Nvidia: The AI Chip Leader Faces Rising Competitive Pressures

When it comes to manufacturing artificial intelligence (AI) chips, Nvidia (NASDAQ: NVDA) holds a commanding lead. Estimates suggest that the company has an 80% to 95% market share for AI graphics processing units (GPUs).

However, Nvidia’s stock is currently priced at 36 times sales, making it sensitive to competition. One key metric indicates that these competitive pressures may appear sooner than anticipated.

Potential Underinvestment in R&D Concerns Analysts

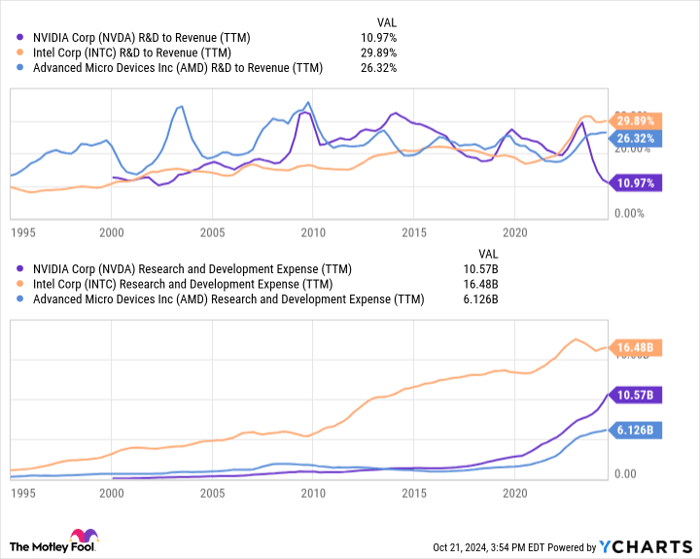

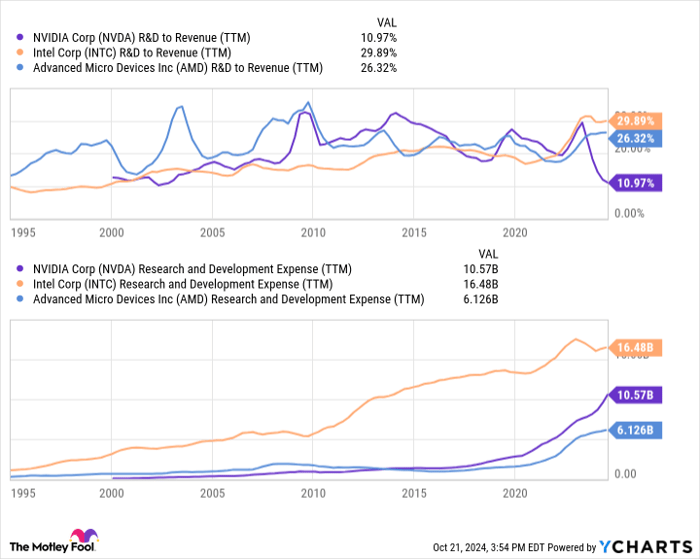

For investors watching high-profile AI companies like Nvidia, tracking research and development (R&D) spending is crucial. These expenses provide insights into how much a company is investing in future innovations. Though these investments may not deliver immediate returns, neglecting R&D can hinder a company’s long-term competitive advantage.

Nvidia currently enjoys a significant edge in the AI GPU market, boasting gross margins of around 75%. In contrast, competitors such as Intel and AMD report gross margins between 40% and 50%, which highlights Nvidia’s pricing strength.

Affordable prices do not come from lower sales volumes either, as nearly every estimate indicates Nvidia’s dominant market share in AI GPUs. Yet, there is growing concern that Nvidia may be underinvesting in R&D at a critical time. Intel is spending billions more on R&D annually, despite having a market cap that is 95% smaller than Nvidia’s. Similarly, AMD appears to allocate a higher percentage of its revenue to R&D.

These trends raise worries about Nvidia’s future growth potential due to insufficient R&D investment.

NVDA R&D to Revenue (TTM) data by YCharts.

Understanding Investment Strategies in AI Stocks

Investing in semiconductor stocks like Nvidia is inherently cyclical. For example, valuations for almost every chipmaker, including Nvidia, fell by double digits in 2022, despite increasing volumes overall. However, 2023 saw a rebound in valuations across the industry.

By 2024, a notable shift took place. Nvidia’s stock price soared, while AMD’s valuation stagnated, and Intel lost about one-third of its value.

These patterns are typical in the semiconductor industry, which constantly faces new challenges and opportunities. While shifts in valuations and market shares are driven by continuous innovations, one major growth driver for the coming decade is clear: AI.

Currently, Nvidia’s GPUs remain the preferred choice for many AI developers, leading companies to pay significantly more for these chips compared to other offerings. This is beneficial for Nvidia, especially as AI infrastructure spending accelerates.

Nonetheless, competition is intensifying. Intel is investing heavily in its Gaudi 3 and Falcon Shores chips, which recently demonstrated performance levels comparable to Nvidia’s H100 models. AMD’s upcoming MI325X chip, expected to launch later this year, is designed to support most current AI applications. Additionally, various private startups, such as Cerebras and SambaNova, are exploring innovative AI GPU technologies that might challenge Nvidia’s established approach.

While Nvidia’s market lead and pricing power are unlikely to vanish immediately, increased competition and the R&D efforts of rivals suggest a cautious approach: avoid overconcentration in a single stock. Many investors betting on Nvidia are primarily optimistic about rising AI spending rather than Nvidia’s ongoing ability to maintain its market position.

If you are among these investors, consider diversifying your portfolio with stocks that are currently out of favor, like Intel and AMD. These companies are allocating significant resources for future product launches, which may take time to materialize. Investing primarily in Nvidia while also including other semiconductor stocks ensures that you can benefit from the growth in AI demand, which is one of the biggest opportunities of this century.

A Second Chance at Potentially Profitable Investments

Have you ever felt like you missed out on the chance to buy the most successful stocks? If so, now is an opportunity worth considering.

Occasionally, analysts recommend a “Double Down” stock — companies they believe are poised for growth. If you worry you’ve missed your investment opportunity, now may be the time to act before it’s too late. The past returns are compelling:

- Amazon: A $1,000 investment when we issued a double down in 2010 would be worth $21,154 now!*

- Apple: For a $1,000 investment in 2008, it would have grown to $43,777!*

- Netflix: If you invested $1,000 back in 2004, you’d be looking at $406,992!*

At present, we are issuing “Double Down” alerts for three remarkable companies, and there may not be another opportunity of this nature soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and has the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.