Nvidia’s Spectacular Stock Performance: A Look Into 2024 and Beyond

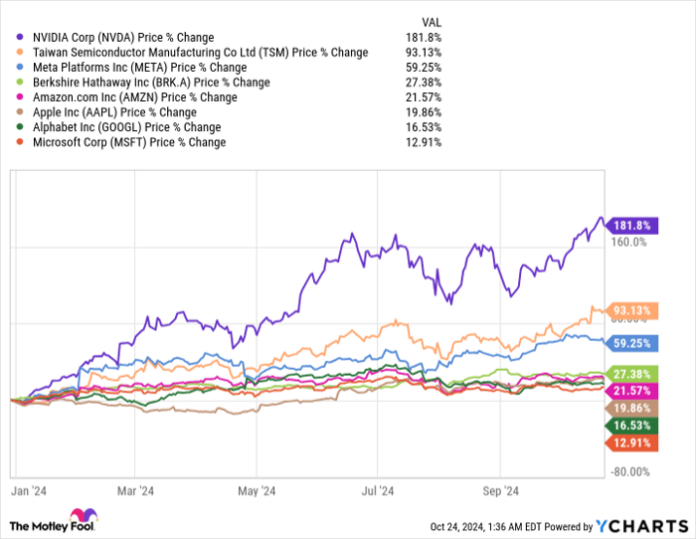

Nvidia (NASDAQ: NVDA) has claimed the title of the best-performing stock in the S&P 500 (SNPINDEX: ^GSPC) for 2023, with an astonishing gain of 239%. In 2024, it continues to rise with an additional 181% increase, although it currently trails behind Vistra Corp for the top spot in the index.

This 181% gain positions Nvidia ahead of all other companies valued at $1 trillion or more.

NVDA data by YCharts.

Nvidia’s remarkable performance stems from the skyrocketing demand for its graphics processing units (GPUs), especially in data centers. These GPUs are favored by developers creating artificial intelligence (AI) models. The company is poised to start shipping its next-generation AI GPUs, which are based on the cutting-edge Blackwell architecture. Nvidia CEO Jensen Huang describes the demand for Blackwell as “insane,” and it’s anticipated that this new technology will again allow Nvidia’s stock to outshine its peers in the trillion-dollar club by 2025.

An Unprecedented Leap in Performance with Blackwell

Nvidia’s H100 GPU has set the standard for AI training and inference. Launched in late 2022, it became the top selection for data center operators like Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), and Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL) throughout 2023. The new H200 GPU increases AI inference speed nearly two-fold from the H100. Yet, Blackwell-based systems such as the GB200 NVL72 claim to deliver AI inference speeds that are 30 times greater than those of H100 systems.

Huang noted that individual GB200 GPUs are expected to sell for $30,000 to $40,000 each—similar to the initial cost of the H100. This jump in cost-efficiency is likely to make advanced AI models more accessible to developers and businesses.

During a CNBC interview in early October, Huang emphasized the “insane” demand for Blackwell GPUs. Analysts estimate Nvidia could ship up to 200,000 GB200 units in the last quarter of 2024, followed by as many as 550,000 in the first quarter of 2025. This could yield around $30 billion in revenue from just this chip in the next two quarters!

Forecasted Revenue Surge for Nvidia in the Coming Year

Nvidia operates on a fiscal year that differs from the standard calendar. Presently, the company is in fiscal 2025, ending January 31, 2025. Fiscal 2026 will then begin.

According to consensus estimates from Wall Street (via Yahoo), Nvidia is projected to reach $125.6 billion in total revenue for fiscal 2025, reflecting a 125% increase from fiscal 2024. The following year, fiscal 2026, is expected to generate $179.2 billion.

The data center segment is anticipated to drive much of this growth, accounting for 87% of Nvidia’s total revenue in the second quarter of fiscal 2025, which recorded $26.3 billion—a staggering 154% increase from the previous year.

The escalating demand for Blackwell GPUs is likely to drive more record results in the upcoming quarters. Reports suggest that Microsoft is among the largest buyers of these new GPUs. For its fiscal 2024 (ending June 30), Microsoft invested an eye-popping $55.7 billion on capital projects, primarily for AI infrastructure and chips, with plans for even greater spending in fiscal 2025.

Likewise, Amazon is expected to allocate over $60 billion for AI infrastructure throughout 2024, while Meta Platforms has announced a budget of up to $40 billion, likely increasing in 2025.

Image source: Nvidia.

Nvidia’s Stock May Still Be Undervalued Despite Gains

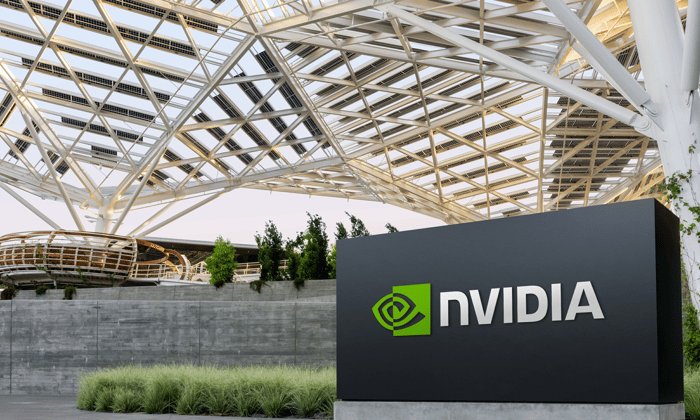

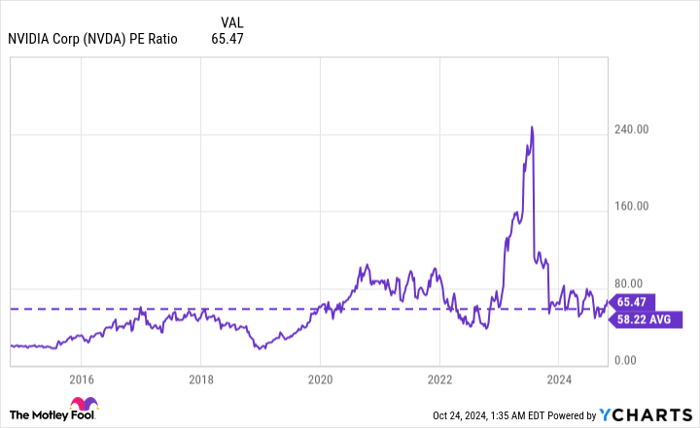

Owning a significant market share in data center GPUs has granted Nvidia exceptional pricing power, thus increasing its profits. Over the past four quarters, the company reported a net income of $54.9 billion, resulting in earnings per share (EPS) of $2.21.

With a current stock price of $139.56, Nvidia’s P/E ratio stands at 63.1. While high, this number is nearly double the Nasdaq-100 technology index’s P/E ratio of 32.1.

However, forecasts suggest Nvidia could achieve an EPS of $4.06 in fiscal 2026, cutting its forward P/E ratio to 34.3. This figure might appear undervalued for two reasons.

Firstly, Nvidia’s average P/E ratio over the last decade has been 58.2, consistently above 50 even before the AI boom gained traction on Wall Street.

NVDA PE Ratio data by YCharts.

Secondly, as fiscal 2026 unfolds, analysts will begin to issue forecasts for 2027. Should Nvidia continue to show potential for substantial growth in revenue and earnings, investors may be inclined to accept a higher P/E ratio. In this context, a ratio of 34.3 could seem too enticing to overlook.

Hence, if Wall Street’s EPS predictions for fiscal 2026 hold true, and Nvidia’s stock aligns with its historical P/E average, it could potentially see a 70% or greater increase within the coming year.

No other company within the trillion-dollar club boasts comparable revenue or earnings growth projections for next year, underscoring the likelihood that Nvidia remains a prime candidate for outstanding performance.

Huang forecasts that data center operators will invest $1 trillion in AI infrastructure over the next five years. If accurate, Nvidia’s stellar momentum might extend well beyond 2025.

Is Now the Right Time to Invest in Nvidia?

Before considering an investment in Nvidia, keep this in mind:

The Motley Fool Stock Advisor analyst team has pinpointed what they believe to be the 10 best stocks for immediate investment… and Nvidia isn’t on that list. The selected stocks are expected to yield significant returns in the coming years.

Consider when Nvidia was recommended on April 15, 2005… a $1,000 investment back then would now be valued at $860,447!*

Stock Advisor provides an accessible strategy for investors, featuring portfolio-building guidance, regular analyst updates, and two new stock picks each month. Since inception, the Stock Advisor service has more than quadrupled the S&P 500’s returns since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.