Upcoming Q3 Earnings: Cboe Global Markets Poised for Continued Growth

Cboe Global Markets Overview and Earnings Expectations

Chicago, Illinois-based Cboe Global Markets, Inc. (CBOE) is a major player in the U.S. stock exchange scene, recognized for its high trading volumes and its status as a leading global market for ETP trading. With a market capitalization of $22.2 billion, CBOE operates through various segments including Options, North American Equities, Europe and Asia Pacific, Futures, Global FX, and Digital. The company is set to announce its Q3 earnings before the market opens on Friday, Nov. 1.

Profit Projections and Recent Performance

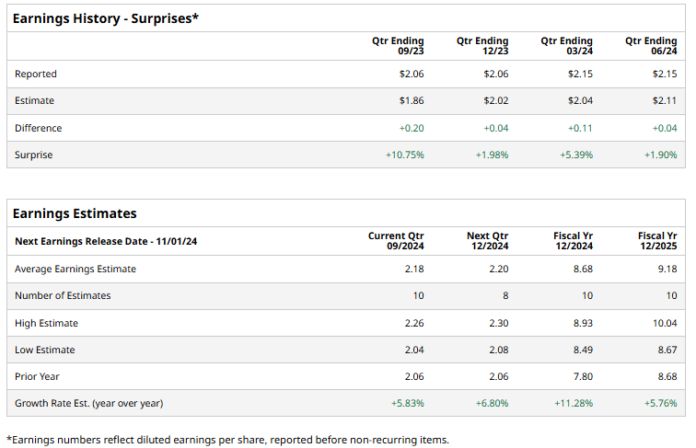

Analysts predict that CBOE will report earnings of $2.18 per share for the upcoming quarter, reflecting a 5.8% increase from last year’s $2.06 per share. Notably, the company has consistently outperformed Wall Street’s adjusted EPS estimates for the past four quarters. In the last reported quarter, its adjusted EPS climbed 20.8% year-over-year to $2.15, surpassing consensus estimates by 1.9%.

Fiscal 2024 Earnings Forecast

Looking ahead to fiscal 2024, analysts anticipate an adjusted EPS of $8.68 for CBOE, marking an 11.3% rise from the $7.80 reported in fiscal 2023.

Year-to-Date Performance Compared to Indices

This year, CBOE shares have appreciated nearly 18%, which is behind the S&P 500 Index’s ($SPX) 22.8% gains and the Financial Select Sector SPDR Fund’s (XLF) 26.7% returns during the same period.

Q2 Earnings Highlight and Analysts’ Ratings

Following the release of its Q2 earnings on August 2, Cboe’s shares jumped 4.3%. The company reported a strong 10% year-over-year increase in net revenues, totaling $513.8 million, largely due to growth in cash and spot markets, derivatives markets, and revenues from data and access solutions. Though operating expenses rose by 36.6%—including an $81 million impairment charge related to the Digital segment—Cboe’s net income to common stockholders rose by 20%, reaching $226.2 million compared to the same quarter last year when excluding non-recurring expenses.

The consensus rating for CBOE stock remains moderately bullish, reflected in the overall “Moderate Buy” rating. Out of 17 analysts monitoring the stock, four recommend a “Strong Buy” while the majority, 13, suggest a “Hold.” Currently, CBOE shares are trading below the average price target of $211.06.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are for informational purposes only. For further details, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.