Earnings season can be unpredictable, often surprising investors with unexpected results. Advanced Micro Devices ($AMD) is set to report its third-quarter earnings, which promises to be another tough challenge. For comparison, Nvidia ($NVDA) reported its Fiscal Q2 2025 earnings in August, exceeding analyst expectations in both revenue and profit, yet the stock still declined post-release. With this in mind, I currently hold a neutral stance on AMD, but that doesn’t mean there aren’t strategies for investors to gain from this stock.

Understanding the Short Iron Condor Options Strategy

This article focuses on an options trading strategy called the “short iron condor.” The term “short” indicates that this strategy is initiated as a net credit, meaning traders start with cash inflow. The goal is for the price of AMD stock to remain within a specific range.

The short iron condor involves executing four different transactions. Essentially, it combines a bull put spread with a bear call spread. To illustrate, think of a classic side-scrolling video game where your airplane must fly through a tunnel. You can’t go too high or too low; maximum profit occurs when AMD stock settles between the middle strike prices.

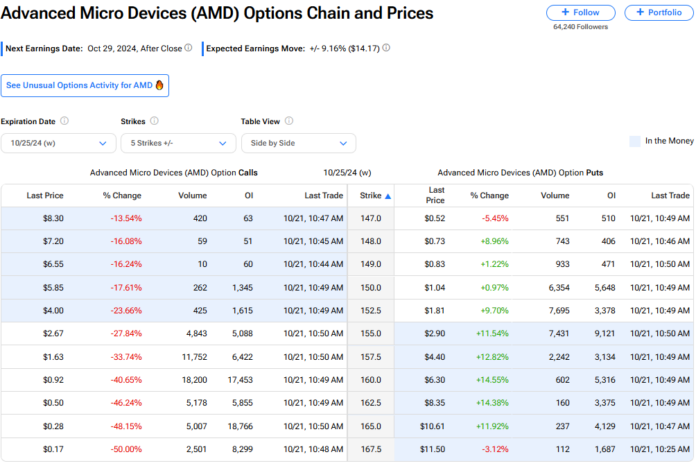

Below, you will find a chart detailing the current options activity on AMD stock according to TipRanks.

Current Outlook for AMD Stock

Many financial analysts utilize technical analysis to identify the strike prices and potential profitability range for iron condors. If a stock trades consistently within a certain range, it helps analysts determine its upper and lower limits. However, I prefer to establish a solid baseline using factual data before guided speculation.

According to TipRanks’ Options Chain and Prices algorithm, AMD stock’s expected move following earnings is 9.29%, which translates to an approximate price fluctuation of $14.49. Additionally, we can calculate this expected movement based on the implied volatility of the options chain.

We’re particularly looking at the options chain that expires on November 29. As of now, the average implied volatility for this chain is 50.22%. By applying stochastic analysis—combining implied volatility, the stock close (Friday’s value of $155.97), and the square root of the time until expiration—we arrive at a potential price movement of $26.25, representing a 16.83% change in either direction.

Exploring Short Iron Condor Scenarios for AMD

Short iron condors can vary greatly in structure. The narrower the profitability range, the higher the yield, yet this comes with an increased risk of losses. To cover the potential price movement of AMD based on our analysis, we could consider setting up the 110P(ut) | 135P || 185C(all) | 210C condor. This structure would create a buffer to the upper breakeven price of 17.48% and a 19.06% gap to the lower breakeven.

This specific trade offers a yield of only 19.05% and carries a risk of $2,100. A more conservative strategy could involve the 125P | 135P || 185C | 195C, which narrows the profitability zone to 16.74% upward and 17.57% downward. This option yields a higher 30.55% while reducing the risk to $766—making it potentially more appealing.

For those willing to take on greater risk, the 130P | 140P || 180C | 190C condor might be attractive. It narrows the “safety” zone to just 14.86% up and 14.01% down. While the yield increases to a compelling 47.06%, traders would only risk $680 to generate a profit of $320. The maximum profit for the first trade is $400, while the second yields $234.

Image by author

Assessing Risks in Options Trading

For traders interested in credit-based iron condors, it may be wise to select options with shorter expiration periods. Such options benefit from rapid theta decay, meaning they lose extrinsic value quickly as they approach expiration. This phenomenon favors options sellers involved in credit trades like the short iron condor.

Another risk to be aware of is market sentiment. While mathematical methods can help determine the spread for iron condors, our previous examples assumed AMD stock would move equally up or down within the predicted range. This analysis relies on a balanced assumption that may not hold true in practice.

If you expect a slight bias in stock movement, it’s wise to adjust your calculations accordingly. In the discussed scenarios, I aimed for condors with an average gap near 0%. However, if you believe AMD stock will trend upwards, consider looking for condors with average gaps closer to 1% or whatever suits your outlook.

Wall Street’s Perspective on AMD

Wall Street currently maintains a Strong Buy consensus on AMD stock, with 25 Buy ratings, six Holds, and zero Sells from the last three months. The average price target for AMD stands at $188.96, suggesting a 22.13% increase from the current price.

Read more analyst ratings on AMD stock

Final Thoughts: A Range-Bound Bet on AMD

Navigating earnings season, especially in the tech sector, can be challenging for investors. While taking a clear directional bet on AMD may seem daunting, trading within a defined range using a short iron condor presents an appealing opportunity. By combining research with sound statistical analysis, traders can isolate effective condor trades that suit their investment strategies.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.