Microsoft’s Earnings Ahead: Is AI the Key to Their Growth?

As another earnings season approaches, corporate America is gearing up for a round of reports that could impact the stock market. Investors are particularly eager to see results from major technology firms leading the way in artificial intelligence (AI), as these companies often report stronger revenue and earnings growth compared to other sectors.

Microsoft (NASDAQ: MSFT) is set to disclose its fiscal 2025 first-quarter earnings, which ended September 30, on October 30. Investors are particularly focused on how well the company is monetizing its AI products and services.

Spotlight on AI Projects at Microsoft

Last year, Microsoft made a significant splash in the tech industry by announcing a $10 billion investment in OpenAI, the developer of ChatGPT. This partnership has led to several AI innovations, including Copilot, a virtual assistant that generates text, images, and code from simple commands.

Currently, Copilot is included free of charge in many of Microsoft’s key software offerings, such as the Windows operating system, the Edge browser, and the Bing search engine. However, there is an added subscription cost for Copilot integration in Microsoft 365, which includes popular applications like Word, PowerPoint, and Excel.

With over 400 million paid seats for Microsoft 365 globally, there lies a substantial opportunity for the company to expand its Copilot revenue. In the fourth quarter of fiscal 2024, Microsoft reported that the number of corporate customers purchasing over 10,000 Copilot add-ons had doubled within just three months, a trend that investors will watch closely in the upcoming quarter.

Azure: A Powerhouse for Earnings Growth

Microsoft’s Azure cloud computing platform is expected to be a highlight in the earnings report, especially due to its Azure AI service. This platform allows businesses to rent cutting-edge data center computing capacity powered by chips from Nvidia and Advanced Micro Devices, enabling the development of tailored AI models. As of the end of Q4, Azure AI had attracted 60,000 customers, marking a 60% increase from the previous year.

Key Metrics to Monitor for Microsoft Investors

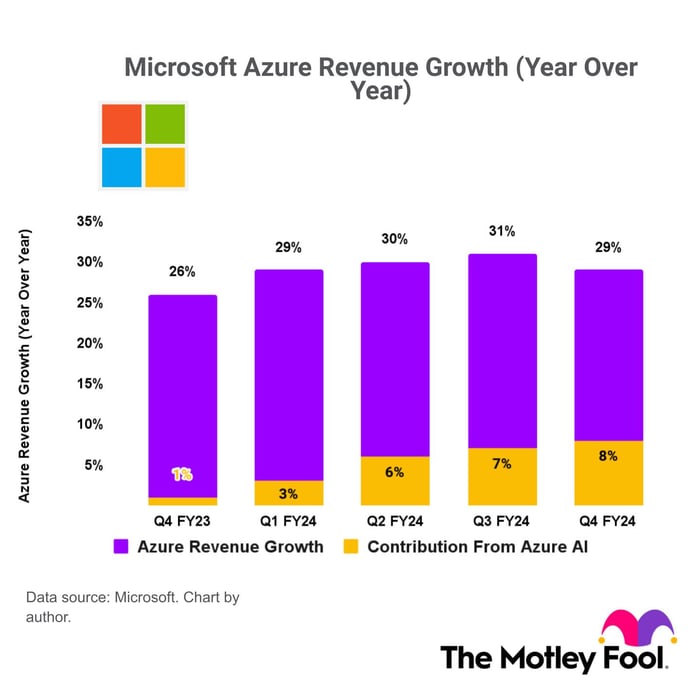

Azure has been the fastest-growing segment of Microsoft, with Q4 revenue up 29% year-over-year, accelerating from a 26% growth the previous year. Notably, Azure AI contributed 8 percentage points to Azure’s total growth, a significant rise from just 1 percentage point a year prior.

Microsoft invested $55.7 billion in capital expenditures during fiscal 2024, primarily for AI infrastructure. This figure is expected to grow in fiscal 2025 as well.

Monitoring the revenue generated by Azure AI will provide insight into the returns Microsoft and its investors are reaping from these substantial investments. An upward trend in Azure AI’s contribution will indicate increasing business spending on AI capabilities.

Microsoft’s Share Valuation: Is It Overvalued?

With a trailing 12-month earnings per share of $11.80, Microsoft’s stock is currently priced at a 35.5 price-to-earnings ratio. This represents a 10.5% premium compared to the Nasdaq-100 index ratio of 32.1, which includes many of its industry rivals.

While heavy spending on AI infrastructure may constrain earnings for the near future, a continuing rise in Azure AI’s contribution to Azure’s overall performance would likely reassure investors, helping maintain the stock’s premium valuation. Conversely, any stagnation in Azure AI’s performance could lead to stock price adjustments.

Thus, Azure AI’s impact on overall revenue growth is a critical figure for investors to watch during the earnings announcement on October 30.

Should You Invest $1,000 in Microsoft Today?

Before deciding to invest in Microsoft, it’s worth noting:

The Motley Fool Stock Advisor team has selected what they believe are the 10 best stocks for investors at this time, and Microsoft is not among them. The selected stocks are anticipated to yield impressive returns over the coming years.

Consider Nvidia’s placement on this list back on April 15, 2005… had you invested $1,000 at that time, it would have grown to $806,459!

Stock Advisor offers a straightforward strategy for investors that includes portfolio-building advice and regular analyst updates, providing two new stock picks each month. Since its inception in 2002, the service has significantly outpaced the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool also recommends options for Microsoft. A disclosure policy is in place.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.