American Water Works Prepares for Q3 Earnings Announcement Amid Mixed Analyst Sentiments

American Water Works Company, Inc. (AWK), headquartered in Camden, New Jersey, specializes in water and wastewater services across the United States. With a valuation of $27.7 billion, the company operates infrastructure in 14 states and on 18 military installations. As it approaches its fiscal Q3 earnings results, set for release after the market closes on Wednesday, Oct. 30, investors are closely watching.

Anticipated Earnings and Past Performance

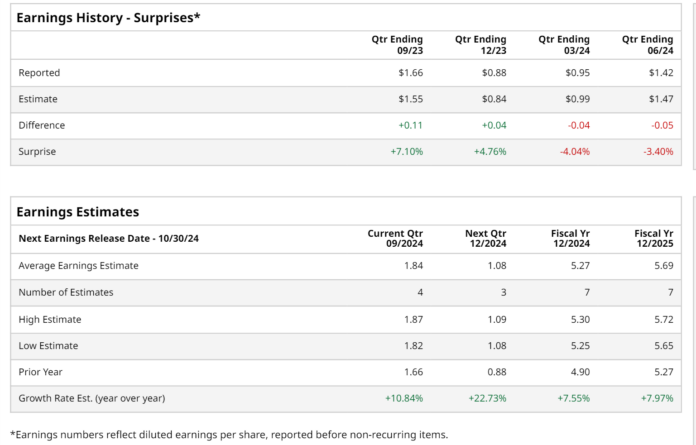

Analysts project that AWK will report a profit of $1.84 per share for the latest quarter, representing a 10.8% increase from the $1.66 per share achieved in the same period last year. Historically, AWK has had a mixed track record against Wall Street’s expectations, having beaten forecasts in two of the last four quarters. In the second quarter, however, the company posted earnings per share (EPS) of $1.42, which fell short of estimates by 3.4% and marked a 1.4% decrease from the previous year. Factors contributing to this decline included unfavorable weather patterns early in 2024 and rising operational expenses.

Future Projections

For fiscal 2024, analysts expect AWK’s EPS to reach $5.27, a rise of nearly 7.6% compared to $4.90 in fiscal 2023. Looking even further ahead, EPS is anticipated to grow almost 8% year-over-year to $5.69 in fiscal 2025.

Market Performance and Investor Confidence

This year, shares of AWK have risen 6.9%, which lags behind the S&P 500 Index’s 22.7% increase and the Utilities Select Sector SPDR Fund’s substantial 28.9% return.

Following its Q2 earnings announcement, AWK’s stock rose 1.5%, even though it missed initial earnings estimates. This uptick was spurred by revenue of $1.15 billion surpassing expectations of $1.07 billion, reflecting a 4.7% increase compared to last year. The growth in revenue was facilitated by a 5.2% year-over-year rise from regulated business segments, along with five acquisitions completed in the quarter that added 33,400 new customers.

Analysts’ Ratings and Price Target

Despite some optimism, analysts hold a cautious stance on AWK stock, with an overall “Hold” rating. Out of 15 analysts covering the stock, three advocate for a “Strong Buy,” one for a “Moderate Buy,” eight suggest “Hold,” two propose “Moderate Sell,” and one recommends “Strong Sell.” This represents a more subdued outlook compared to three months ago when there were no “Strong Sell” recommendations.

The median price target set by analysts for AWK is $143.17, suggesting a modest upside of 1.5% from current levels.

More Stock Market News from Barchart

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.