Tesla Faces Investor Discontent After Cybercab Launch Event

Tesla’s (TSLA) stock saw an over 8% decline in just five days following the much-anticipated robotaxis event where the company introduced its Cybercab. The numbers indicate more than just a drop in share price; they reflect investor confusion stemming from the event.

Disappointment Among Investors

Many attendees left the event feeling disappointed due to the lack of substantial information shared. There was no clear strategy outlined, no time frame provided for Cybercab’s launch, and minimal technical details on the autonomous vehicle itself, leaving guests with more questions than answers.

Elon Musk’s Humanoid AI Reveal

In a bid to generate excitement, Tesla also showcased Optimus, a humanoid AI robot intended for household tasks and potentially babysitting. Optimus engaged with the audience by dancing, pouring drinks, and chatting. While this demonstration was entertaining, many felt it overshadowed the primary focus on the Cybercab. Controversy arose as some guests alleged that the robots were actually being remotely controlled by Tesla staff, casting doubt on the effectiveness of the presentation and raising concerns about Musk’s credibility, a key factor in Tesla’s lofty valuation.

If you’re interested in a deeper dive into Tesla’s robotaxis event, check out our writer Marc Guberti’s insights.

Three Key Challenges Facing Tesla

- Tesla’s Competitors in the Autonomous Industry: While Tesla continues to unveil projects like the Cybercab without sharing meaningful progress updates, competitors, such as Waymo, backed by Google (GOOGL), are already operational. Waymo is completing around 100,000 rides weekly and has logged over 4.7 million miles this year, according to the California DMV. Other companies like Cruise, Zoox, Nuro, and even Apple (AAPL) are also making strides in the field of autonomous vehicles, intensifying the competition.

- Current Market Challenges: Despite efforts towards a profitable future, Tesla currently faces hurdles. In the second quarter of this year, TSLA reported a 7% year-over-year revenue drop from its existing vehicle lineup. As the first mover in electric vehicles (EVs), Tesla now contends with increasing competition from budget-friendly alternatives. Companies like BYD (BYD), NIO (NIO), Ford (F), and General Motors (GM) are competing for market share, presenting a significant challenge for Musk to swiftly address.

- High Valuation Issues: Currently, Tesla trades at a multiple ratio of 61. This is especially concerning following disappointing second-quarter results and a 12% year-over-year decline. While Musk’s reputation has fueled a higher stock valuation, some investors question whether it is justified, particularly given Tesla’s net profit margin of 5.8%. In comparison, Ford’s valuation stands at a multiple of 11 with a net profit margin of 3.8%, while Ferrari (RACE) trades at a valuation of 54x but boasts net profits exceeding 16% year-over-year.

What Is TSLA’s Price Target?

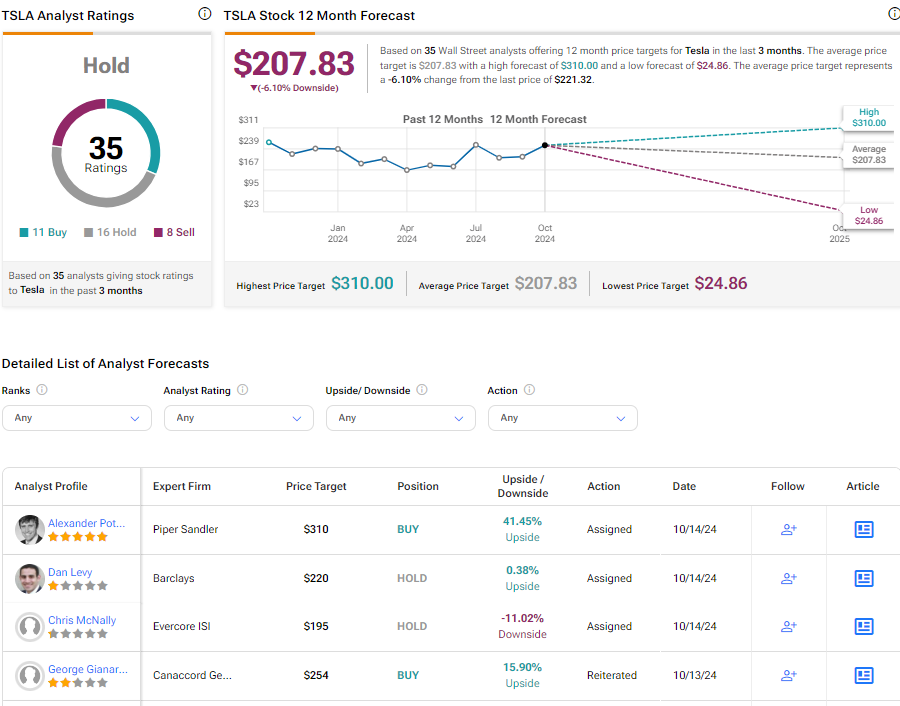

On Wall Street, Tesla holds a rating of Hold. The consensus includes 11 Buys, 16 Holds, and 8 Sell ratings, with the average price target for TSLA stock set at $207.83, indicating a -6.10% downside.

See more TSLA analyst ratings

Conclusion

The recent introduction of Tesla’s Cybercab failed to create positive momentum, resulting in an over 8% drop in TSLA stock. The company now faces mounting challenges, including increasing competition in the autonomous vehicle sector and difficulties in the current EV market. Furthermore, Tesla’s high valuation could deter investors as profits remain constrained in comparison to other industry players. With much riding on Musk’s reputation, the urgency for Tesla to deliver on its promises has never been greater.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.