Understanding Stock Recommendations: A Case Study of Agnico Eagle Mines

Investor decisions often hinge on analyst recommendations, yet the significance of these ratings remains a topic of debate. While media reports can sway stock prices following rating changes, how much should investors truly rely on these insights?

First, let’s analyze the current sentiment from reputable Wall Street analysts regarding Agnico Eagle Mines AEM.

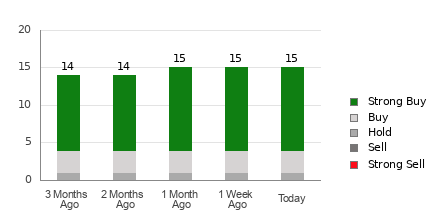

Agnico Eagle Mines holds an average brokerage recommendation of 1.33 on a scale from 1 to 5, where 1 is “Strong Buy” and 5 is “Strong Sell.” This average is derived from the recommendations made by 15 different brokerage firms, suggesting an inclination towards buying the stock.

Notably, of the 15 recommendations, 11 are classified as Strong Buy while three are rated as Buy. This translates to 73.3% for Strong Buy and 20% for Buy, indicating strong positive sentiment.

Current Trends in Brokerage Recommendations for AEM

While the average brokerage recommendation indicates a buying trend for Agnico, relying solely on this data might not be prudent. Studies reveal that brokerage ratings often fail to identify stocks with substantial growth potential effectively.

This raises the question: Why does this disparity exist? Brokers frequently have vested interests in the stocks they cover, leading to a pronounced positive bias in their ratings. Research indicates that for every “Strong Sell” rating, brokers tend to issue five “Strong Buy” recommendations.

Consequently, these ratings may not accurately reflect the stock’s true future trajectory. Instead, using them to support your independent research could be more beneficial.

One robust tool that can aid investors is the Zacks Rank, a proprietary ranking method with a proven track record based on externally audited results. This system categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) and has shown to effectively predict short-term price performance. A wise strategy may involve using the average brokerage recommendation to corroborate the Zacks Rank before making investment decisions.

Distinguishing Between Zacks Rank and Average Brokerage Recommendations

While both tools employ a scale of 1 to 5, their methodologies differ significantly.

The average brokerage recommendation (ABR) derives solely from analysts’ ratings and is typically expressed in decimal form (for example, 1.28). In contrast, Zacks Rank is a quantitative model that leverages earnings estimate revisions and is displayed as whole numbers—ranging from 1 to 5.

Brokerage analysts often display overly optimistic tendencies in their ratings. Due to their employers’ interests, they tend to issue more favorable views than justified by their research, ultimately misleading investors more than aiding them.

On the flip side, Zacks Rank focuses on earnings estimate revisions, which have a proven correlation with stock price fluctuations. This system maintains consistent applications across all stocks under consideration from brokerage analysts.

Another notable distinction lies in the recency of data. The ABR may not always reflect the latest information, whereas Zacks Rank responds quickly to analysts’ updated earnings estimates based on shifts in a company’s business landscape, resulting in real-time insights into future price movements.

Assessing the Investment Potential of AEM

Turning to Agnico Eagle Mines, the Zacks Consensus Estimate for the current fiscal year has risen by 4.1% in the past month to $3.88.

This increase shows analysts’ growing optimism about Agnico’s earnings potential, as demonstrated by consistent upward revisions of EPS estimates. Such trends could indicate a strong price surge on the horizon for the stock.

The magnitude of the recent adjustment in the consensus estimate, alongside three additional earnings estimate indicators, has earned Agnico a Zacks Rank #1 (Strong Buy).

Thus, the ABR for Agnico, while valuable, should be viewed alongside Zacks Rank to guide investment choices effectively.

To read this article on Zacks.com click here.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.