3 earnings, Abbott Laboratories, Equifax, and SL Green Realty stand out as intriguing stocks to watch. If these companies can meet or exceed market expectations and provide positive guidance, they may offer significant upside potential.

National Infrastructure Investment Set to Surge

A major initiative to repair and rebuild the U.S. infrastructure is on the horizon. This effort is bipartisan and urgent, projected to involve trillions of dollars in spending, creating vast opportunities for savvy investors.

The key question remains: “Will you invest in the right stocks before their growth potential peaks?”

Zacks has released a Special Report that explores this very opportunity, and it’s available to you for free. Learn about five companies positioned to benefit from funding for roads, bridges, buildings, cargo transport, and energy transformation at an unprecedented scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Looking for the latest stock recommendations from Zacks Investment Research? Download the report on 5 Stocks Set to Double at no cost.

Abbott Laboratories (ABT): Free Stock Analysis Report

Equifax, Inc. (EFX): Free Stock Analysis Report

SL Green Realty Corporation (SLG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.