GoDaddy Inc. Set to Release Q3 Earnings: Analysts Anticipate Strong Performance

Tempe, Arizona-based GoDaddy Inc. (GDDY) is a key player in the cloud-based products market, offering solutions to small businesses, web design professionals, and individual users. With a market capitalization of $23.5 billion, GoDaddy’s platform provides tools for customer engagement, business management, and online presence enhancement. The company, known for its leadership in domain registration, web hosting, and online marketing, is scheduled to announce its fiscal third-quarter earnings for 2024 on Wednesday, October 30, after the market closes.

Strong Earnings Expected for Q3

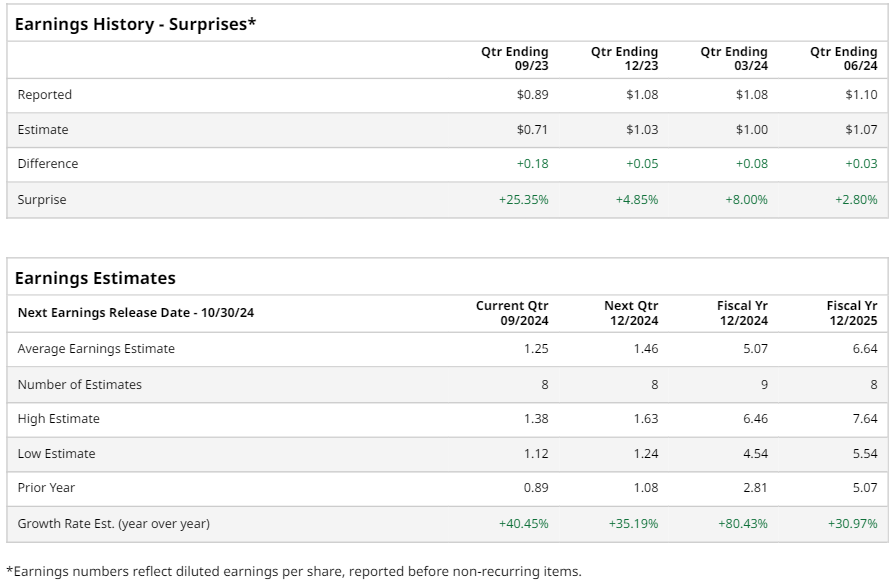

In anticipation of the upcoming announcement, analysts project that GDDY will report earnings of $1.25 per share on a diluted basis, reflecting a significant 40.5% increase from $0.89 per share reported in the same quarter last year. Notably, GoDaddy has exceeded Wall Street’s earnings-per-share (EPS) expectations in its last four quarterly reports.

Yearly Projections Look Positive

For the entire fiscal year, analysts forecast GDDY’s EPS to reach $5.07, marking an impressive 80.4% increase compared to the $2.81 reported in fiscal 2023. Looking ahead, the EPS is projected to rise further to $6.64 in fiscal 2025, representing a year-over-year increase of 31%.

Impressive Stock Performance

Over the past year, GDDY’s stock has outshined the S&P 500’s gains of 38.6%, surging by 120%. In a similar vein, the stock has surpassed the Technology Select Sector SPDR Fund’s (XLK) 41.5% growth during the same period.

Recent Downgrade and Q2 Performance

On September 23, GDDY shares fell by more than 1% following Piper Sandler’s decision to downgrade the stock from “Overweight” to “Neutral.” However, the company’s performance in Q2 was robust. On August 1, it reported adjusted EPS of $1.10, surpassing analysts’ expectations of $1.07, alongside revenue of $1.12 billion, above the anticipated $1.11 billion. For Q3, GDDY forecasts revenue between $1.13 billion and $1.15 billion and projects total revenue for the year to fall between $4.53 billion and $4.57 billion.

Analyst Ratings Favorable

The overall consensus on GDDY stock remains positive, with a “Moderate Buy” rating from analysts. Out of 17 analysts, nine recommend a “Strong Buy,” one suggests a “Moderate Buy,” and seven indicate a “Hold.” The average analyst price target stands at $171.20, suggesting a potential upside of 4.5% from current levels.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.