The Golden Arches McDonald’s Corporation has been on a steady climb, powered by solid digital adoption and menu innovation. Despite macroeconomic challenges, the company’s strong comps growth and strategic initiatives are setting it apart in the market. Let’s delve deeper into why investors should hang on to their MCD shares.

Accelerating the Arches

McDonald’s continues to impress with robust global comps growth, leveraging its successful ‘Accelerating the Arches’ strategy. While the fourth quarter of 2023 saw a 3.4% uptick, the U.S., international operated markets, and international developmental licensed segments each posted compelling comp figures. The company attributes this success to menu price adjustments, effective marketing, and a boost in digital and delivery channels. Looking ahead to 2024, McDonald’s anticipates maintaining historical comp growth rates of 3% to 4% in key markets.

In the U.K., McDonald’s garnered praise for its quality offerings and loyalty initiatives like Festive Wins, attracting millions of active users. Down under in Australia, the company’s promotional campaign on the MyMacca’s app drove engagement and membership numbers skyward.

The introduction of value-driven pricing and Monopoly promotions is paying dividends, especially in markets like Canada, Germany, and France. With a substantial base of active loyalty members and a clear focus on digital expansion, McDonald’s is eyeing 250 million active users and $45 billion in annual loyalty system-wide sales by 2027.

Building on a Solid Foundation

McDonald’s is not resting on its laurels when it comes to menu offerings. The success of the McCrispy chicken sandwich in Germany and the McCrispy Smokehouse launch in the U.K. underscores the company’s commitment to consumer preferences and affordability. Initiatives like the McMuffin and hot coffee pairing in Canada and expanded Saver Meal deals in the U.K. highlight McDonald’s agility in meeting customer needs while boosting market share.

These strategic moves, coupled with effective marketing campaigns, are expected to fuel further growth in the foreseeable future.

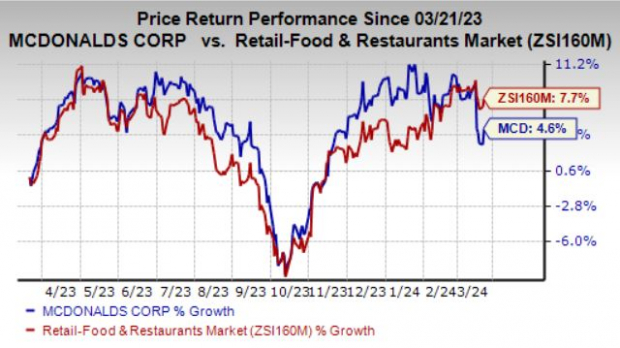

Image Source: Zacks Investment Research

Despite McDonald’s positive trajectory, challenges persist. The company’s margins are under pressure due to mounting expenses, exacerbated by the prevailing macroeconomic headwinds. McDonald’s reported increased company-operated restaurant expenses in fourth-quarter 2023, signaling a squeeze on profitability. Factors like rising interest rates are further complicating the landscape, with inflationary pressures expected to persist in the near term.

Internationally, McDonald’s anticipates commodity inflation in the low single-digit range and wage inflation in the low to mid-single-digit range, posing additional hurdles to sustained growth.

Looking Ahead

Despite these challenges, McDonald’s resilience and strategic initiatives position it well for the future. With a Zacks Rank #3 (Hold), the company is navigating the industry landscape with prudence and innovation.

Exploring Opportunities

For investors seeking promising avenues in the retail-wholesale sector, key picks like Brinker International, Inc. (EAT), Texas Roadhouse, Inc. (TXRH), and Shake Shack Inc. (SHAK) offer intriguing possibilities. These companies, with their respective Zacks Ranks #2, present unique growth prospects in a dynamic market environment.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.