Cathie Wood’s Bold Bet: Should You Buy Shopify Stock?

Cathie Wood, the CEO of ARK Invest, has made headlines with her investment strategies over the past few years. Known for her firm’s actively managed exchange-traded funds (ETFs), she gained recognition when they outperformed the market during the pandemic’s early days. Although her performance has cooled, her stock picks remain relevant. One notable focus for Wood is Shopify (NYSE: SHOP), which stands as the largest holding in ARK Invest’s portfolio. Should investors consider following her lead by putting money into Shopify?

Shopify: An Overview of Its Business Model

To understand Shopify, it’s essential to know what it does. The company provides a platform that enables merchants to create online stores, which are crucial for success in today’s marketplace.

Shopify particularly supports small to medium-sized businesses. It features an app store, where developers have designed numerous tools that assist with inventory management, payment processing, cross-platform selling, and various other services.

Shopify’s app store benefits from a network effect. As more merchants use the platform, the appeal for developers increases. In turn, this attracts even more merchants as new apps emerge.

Merchants face high switching costs with Shopify; they invest substantial time and resources into creating their storefronts and attracting customers, making it unlikely they will leave without significant cause.

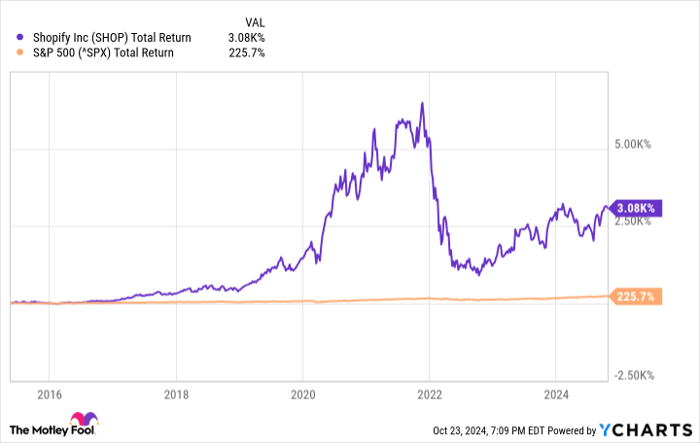

These factors contribute to Shopify’s strong competitive advantage, or “moat.” Its financial performance has been solid overall. While growth has slowed in recent years and profitability has historically been an issue, Shopify has still outperformed many stocks since its 2015 initial public offering (IPO).

SHOP total return level; data by YCharts.

The critical question is: What lies ahead for Shopify in the long run?

Growth Potential in a Changing Market

Wood’s ARK Invest targets disruptive innovation—companies that are pushing boundaries and potentially yielding substantial returns.

E-commerce is set to play a significant role in the future of retail. It offers considerable advantages over traditional stores, allowing customers to access thousands of merchants worldwide. E-commerce also helps reduce operating costs, benefiting consumers with lower prices.

Some critics argue that online retail is already widespread, but that’s not entirely accurate. In the U.S., e-commerce sales represented only 15.2% of total retail sales in the second quarter, a steep increase from roughly 7% in early 2015. This growth indicates a promising future.

Shopify capitalizes on this development, capturing a 30% share of the U.S. e-commerce software market—8% more than its nearest competitor. This competitive strength should help it remain an industry leader for the foreseeable future.

The substantial opportunities on the horizon are likely to support consistent revenue growth. It’s not unusual for larger companies to experience a decrease in their growth rates, particularly after significant booms like Shopify experienced early in the pandemic.

Recently, Shopify has taken steps to enhance its profitability. It divested its costly logistics segment, which faced challenges competing with larger players.

Additionally, Shopify’s free cash flow is on the rise, and it recorded a profit in the second quarter. The company aims to establish long-term sustainability, aspiring to become a hundred-year company.

While it’s uncertain if Shopify can achieve this goal, the stock appears well-positioned for growth in the near term. Investors might consider following Wood’s example by investing in Shopify.

Is Now a Good Time to Invest $1,000 in Shopify?

Before making a decision to buy Shopify stock, it’s important to consider some factors:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks for potential investors, and notably, Shopify did not make the list. These top stocks are expected to generate substantial returns over the coming years.

For instance, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, that investment would have grown to $867,372!*

The Stock Advisor program offers investors a straightforward approach to building a successful portfolio, including expert guidance, regular updates, and new stock recommendations twice a month. This service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Prosper Junior Bakiny has positions in Shopify. The Motley Fool has positions in and recommends Shopify. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.