AI Stocks Show Potential for Explosive Growth in 2025

As we near the end of 2024, Artificial Intelligence (AI) stocks have demonstrated remarkable performance, and forecasts suggest that 2025 could be even more promising. Some analysts anticipate the market could reach $826 billion by 2030, indicating it will continue to attract significant investments and growth opportunities.

1. Nvidia: The Leader Maintains Its Edge

Nvidia (NASDAQ: NVDA) remains a strong contender in the tech market with prospects for even more growth. The company is set to launch its “Blackwell” architecture chips, which are expected to boost sales significantly. Currently, demand is robust for its “Hopper” chips, with a backlog of orders for Blackwell anticipated to support revenue growth well into 2025.

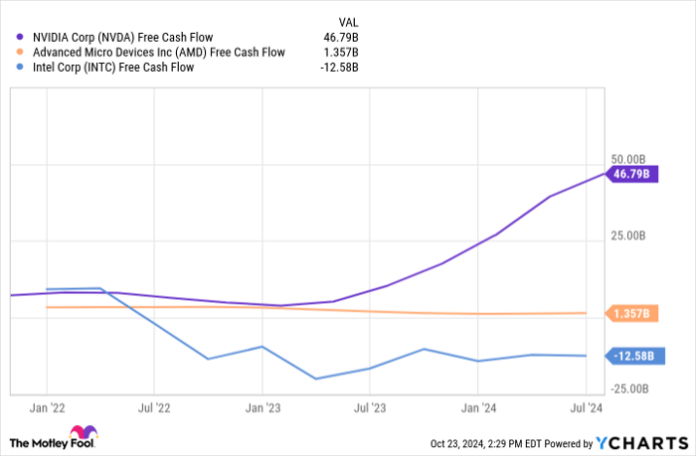

Next month’s earnings report will shed light on Nvidia’s strategies going forward. Notably, Elon Musk recently ordered 100,000 H100 chips, with further plans for additional H200 chips, highlighting continued strong demand. Competitors like AMD are trailing; they plan to introduce their new AI chips around the same time as Blackwell, but their products will directly compete with Nvidia’s H200 architecture rather than Blackwell itself. This situation provides Nvidia with ample opportunity to innovate, benefiting from a significant cash reserve compared to AMD, which spent much less on research and development in the last quarter.

Take a look at the chart below, illustrating Nvidia’s impressive free cash flow that will help sustain its market lead.

NVDA Free Cash Flow data by YCharts

2. Meta: Risks Could Lead to Big Rewards

Meta (NASDAQ: META) has faced criticism for its focus on the metaverse, especially after Reality Labs reported a $4.5 billion loss last quarter. However, this push may not be as misguided as some believe. The tech giant is not shying away from risks, demonstrating a willingness to invest heavily in innovative fields, including AI, which could enhance its advertising efficiency on social media platforms.

Despite losses in its metaverse sector, Meta remains a highly profitable company, benefitting from strong user engagement and revenue across its platforms. It also stands out as one of the more affordable stocks within the tech industry, second only to Alphabet in price-to-earnings ratio. This affordability, combined with its potential in AI, makes Meta an attractive investment option.

Looking ahead, there is speculation that Meta might integrate its AI initiatives with the metaverse. If this combination is executed well, it could significantly impact the company’s future, potentially unveiling new products in 2025.

A Second Chance at Promising Investments

Have you ever felt like you missed the opportunity to invest in successful stocks? You are not alone. Occasionally, our team of experts issues “Double Down” stock recommendations for companies they believe are primed for growth. If you’re hesitant that you’ve missed your chance, now might be the ideal time to invest.

- Amazon: A hypothetical $1,000 investment in 2010 would be worth $21,154 today!*

- Apple: A $1,000 investment in 2008 would have grown to $43,777!*

- Netflix: If you invested $1,000 in 2004, it would now be worth $406,992!*

We are currently issuing “Double Down” alerts for three remarkable companies that may offer substantial gains soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.