“`html

Analyzing Traditional Automakers: Why General Motors Stands Out

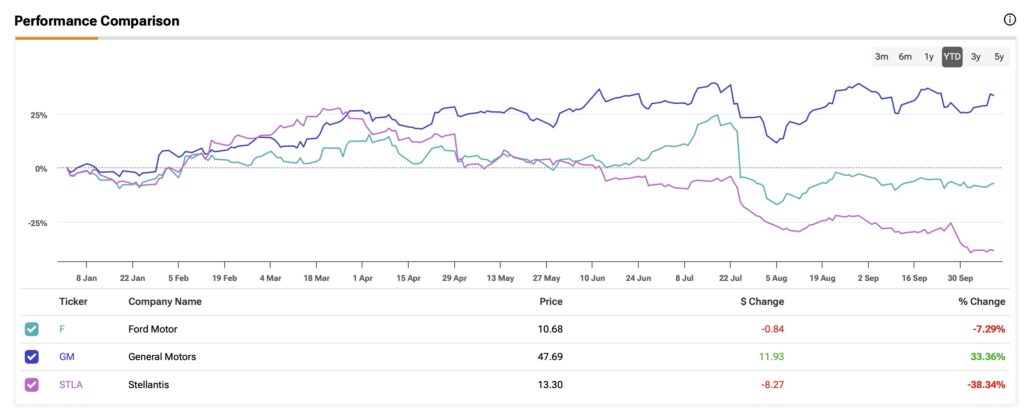

In this article, I will use the TipRanks Stock Comparison Tool to analyze traditional automakers, including Ford (F), General Motors (GM), and Stellantis (STLA). A closer look suggests a neutral stance on Ford, while a bullish outlook is favored for both GM and Stellantis. However, if I had to choose one, I believe investing in General Motors is the best option compared to the other two, which I will discuss next.

Ford: Managing Challenges

I hold a neutral view on Ford, a historic U.S. automaker grappling with significant restructuring challenges aimed at boosting profitability and coping with industry uncertainties. Unfortunately, recent results have not met expectations due to quality and warranty troubles, difficulties in transitioning to electric vehicles, and waning investor confidence.

In its Q2 report, Ford posted disappointing earnings—47 cents per share, missing the 68-cent estimate. This represents the third consecutive quarter of sharp year-over-year declines, largely driven by warranty costs. Furthermore, the Ford Blue segment, focusing on internal combustion engine (ICE) vehicles, saw an adjusted EBIT of $1.2 billion, down 48% from the previous year.

Warranty costs have plagued Ford for several years, diminishing its reputation for quality. In 2023, Ford recalled 5.9 million vehicles, marking it as the highest recall of any U.S. automaker. These losses, alongside increasing warranty claims, raise concerns about the overall quality of Ford’s combustion vehicles.

Positive Moves Amidst Adversity

Despite these challenges, I do not adopt a purely bearish perspective. There are encouraging signs; CEO Jim Farley has announced upcoming resolutions for warranty issues, with plans to invest in advanced technologies and improve testing protocols to address these problems by 2025.

Moreover, Ford reinstated its dividend in 2021 after suspending it during the pandemic, indicating renewed confidence in its financial health and consistent cash flow. The company offers a dividend yield of 7.43% with a payout ratio of 47.5%, making it appealing for income-focused investors. In terms of valuation, Ford is trading at a forward P/E ratio of 5.6x, approximately 30% below its five-year average.

According to TipRanks, Wall Street rates Ford as a Moderate Buy, with an average price target of $14.40, suggesting a potential upside of 34.33%.

General Motors: Leading the Charge

My outlook on General Motors is positive, as the company continues to be a major player and leader in vehicle electrification. The strong sales growth and aggressive shift toward electric vehicles have allowed GM to outperform many rivals this year.

In its Q2 report, GM showcased impressive results, especially in its ICE trucks and SUVs, achieving EPS of $3.06—a 60.2% increase year-over-year. Additionally, its adjusted EBIT reached $4.4 billion, up 37% from last year, prompting the company to raise its full-year guidance by $500 million, now estimated at $13 billion to $15 billion.

GM’s Growth and Stock Performance

General Motors’ commitment to expanding its Electric Vehicle (EV) initiatives is key to its bullish investment outlook. The company has set ambitious goals to electrify 50% of its fleet by 2030 and 100% by 2035, now emphasizing that these targets will align with consumer demand.

One primary reason for GM’s stock outperformance is its nearly 5% revenue growth year-over-year, significantly higher than the industry average of 2%. Its EBIT increased by 4.2%, in contrast to the industry’s 1.8% average. On the other hand, competitors like Ford and Stellantis reported EBIT declines of 55% and 27%, respectively.

While GM offers a dividend yield just under 1%, less appealing than Ford’s, it has repurchased approximately $11.5 billion in shares over the past year, yielding a buyback yield of about 21.6%—far exceeding Ford’s 1.3%. Additionally, GM trades at a forward P/E ratio of 4.8x, nearly 40% below its historical average, despite a remarkable 55% stock appreciation over the last year.

As per TipRanks, the Wall Street consensus rates GM as a Moderate Buy, with a promising outlook ahead.

“`

Stellantis Faces Challenges Ahead, Yet Shows Potential for Growth

Analysts have set an average price target of $57 for Stellantis, indicating a possible upside of 19.07%.

A Closer Look at Stellantis

Stellantis, formed from the merger of Fiat Chrysler Automobiles (FCA) and Peugeot Groupe in 2021, is currently in a phase of transition that may impact its performance. With a diverse portfolio of 14 brands, the company has faced recent challenges despite having strong performances in the past. After achieving record highs in net revenue, net profit, and free cash flow in 2023, results for the first half of 2024 showed declines of 14% in revenue and 38% in profit.

Investors are concerned about the company’s ability to navigate this transitional phase. Stellantis plans to invest $50 billion over the next ten years into battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), aiming for an annual investment of about $8.3 billion. However, positive cash operations exceeding $20 billion annually have provided the company with enough free cash flow to sustain dividends and buybacks.

Capital Efficiency Sets Stellantis Apart

While recent results may cause some hesitation, several aspects of Stellantis’ performance offer a cause for optimism. The company boasts a return on total capital of 9.7%, which surpasses the industry average of 6.1%, and is significantly higher than Ford’s 1.1% and GM’s 3.7%. This strong performance results from effective operations and a focus on high-margin vehicles, positioning Stellantis well for its electrification efforts.

Moreover, Stellantis currently provides a dividend yield of 10.4%, with a payout ratio of 41.5%. Plans to reduce this ratio to 25-30% by 2025 could lower the yield, yet the company’s valuation remains attractive, trading at a forward P/E ratio of 4.1x, which is lower than that of both Ford and GM. According to TipRanks, Wall Street views STLA as a Moderate Buy, with an average price target of $21, suggesting a possible upside of 61.41%.

Final Thoughts

Comparatively, General Motors appears to be on a stronger trajectory than both Ford and Stellantis. While GM offers a modest dividend yield, it provides remarkable returns to shareholders through strategic buybacks. The company’s consistent outperformance against its competitors reflects its robust earnings, which have prompted an optimistic outlook for future results.

Disclosure

Disclaimer

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.