HarborOne Bancorp, Inc. HONE, the financial institution, recently made waves in the market by revealing a 6.7% boost in its quarterly cash dividend, setting it at 8 cents per share. This uptick heralds a positive change compared to its previous payout. The dividend distribution date is set for Apr 24, 2024, with shareholders on record as of Apr 10 eagerly observing the tide.

HarborOne has shown a penchant for raising its dividend thrice within the past five years, indicating a steady flow for investors. Back in March 2023, the company had also ramped up its quarterly dividend by 7% to 7.5 cents per share, enhancing the benefits for its stakeholders. The current payout ratio stands at 48%, showcasing a balance between reinvestment for growth and rewarding shareholders.

With its closing price hovering around $10.66 as of Mar 28, the dividend yield from HONE stands at a respectable 3%, ensuring a modest return for investors. Remarkably, the company’s five-year annualized dividend growth is an impressive 33.33%, signifying stability in payouts over time.

Joseph F. Casey, the president, and CEO of HarborOne, expressed his buoyant confidence by stating, “The dividend increase is supported by our current and projected earnings as we continue executing our business plan.”

The institution is not merely stopping at dividend hikes; it also sails into share repurchases. Having begun the share repurchase program in July 2023, the bank was authorized to buy back up to 2.3 million shares to enhance shareholder value. By the close of 2023, 1.1 million shares were still up for grabs under the current repurchase scheme.

Strong Financial Foundations and Market Growth

HarborOne boasts a sturdy balance sheet, with $227.35 million in total cash and cash equivalents as of Dec 31, 2023. The company’s $4.8 billion in total loans and $265.5 million in Federal home loan borrowings showcase a solid liquidity position favorable for future ventures.

Its common equity Tier-1 capital ratio of 12% and total capital ratio of 13.1% comfortably exceed regulatory requirements, underscoring the institution’s robust financial standing.

Given its healthy financial foundations and liquidity, investors foresee a continuation of HarborOne’s dynamic capital distribution efforts aimed at enhancing shareholder returns and fortifying its value proposition.

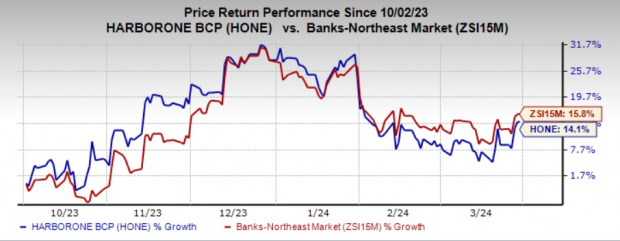

Over the last six months, HarborOne Bancorp’s shares have experienced a buoyant 14.1% growth, although slightly trailing the industry average of 15.8%.

Wider Financial Horizons: Industry Update

The current narrative of dividend hikes extends beyond HarborOne Bancorp to other players in the market. Independent Bank Corp’s recent dividend increase of 3.6% and NorthEast Community Bancorp Inc.’s significant 66.7% surge in their quarterly cash dividend signal an industry-wide trend of reinforcing shareholder value.