Transform Your Future: The Potential of Emerging Stocks

Some stocks have the potential for life-changing returns over time.

If you had invested $3,500 in Apple (NASDAQ: AAPL) two decades ago, your investment would have ballooned to $1.1 million today, thanks to the smartphone revolution sparked by Steve Jobs.

On the other hand, if you had chosen to invest that same $3,500 in Netflix (NASDAQ: NFLX) 20 years ago, you would currently be looking at a staggering $1.9 million. Netflix’s innovative shift from DVD rentals to a thriving streaming service left competitors like Blockbuster in the dust.

Finally, a $3,500 investment in Nvidia (NASDAQ: NVDA) would now amount to $4.7 million. Nvidia, known for its graphics processing units (GPUs), saw explosive growth, especially in late 2022, achieving an incredible 1,050% return in just two years. The company’s pivotal role in artificial intelligence (AI) processing hardware continues to draw Wall Street’s admiration.

Are Proven Winners Still Worth Investing In?

However, it’s essential to recognize that these impressive gains have already occurred. While Netflix, Apple, and Nvidia remain strong stocks for those seeking steadiness, it is unlikely the massive market capitalizations will allow for similar explosive growth in the future.

Investors should look to smaller, emerging companies that offer more potential for significant growth. Many established high-growth stocks may ultimately fail, but even one successful early investment could lead to substantial returns.

Exploring Duolingo’s Potential in E-Learning

Two stocks I am particularly excited about are Roku (NASDAQ: ROKU) and Duolingo (NASDAQ: DUOL). These mid-cap companies have remarkable growth potential. While I can’t guarantee they’ll make anyone a millionaire, they represent strong opportunities in today’s market.

Duolingo is gaining momentum, boasting a remarkable 242% return over the last two years. Recent financial reports reveal a staggering 87% increase in trailing twelve-month sales, with free cash flows soaring by 553%. Clearly, this company is experiencing healthy growth, catching the eye of investors.

That said, Duolingo’s stock isn’t cheap. Currently valued at 55 times free cash flow and 203 times earnings, these figures are substantial even for a promising growth stock.

Nevertheless, the metrics show promise. In the second quarter, revenues grew by 41% year-over-year, monthly active users climbed by 40%, and the number of paid subscriptions jumped 52%, alongside a 60% increase in free cash flow. Duolingo is building a solid foundation for future expansion, recently diversifying its offerings with math and music courses. As the global online learning market reached over $165 billion in 2023, with expectations for growth exceeding 50% in the next five years, Duolingo is well-positioned for a significant market share increase.

Roku: Shaping the Future of Media-Streaming

Then there’s Roku, a pioneer in media-streaming technology, originally developed as part of Netflix’s hardware division. As an independent entity, Roku has established itself as the leader in North America’s streaming platform industry while also exploring international opportunities.

This company seeks to capitalize on the global shift from traditional media sources, such as cable and broadcast networks, to the growing area of digital streaming services. Roku’s business model now focuses more on software sales rather than hardware. As the digital landscape continues evolving, Roku’s existing experiences domestically will be invaluable in expanding into new markets.

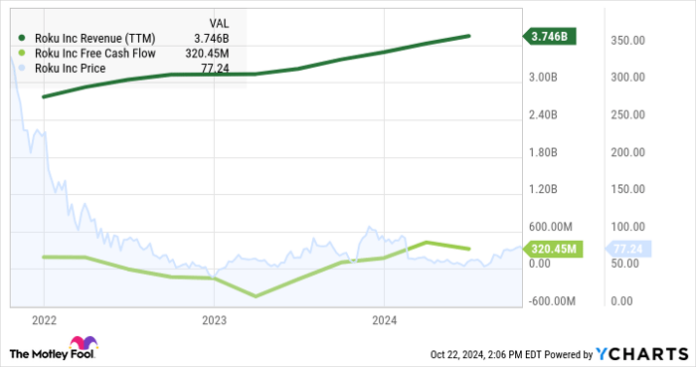

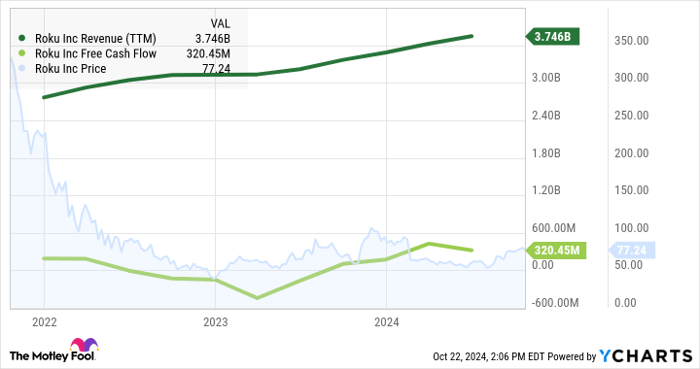

Roku has seen its sales surge as free cash flow recovers from recent declines:

ROKU Revenue (TTM) data by YCharts

Despite its growth potential and profitability, market participants are currently fixated on Roku’s past earnings struggles, leading to a price-to-sales ratio of just 3.0. However, considering the eventual recovery of the digital advertising market and Roku’s prospects for international growth, this stock offers a much more attractive entry point today for long-term investors.

Is Roku a Smart Investment Right Now?

Before deciding to buy Roku stock, it’s wise to consider this:

The Motley Fool Stock Advisor team recently highlighted what they see as the 10 best stocks for investors to pursue, and Roku was not included. These selections are believed to hold significant potential for high returns in the years ahead.

For context, if you had invested $1,000 in Nvidia when it was listed on April 15, 2005, today that investment would be worth about $855,238!*

The Stock Advisor service provides investors a comprehensive approach to portfolio growth through regular market analyses and two stock recommendations per month. Since 2002, its returns have more than quadrupled those of the S&P 500*.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Anders Bylund has positions in Duolingo, Netflix, Nvidia, and Roku. The Motley Fool has positions in and recommends Apple, Duolingo, Netflix, Nvidia, and Roku. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.