By RoboForex Analytical Department

EUR/USD Hits Near Three-Month Low Amid Economic Pressures

The major currency pair dropped to 1.0789 on Thursday, marking its lowest point in nearly three months. Demand for the US dollar is increasing, driven by expectations of a planned interest rate cut by the US Federal Reserve, along with positive forecasts for a potential second term for Donald Trump.

Euro Under Pressure from Central Bank Moves

The Euro is also facing pressure, influenced by a significant rate cut anticipated from the European Central Bank. This trend suggests limited options for the EUR exchange rate moving forward.

This week, Federal Reserve officials indicated a preference to avoid drastic measures in easing monetary policy. Predictions suggest that US credit costs could decrease by 50 basis points before year-end, but likely no more than that.

Fed caution, combined with the likelihood of a Trump victory in the upcoming November elections, is strengthening the US dollar. Additionally, US government bond yields are on the rise.

Market attention today will focus on October statistics regarding business activity in both services and industry from Markit. Key metrics to watch include new home sales and the weekly unemployment claims report, particularly employment figures, which the Fed monitors closely.

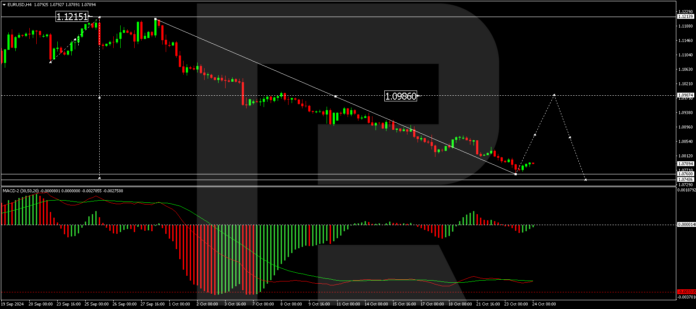

Technical Analysis of EUR/USD

The EUR/USD pair has completed a downward wave to 1.0760 and is now recovering towards 1.0880. Following this bounce, a pullback to 1.0820 is expected. The market may establish a consolidation phase at these lower levels, with a potential upward breakout towards 1.0900, possibly reaching 1.0990. The MACD indicator is currently below zero but increasing, suggesting a possible corrective rally.

On the hourly chart, EUR/USD is showing a second growth impulse heading towards 1.0824. Upon reaching this point, a corrective phase targeting 1.0790 will likely begin. The Stochastic oscillator indicates a short-term bullish correction is possible, with its signal line moving towards 80 from above 50, within a broader bearish context.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs