Martin Marietta Materials Set to Reveal Q3 Earnings Amid Mixed Analyst Sentiment

On Wednesday, October 30, Martin Marietta Materials, Inc. (MLM), based in Raleigh, North Carolina, is scheduled to announce its fiscal Q3 earnings results before the market opens. This natural resources company, valued at a market cap of $35.6 billion, specializes in providing aggregates and heavy-side building materials to the construction industry. In addition to its primary offerings, MLM also produces magnesia-based chemicals.

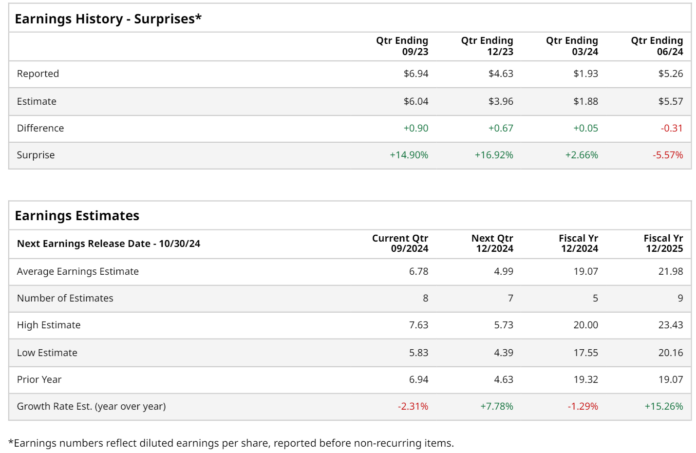

Analysts forecast that MLM will report a profit of $6.78 per share, a slight drop of 2.3% from last year’s figure of $6.94. Historically, the company has exceeded Wall Street’s expectations in three out of its last four quarters, although it fell short once. In Q2, MLM’s adjusted earnings per share (EPS) came in at $5.26, missing estimates by 5.6% and representing a 6.1% decline compared to the previous year.

Looking ahead to fiscal 2024, estimates suggest an EPS of $19.07, a decrease of 1.3% from $19.32 in fiscal 2023. However, a more positive outlook for fiscal 2025 sees EPS anticipated to rise by 15.3% to $21.98 year-over-year.

In terms of stock performance, MLM shares have risen by 15.6% year-to-date, which is lower than the S&P 500 Index’s increase of 22.7%, but still better than the Materials Select Sector SPDR Fund’s (XLB) 12.2% gain during the same time frame.

On August 8, Martin Marietta reported its Q2 earnings, detailing $1.76 billion in revenue, which fell short of analysts’ expectations of $1.81 billion and represented a 3.1% decline from the previous year. This underperformance was largely attributed to challenges stemming from historic rainfall in Texas and parts of the Midwest, combined with a tight monetary environment and slowing demand in private construction. Nonetheless, MLM’s stock saw a slight increase following the earnings announcement.

Analysts largely maintain a favorable view of Martin Marietta Materials, assigning the stock a “Moderate Buy” rating overall. Among the 16 analysts monitoring MLM, 10 recommend a “Strong Buy,” two advise a “Moderate Buy,” and four suggest holding the stock.

The average price target for MLM from analysts stands at $615.16, reflecting an 8.5% upside potential from current trading levels.

More Stock Market News from Barchart

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.