GSK has set its sights on bolstering its already burgeoning pipeline of respiratory biologics by finalizing an agreement to acquire the private biotech firm Aiolos. Aiolos specializes in developing medications tailored to address specific respiratory and inflammatory conditions.

The cornerstone of the acquisition is anticipated to be Aiolos’ primary pipeline candidate, AIO-001 – a long-acting antibody engineered to target the TSLP (thymic stromal lymphopoietin) pathway, which has been robustly validated in the clinical realm for its potential in effectively addressing asthma. It is projected that AIO-001 will imminently enter phase II development for the treatment of asthma. Aiolos secured exclusive rights to AIO-001, outside of China, from Jiangsu Hengrui Pharmaceuticals.

In exchange for this seminal deal, GSK is poised to make an initial payment of $1 billion, with Aiolos potentially receiving an additional $400 million linked to regulatory milestones.

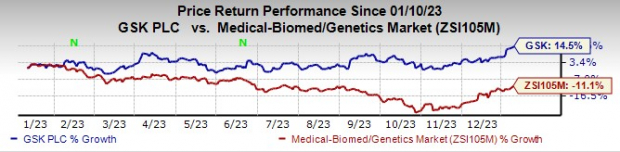

The stock performance for GSK has exhibited a noteworthy ascent of 14.5% over the past year, a stark contrast to the 11.1% decline recorded for the industry.

Image Source: Zacks Investment Research

GSK currently boasts an extensive array of both marketed and investigational respiratory products. These products focus on treating asthma patients who exhibit high levels of eosinophils or high T2 inflammation. By integrating AIO-001 into its portfolio, GSK is expected to expand its reach to a wider spectrum of asthma patients, including those with asthma regardless of their biomarker status and those with low T2 inflammation. Preliminary data from studies focusing on AIO-001 have already demonstrated its initial safety, tolerability, pharmacokinetics, and biological activity in patients with asthma.

Moreover, the potential of AIO-001 extends to potentially redefining the standard of care through its development as a therapy for longer dosing intervals, such as every six months.

Strategic Positioning Amidst Industry Challenges

Despite the challenges faced by the industry in the past year, with a decline of 11.1% for the sector, GSK has distinguished itself by achieving a commendable 14.5% increase in stock performance. This prominent advance illustrates GSK’s strategic positioning and its commitment to establishing itself as a dominant force within the respiratory and biologics space.

Industry Resilience and Competitive Advantage

GSK’s foray into the acquisition of Aiolos and the subsequent integration of AIO-001 into its existing portfolio underscores the resilience of the industry in the face of adversity. It also showcases GSK’s unwavering commitment to fortifying its competitive advantage amidst evolving market dynamics and patient needs.

Zacks Rank & Stocks to Consider

GSK currently holds a Zacks Rank #3 (Hold).

GSK PLC Sponsored ADR Price and Consensus

GSK PLC Sponsored ADR price-consensus-chart | GSK PLC Sponsored ADR Quote

Among the biotech companies showing significant promise are Regeneron Pharmaceuticals (REGN), Sarepta Therapeutics (SRPT), and Puma Biotechnology (PBYI), each commanding a Zacks Rank #1 (Strong Buy). More information and the complete list of today’s Zacks #1 Rank stocks can be accessed here.