Amazon’s Path Forward: Growth Prospects Amidst Market Challenges

Amazon’s (NASDAQ: AMZN) business has transformed significantly in recent years. The e-commerce leader has more than doubled its shipping infrastructure since 2021 and expanded its cloud division while increasing profitability. These achievements propelled the stock to record highs, achieving a market valuation of $2 trillion by mid-October.

Looking ahead, it may be challenging to replicate such rapid successes. Nonetheless, Amazon still has substantial room for growth and profit expansion. With this optimistic outlook, let’s explore the key factors that could influence Amazon’s stock performance in the coming years.

Driving Success Through E-commerce and Cloud Services

Recent excitement around Amazon’s stock largely stems from the success of its Amazon Web Services (AWS) platform, which is vital to the company’s earnings. Although companies had slowed new spending on cloud services in 2022, they have recently resumed aggressive shifts to cloud technology. This renewed focus has benefited AWS, which nearly doubled its earnings during the first half of 2024, reporting an operating income of $19 billion compared to the previous year.

While AWS’s performance might fluctuate alongside broader IT spending trends, investors can anticipate positive movement from this segment as it competes with other industry players like Microsoft and its Azure platform.

On the retail side, the e-commerce segment is expected to significantly enhance annual earnings by 2027. Since 2020, Amazon has invested heavily in numerous fulfillment and distribution centers to meet rising e-commerce demand. This level of spending isn’t expected to continue in the coming years, even with growing sales. As a result, Amazon is poised to generate meaningful profits from its retail segment.

Though the e-commerce segment may play a diminished role in overall profits by 2027—due to AWS’s faster growth—it remains a crucial part of the business. The retail segment reduces overall risk and provides a strong platform for launching new products and services.

Prospects for Higher Margins

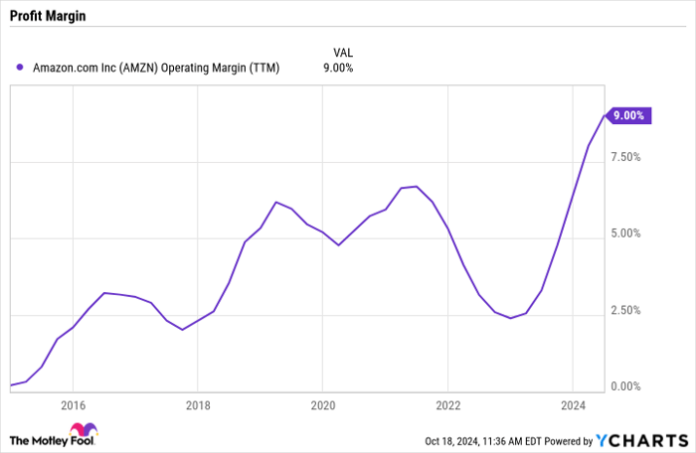

A key concern moving forward is whether Amazon can maintain expanding profit margins without compromising its growth. In the past year, while AWS spending has increased, investments in retail have lagged. This has led the company close to achieving a double-digit operating profit after years of marginal returns.

AMZN Operating Margin (TTM) data by YCharts.

Profitability could rise to 15% of sales over the next few years, assuming strong continued IT investments. This promising scenario could yield substantial returns for Amazon shareholders, even at the current $2 trillion market cap.

Conversely, reduced technology budgets might temporarily lower profit margins back to low single digits. The company may also encounter new growth initiatives that take time to yield results, impacting the stock’s performance adversely.

Despite these potential challenges, Amazon possesses strong cash flow, which can help weather downturns. The company’s core markets have many years of growth potential, particularly seeing that e-commerce now represents just 16% of the total retail landscape, compared to under 1% when Amazon went public in 1997. Therefore, even if returns dip below the norm, long-term investors should remain confident in Amazon’s prospects.

A Second Chance at a Lucrative Opportunity

If you frequently feel like you missed out on some of the most successful stock investments, you may find this opportunity compelling.

Occasionally, our expert analysts provide “Double Down” stock recommendations for companies they believe are set for significant gains. If you’re anxious that the best opportunities have already passed, now could be a strategic time to invest before prices rise further. The results speak for themselves:

- Amazon: An investment of $1,000 made in 2010 when we doubled down would be worth $21,285!*

- Apple: If you had invested $1,000 when we doubled down in 2008, your investment would now be worth $44,456!*

- Netflix: An investment of $1,000 made during our double down in 2004 would now be valued at $411,959!*

We are currently issuing “Double Down” alerts for three promising companies, and this may be one of the best chances to seize such opportunities soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Demitri Kalogeropoulos has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.