“`html

Investors Celebrate Strong 2024 After Wall Street’s Bull Market Rally

The Dow Jones Industrial Average, benchmark S&P 500, and growth-focused Nasdaq Composite all saw impressive gains at the end of 2024, with increases of 13%, 23%, and 29% respectively.

Key Drivers of Stock Market Success

Several factors fueled Wall Street’s second year of a bull market, most notably Donald Trump’s election victory in November, which historically boosts stock prices. Additionally, excitement surrounding stock splits and the surge in artificial intelligence (AI) created positive momentum.

Where should you invest $1,000 today? Our analyst team has identified the 10 best stocks currently worth buying. See the 10 stocks »

Image source: Getty Images.

AI’s ability to enhance software and systems, enabling them to execute tasks more efficiently and acquire new skills, has captured investor enthusiasm. A report by PwC titled Sizing the Prize predicts that AI could contribute an astounding $15.7 trillion to the global economy by 2030.

Leading the charge in the AI revolution is semiconductor titan Nvidia (NASDAQ: NVDA). Since the start of 2023, Nvidia’s stock has skyrocketed, adding nearly $3 trillion in market value, with shares soaring 830% as of January 10.

Understanding Nvidia’s Growth Trajectory

Before examining Nvidia’s future, it’s crucial to recognize the factors behind its rise. Nvidia has emerged as the “brain” of high-performance data centers, a sector offering immense growth potential.

According to TechInsights, data-center GPU shipments totaled 2.67 million units in 2022 and increased to 3.85 million units in 2023. Impressively, Nvidia’s hardware accounted for nearly all GPU shipments, with only 30,000 units in 2022 and 90,000 in 2023 sourced from other manufacturers. Demand for its Hopper (H100) chip and the next-gen Blackwell GPU architecture remains exceptionally high.

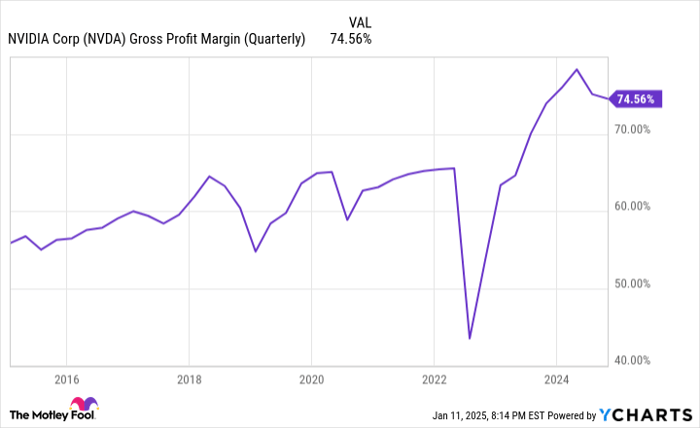

As demand continues to outstrip supply, Nvidia has leveraged this situation to charge between $30,000 and $40,000 for its sought-after Hopper GPU, far exceeding the $10,000 to $15,000 charged by Advanced Micro Devices (NASDAQ: AMD) for its Instinct MI300X GPU. This pricing power has dramatically boosted Nvidia’s gross margins.

Nvidia’s success is also tied to its CUDA software platform, which keeps clients loyal by helping them harness the full power of their GPUs and create advanced language models.

Additionally, Nvidia has established itself as the go-to AI-GPU supplier for many major corporations, including Microsoft, Meta Platforms, Amazon, and Alphabet.

Image source: Getty Images.

What History Tells Us About Nvidia’s Price Surge

To understand the current situation with Nvidia trading at around $136 per share, we must consider historical trends.

Throughout the past decades, innovations have emerged with much fanfare, attracting investments only for competitive forces to emerge, diluting the early leading companies’ market share.

Currently, Nvidia dominates the AI-accelerated data center GPU market. However, competition from AMD, which is ramping up production of its MI300X and new MI325X chips, poses a significant threat. These alternatives are cheaper and could appeal to businesses looking for less expensive options as they navigate Nvidia’s backlog.

Moreover, Nvidia’s top clients are now developing their own AI chips for internal use. Although these chips may lack the performance of Nvidia’s Hopper and Blackwell GPUs, they are cheaper and more readily available, further reducing Nvidia’s pricing advantage.

An end to AI-GPU scarcity would likely weigh on Nvidia’s gross margin. NVDA Gross Profit Margin (Quarterly) data by YCharts.

Given historical patterns, it’s important to note that leading firms in transformative trends often see their market value drop significantly—sometimes by over 80%—when bubbles burst. Fortunately for Nvidia, the company has diverse business segments, including gaming GPUs and cryptocurrency mining, that may provide stability in turbulent times.

“`

Is Nvidia’s Stock Headed for a Drop? Expert Predictions Raise Concerns

The Reality of Rapid Stock Gains

History shows that significant rises in stock prices—especially in early-stage companies—often aren’t sustainable. Analysts are warning that Nvidia stock could fall below $100 in 2025, a possibility that investors need to consider.

A Second Chance at Investing in Top Stocks

Many investors have felt the sting of missing out on buying successful stocks. Fortunately, there are new opportunities to consider.

Occasionally, our analysts identify stocks they believe are poised for significant growth, dubbed “Double Down” recommendations. If you’re concerned about missing your chance, experts suggest now may be the time to invest. Here’s a look at some impressive returns:

- Nvidia: An investment of $1,000 in 2009 would now be worth $345,467!*

- Apple: A $1,000 investment in 2008 would have grown to $44,391!*

- Netflix: If you invested $1,000 in 2004, it would now stand at $453,161!*

Currently, three new “Double Down” alerts have been issued for companies that show great potential. Opportunities like this don’t come along every day.

Discover the 3 “Double Down” stocks now »

*Stock Advisor returns as of January 13, 2025

Suzanne Frey, an executive at Alphabet, sits on the board of The Motley Fool. John Mackey, former CEO of Whole Foods Market, also serves on this board. Randi Zuckerberg, previously a director at Facebook, rounds out the board. Sean Williams has investments in Alphabet, Amazon, and Meta Platforms. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. It also recommends options involving Microsoft stock. The Motley Fool has a clear disclosure policy.

The views expressed here are solely those of the author and do not necessarily represent the views of Nasdaq, Inc.