Expedia Group Prepares for Q3 Earnings Report Amid Stock Developments

Headquartered in Seattle, Washington, Expedia Group, Inc. (EXPE) stands as a significant player in the global travel and hospitality sector. The company boasts a wide array of brands and services including Expedia, Hotels.com, Vrbo, and Travelocity. With a market capitalization of $21.8 billion, Expedia is known for its innovative approach, user-friendly platforms, and dedication to facilitating seamless travel experiences. The company plans to release its fiscal Q3 earnings results after the market closes on Thursday, November 7.

Analysts Predict Positive Earnings Growth

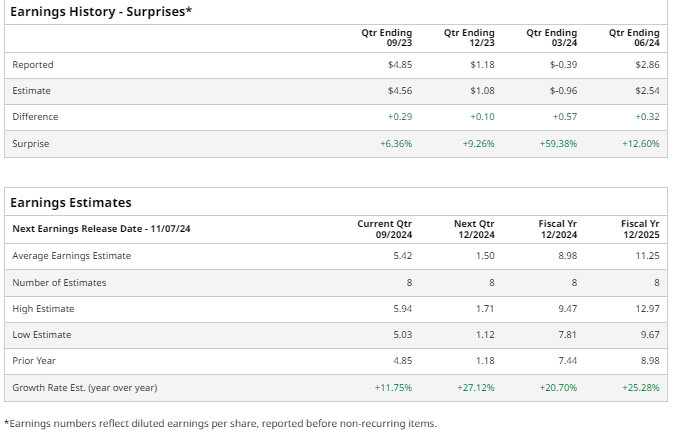

In anticipation of the earnings announcement, analysts forecast EXPE will report earnings of $5.42 per share, reflecting an 11.8% increase from $4.85 per share during the same period last year. The company has a history of exceeding Wall Street’s expectations, having surpassed EPS estimates in each of its last four quarterly reports. Most recently, EXPE reported an adjusted EPS of $2.86 for the last quarter, beating analyst expectations by 12.6%.

Future Earnings Expectations

Looking ahead to fiscal 2024, expectations are high, with analysts predicting EPS of $8.98, a 20.7% increase from the previous year’s $7.44.

Stock Performance and Market Comparison

Year to date, EXPE shares have appreciated by 5.2%. However, this growth lags behind the S&P 500 Index ($SPX), which has surged by 23%, and the Consumer Discretionary Select Sector SPDR Fund (XLY), with an increase of 11.6% over the same period.

Recent Stock Movements

On October 17, EXPE’s stock price jumped over 4% after a Financial Times report suggested that Uber Technologies, Inc. (UBER) might be interested in acquiring the company. This wasn’t the first instance of significant stock movement; on August 8, an earnings report showed strong results, prompting a more than 10% increase in stock price during the following trading session. The company revealed a 6% increase in gross bookings, totaling $28.8 billion.

Analysts’ Ratings and Price Targets

Currently, the consensus rating for EXPE stock is “Moderate Buy.” Out of 31 analysts, eight recommend “Strong Buy,” one suggests “Moderate Buy,” while 22 recommend holding the stock. This is a slight decline in bullish sentiment compared to last month, when nine analysts had given a “Strong Buy” rating.

Despite EXPE trading above its average price target of $148.97, a Street-high target of $200 suggests potential for a 25.3% increase from current price levels.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data provided here is solely for informational purposes. For further details, please refer to the Barchart Disclosure Policy here.

The views expressed are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.