Goldman Sachs Lowers Prologis Outlook: Analysts Remain Cautiously Optimistic

Latest Recommendations and Price Targets

Fintel reports that on October 21, 2024, Goldman Sachs downgraded their outlook for Prologis (LSE:0KOD) from Buy to Neutral.

Analysts Predict Modest Growth Ahead

As of September 25, 2024, the average one-year price target for Prologis stands at 138.13 GBX/share. Predictions vary, with a low estimate of 121.20 GBX and a high of 161.70 GBX. This average price target suggests an increase of 16.91% from its latest closing price of 118.15 GBX/share.

Revenue Projections and Earnings Analysis

The projected annual revenue for Prologis is 7,470MM, reflecting a decrease of 9.34%. The anticipated non-GAAP EPS is estimated at 2.90.

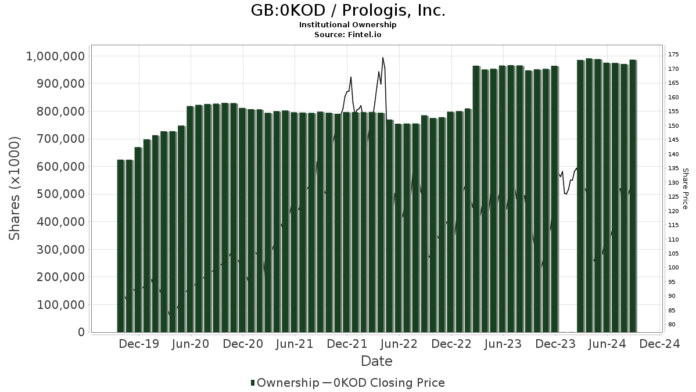

Institutional Investment Insights

There are currently 2,555 funds or institutions with positions in Prologis, marking a slight decrease of four owners, or 0.16%, over the last quarter. The average portfolio weight for these funds in Prologis is 0.84%, an increase of 7.10%. Total institutional shares increased by 3.86% in the last three months, bringing the total to 987,442K shares.

VGSIX – Vanguard Real Estate Index Fund Investor Shares holds 37,050K shares, representing 4.00% ownership of the company. This is a decrease from the previous 37,733K shares, indicating a reduction of 1.84%. However, the firm has increased its portfolio allocation in 0KOD by 8.06% over the last quarter.

JPMorgan Chase has 34,186K shares, which equals 3.69% ownership. This reflects a decrease from 36,257K shares, or a decline of 6.06%. The firm’s allocation in 0KOD dropped significantly by 87.63% in the last quarter.

Cohen & Steers owns 33,947K shares, accounting for 3.67% ownership. This marks an increase from 28,788K shares, or a growth of 15.20%. Their portfolio allocation in 0KOD increased by 1.86% over the prior quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares possesses 29,267K shares, representing 3.16%. Previously, they held 29,080K shares, a slight increase of 0.64%, but their allocation for 0KOD decreased by 15.59% recently.

Finally, VFINX – Vanguard 500 Index Fund Investor Shares holds 23,763K shares, about 2.57% ownership. This is up from 23,284K shares, an increase of 2.01%, although their allocation also fell by 16.68% last quarter.

Fintel is recognized as a comprehensive research platform for investors, traders, financial advisers, and small hedge funds. Our data encompasses fundamentals, analyst insights, ownership trends, fund sentiment, and much more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.