Exxon Mobil Corporation XOM has unveiled a forthcoming decline in its first-quarter financials for 2024.

The inevitable downturn arrives on the back of a period of exceptional prosperity, with the global energy powerhouse setting a new bar with a staggering $11.4 billion in profits during the first quarter of 2023.

However, present indicators paint a contrasting picture, with expected operating profits standing at $6.65 billion – a decline compared to the $11.6 billion of Q1 2023 and the $7.63 billion from the preceding quarter.

Diminished profits are primarily attributed to softened oil and gas prices along with substantial losses in fuel derivatives. A plunge in natural gas prices to multi-year lows is a key factor contributing to the anticipated decrease in upstream earnings by $200-$600 million.

On the brighter side, ExxonMobil anticipates an uptick in its refining earnings, foreseeing an increase of $500-$700 million. Furthermore, the company predicts a margin improvement of $200 million in its chemical units or at least maintaining the previous quarter’s level.

Regarding asset management, ExxonMobil foresees a $300-million boost from asset divestments in Q1. Despite these compensating factors, an air of caution engulfs the energy sector as it navigates through declining commodity prices.

According to Zacks Earnings Trends, the energy sector is projected to rake in $31.6 billion in the first quarter of 2024, marking a notable plunge from the $41.9 billion achieved in the same quarter of 2023.

ExxonMobil’s proactive release of its earnings forecast sets the stage for other oil majors, signaling a possibly bumpy earnings season on the horizon. This development follows a period where four out of the five supermajors surpassed expectations, despite the backdrop of dwindling commodity prices.

Performance Perspective

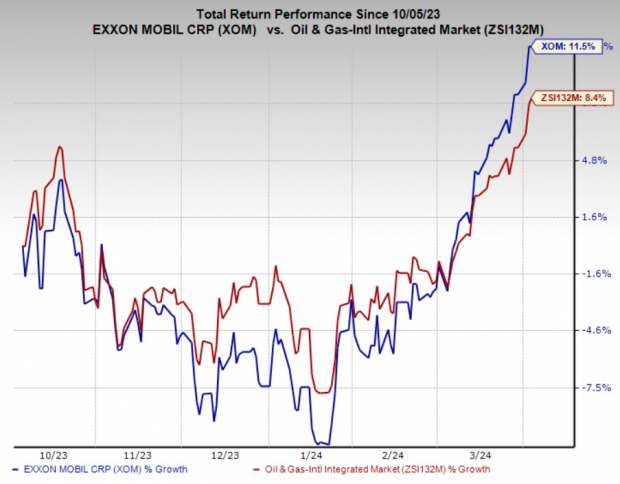

ExxonMobil shares have outshone the industry in the last six months, with a 11.5% increase compared to the industry’s 8.4% growth.

Image Source: Zacks Investment Research

Zacks Analysis & Promising Picks

ExxonMobil currently holds a Zacks Rank #3 (Hold).

Investors eyeing the energy sector might find appeal in the following better-ranked companies, each sporting a Zacks Rank #1 (Strong Buy). Check out the extensive list of today’s Zacks #1 Rank stocks here.

Global Partners GLP leads the pack in operating gasoline stations and convenience stores. GLP witnessed upward revisions in earnings estimates for 2023 and 2024 over the past month.

The Zacks Consensus Estimate for Global Partners’ 2024 and 2025 EPS stands at $3.90 and $4.47, respectively. GLP holds a Zacks Style Score of A for Value.

Murphy USA Inc. MUSA is a prominent independent retailer of motor fuel and convenience goods in the United States.

The Zacks Consensus Estimate for MUSA’s 2024 and 2025 EPS sits at $26.32 and $27.94, respectively. MUSA garners a Zacks Style Score of B for Value, Growth, and Momentum. Over the last 30 days, MUSA experienced upwards earnings estimate revisions for 2024 and 2025.

Sunoco LP SUN ranks among the top motor fuel distributors in the U.S. wholesale market based on volumes. Through dispensing over 10 fuel brands at 10,000 convenience stores under prolonged distribution pacts, the partnership continues to yield a steady cash flow.

The Zacks Consensus Estimate for SUN’s 2024 and 2025 EPS is pegged at $4.96 and $4.40, respectively. SUN observed upwards earnings estimate revisions for 2024 and 2025 in the last 30 days. SUN currently holds a Zacks Style Score of A for Momentum and B for Value.

Four Oil Stocks Ready for a Surge

The global thirst for oil is insatiable… and oil providers find themselves struggling to meet demands. Despite oil prices experiencing a dip, companies involved in supplying the world with “black gold” are poised for substantial gains.

Zacks Investment Research has released a critical report to help investors capitalize on this trend.

In Oil Market on Fire, uncover four unexpected oil and gas stocks positioned for remarkable growth in the coming weeks and months. These recommendations are not to be overlooked.

Access your free report now for more details.

Exxon Mobil Corporation (XOM) : Complimentary Stock Analysis Report

Sunoco LP (SUN) : Complimentary Stock Analysis Report

Murphy USA Inc. (MUSA) : Complimentary Stock Analysis Report

Global Partners LP (GLP) : Complimentary Stock Analysis Report

To peruse this article on Zacks.com, please click here.

The perspectives shared here are those of the author and do not necessarily align with Nasdaq, Inc.