General Motors Exceeds Expectations in Q3 2024 Earnings

Strong Performance Boosts Earnings and Revenue

General Motors (GM) reported adjusted earnings of $2.96 per share for the third quarter of 2024, surpassing the Zacks Consensus Estimate of $2.49. This figure also shows an improvement from the previous year’s quarter, which reported $2.28. The strong performance was credited to the GM North America (GMNA) segment. Revenues reached $48.75 billion, exceeding the Zacks Consensus Estimate of $44.29 billion and rising from $44.13 billion reported a year ago.

Stay up-to-date with the quarterly releases: See Zacks Earnings Calendar.

In terms of adjusted earnings before interest and taxes (EBIT), GM posted $4.11 billion, comparing favorably to $3.56 billion in the same quarter last year. However, the automaker’s market share dipped to 8.1%, down from 9% in the previous year.

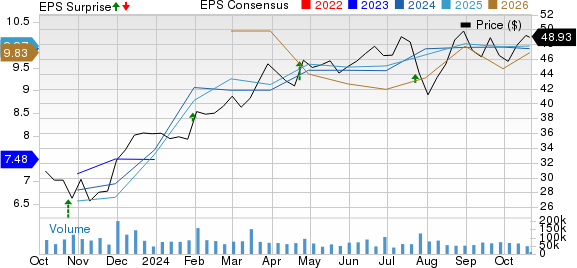

General Motors Company Price, Consensus, and EPS Surprise

General Motors Company price-consensus-eps-surprise-chart | General Motors Company Quote

Breakdown of Segments

GM North America (“GMNA”) showed impressive growth, generating net revenues of $41.15 billion—up from $36.1 billion during the same period in 2023. This beat our model’s estimate of $36.56 billion, thanks in part to higher-than-expected vehicle deliveries. Wholesale vehicle sales in GMNA were 893,000 units, an increase from 810,000 units a year earlier and also surpassing our estimate of 825,000 units. The adjusted EBIT for this segment was $3.98 billion, exceeding both the previous year’s $3.52 billion and our estimate of $3.81 billion.

GM International (“GMI”) reported net revenues of $3.51 billion, a decrease from $4.3 billion in the same quarter last year. This fell slightly short of our expectation of $3.57 billion. GMI’s wholesale vehicle sales dropped to 140,000 units from 171,000 units a year ago, missing our forecast of 150,000 units. The segment’s operating profit fell to $42 million, down from $357 million in the previous year, which also did not meet our estimate of $44 million.

GM Financial achieved net revenues of $4.03 billion, growth compared to $3.64 billion a year ago but still short of our estimate of $4.19 billion. The EBIT-adjusted operating profit amounted to $687 million, down from $741 million a year ago, and below our prediction of $768 million.

GM Cruise reported net revenues of $26 million, slightly up from $25 million the previous year and matching our expectations. The segment’s operating loss narrowed to $383 million from a much larger loss of $732 million reported in the same quarter last year, which was also an improvement over our estimate of $413 million.

Financial Overview

As of September 30, 2024, General Motors held $23.7 billion in cash and cash equivalents. The company’s long-term automotive debt stood at $15.5 billion. Net automotive cash from operating activities for the quarter totaled $7.86 billion, while adjusted automotive free cash flow increased to $5.8 billion, up from $4.9 billion in the prior year.

GM announced a quarterly dividend of 12 cents per share, which will be paid on December 19, 2024, to shareholders on record as of December 6, 2024.

2024 Outlook Revised Upward

For the full year of 2024, GM has raised its guidance for adjusted EBIT to a range of $14-$15 billion, from the previously anticipated range of $13-$15 billion. Adjusted EPS is now expected to be between $10 and $10.5, up from $9.50-$10. Furthermore, the adjusted automotive free cash flow estimate has increased to $12.5-$13.5 billion from the previous forecast of $9.5-$11.5 billion.

Zacks Rankings and Comparable Companies

General Motors currently holds a Zacks Rank #3 (Hold).

Other notable companies in the automotive sector include BYD Co Ltd (BYDDY), Tesla (TSLA), and Lucid Group (LCID). BYDDY is ranked #1 (Strong Buy), while both TSLA and LCID have a Zacks Rank #2 (Buy). You can find the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BYDDY suggests 22% year-over-year growth in sales and 20% in earnings for 2024. Furthermore, EPS estimates for both 2024 and 2025 have increased by 8 cents and 14 cents, respectively, over the last month.

For TSLA, the 2024 and 2025 sales estimates indicate 2% and 15% year-over-year growth, respectively. However, EPS projections for 2024 suggest a 28% decline, followed by a forecasted growth of 34.3% in 2025 based on 2024 estimates.

Finally, the Zacks Consensus Estimate for LCID suggests a 29.3% and 10.3% year-over-year growth in sales and earnings, respectively. Loss per share estimates for both 2024 and 2025 have been narrowed over the past week by 5 cents and 4 cents.

Infrastructure Investment Surge Ahead

A comprehensive effort to revitalize America’s aging infrastructure is on the horizon. This initiative is projected to be bipartisan, urgent, and significant, with trillions expected to be invested over time.

The key question remains: “Will you position yourself in the right stocks before the growth potential peaks?”

Zacks has released a Special Report to guide you in this endeavor, available for free today. Discover five companies poised to benefit significantly from upcoming infrastructure projects involving roads, bridges, buildings, cargo transport, and energy transformation.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

For the latest recommendations from Zacks Investment Research, you may download “5 Stocks Set to Double” free of charge.

General Motors Company (GM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Byd Co., Ltd. (BYDDY): Free Stock Analysis Report

Lucid Group, Inc. (LCID): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.