GSI Technology Reports Wider Loss and Declining Revenues in Q2 Fiscal 2025

In the second quarter of fiscal 2025, GSI Technology, Inc. (GSIT) reported a net loss per share of 21 cents, which is a deeper loss than the 16 cents per share recorded in the same quarter last year.

The revenues for this quarter totaled $4.6 million, down from $5.7 million during the second quarter of fiscal 2024. The decrease stemmed from shifts in product mix and workforce reductions, which affected the company’s gross margins.

GSI Technology’s recent performance reflected significant challenges, marked by falling revenues and narrowing gross margins. To address these issues, the firm implemented strategic cost-cutting measures in the fiscal second quarter, expecting to save $3.5 million annually, thereby enhancing cash flow.

Management remains optimistic about a potential recovery in demand for SRAM products as customer inventories stabilize, which could boost sales in upcoming quarters.

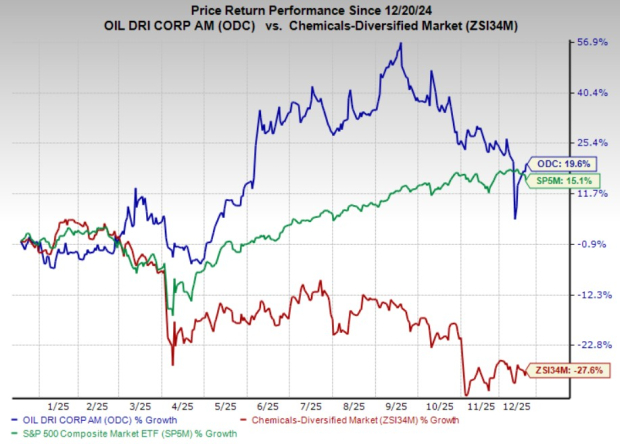

Stock Performance: Analyzing Price, Consensus, and EPS Surprise

GSI Technology, Inc. price-consensus-eps-surprise-chart | GSI Technology, Inc. Quote

Business Metrics Analysis

Revenue Trends

The decline in revenue compared to last year was largely due to diminished demand for key products. Sales to Nokia reached $0.8 million, or 17.8% of total revenues, a decrease from $1.2 million, which represented 20.3% of revenue a year ago. Conversely, military and defense sales were robust, forming 40.2% of total shipments, an increase from 34.8% the previous year.

Costs and Expenditures

Operating expenses rose slightly to $7.3 million, exceeding the $7.2 million reported in the same quarter last year. This uptick was primarily due to increased research and development (R&D) and selling, general and administrative (SG&A) costs. R&D expenses were $4.8 million, up from $4.7 million a year earlier, while SG&A costs were noted as $2.6 million. As a result, the company’s operating loss expanded to $5.6 million from $4.1 million in the prior year, highlighting the impact of higher expenses coupled with lower revenues.

Gross Margin Insights

The gross margin experienced a considerable contraction from 54.7% in Q2 of fiscal 2024 to 38.6% in Q2 of fiscal 2025. This decline was linked to the changes in product mix and added costs associated with workforce reorganization. The transition away from higher-margin SigmaQuad products adversely affected overall margin quality, coupled with severance costs that increased manufacturing expenditures.

Net Income Analysis

For the second quarter of fiscal 2025, GSI Technology reported a net loss of $5.5 million, which widened from a loss of $4.1 million during the same period last year. Interest and other income provided some relief, contributing $0.1 million to the results, marking an improvement from the previous year.

Financial Position Overview (As of Sept. 30, 2024)

As of September 30, 2024, the company’s cash and cash equivalents totaled $18.4 million, up from $14.4 million as of March 31, 2024. Additionally, total assets increased to $47.4 million, compared to $42.5 million at the end of the previous fiscal year. Current liabilities also saw a slight increase to $5.5 million from $5.4 million as of March 31, 2024. However, stockholders’ equity fell to $33.3 million from $36 million.

Management’s Future Outlook

Looking ahead to the third quarter of fiscal 2025, GSI Technology projects revenues between $4.7 million and $5.5 million, and anticipates a gross margin of around 50-52%.

Recent Developments in Innovation

During this quarter, GSI Technology made progress on its Gemini-II benchmarking project, remaining on track to meet its December 31, 2024, deadline. Additionally, the company is dedicated to completing its Small Business Innovation Research contract with the U.S. Air Force Labs, with plans to deliver essential software algorithms by the first quarter of calendar year 2025. These efforts illustrate GSI Technology’s commitment to innovate and expand its offerings beyond traditional memory products.

Expert Insights on Stock Potential

Five Zacks analysts have selected their top stock picks, anticipating potential increases of over 100% in the coming months. Among these, Director of Research Sheraz Mian has identified one with exceptional growth potential, focusing on millennial and Gen Z markets and achieving nearly $1 billion in revenue last quarter. Recent declines in stock value suggest it may be an opportune time to invest. The selected stock could surpass previous Zacks winners like Nano-X Imaging, which rose by 129.6% within nine months.

Free: See Our Top Stock And 4 Runners Up

GSI Technology, Inc. (GSIT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.