Aptiv PLC (APTV) is revving up to seize opportunities in the automotive market, leveraging technology investments and strategic acquisitions. The company boasts a solid Growth Score of B, reflecting favorable metrics from its financial statements to gauge growth quality and sustainability.

Driving Growth

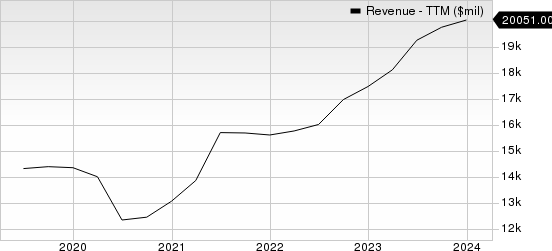

With an anticipated long-term earnings per share growth rate of 13.7%, Aptiv is set to accelerate. Forecasts predict an earnings surge of 16.7% in 2024 and a robust 25.5% in 2025. Revenue projections are equally promising, with expected year-over-year growth of 7.5% in 2024 and 8.1% in 2025.

Aptiv PLC: Charting the Revenue Path

Aptiv PLC revenue-ttm | Aptiv PLC Quote

Accelerating Factors

Aptiv is in pole position to benefit from the growing global demand for vehicles, which surged by 10% in 2023. With a focus on the connected cars sector, Aptiv is primed to capitalize on the rising need for security features in automobile technology. The trend towards driver-assistance systems is gaining momentum, driven by demands for personalization, infotainment connectivity, and user convenience.

As vehicles integrate more features, there is a growing need for increased wiring inside cars. Aptiv’s expertise in system integration positions it to tap into the expanding electrification, connectivity, and autonomy trends within the automotive industry.

Aptiv’s “smart architecture” provides it with a competitive edge, driving market share growth. The company’s focus on reducing environmental impact and enhancing fuel efficiency aligns with industry trends seeking improved engine management and lower power consumption. Aptiv’s innovative approach minimizes wiring in vehicles, enhancing fuel efficiency and enabling feature-rich automobiles.

Strategic acquisitions, such as the 2023 purchase of Höhle and the 2022 acquisition of Wind River, underscore Aptiv’s commitment to expanding its Signal and Power Solutions segment and reinforcing its presence in the automotive software solutions market.

Challenges on the Horizon

While poised for growth, Aptiv faces escalating costs from continuous investments in organic and inorganic expansion. Operating expenses surged by 14% year-over-year in 2023. Furthermore, the company’s liquidity, as indicated by the current ratio, decreased from 1.81 to 1.72 between the fourth quarter of 2023 and the preceding quarter.

Looking Ahead

With a Zacks Rank of 3 (Hold), Aptiv remains a stock to watch. For investors eyeing alternative prospects, companies like APi Group (APG) and Charles River Associates (CRAI) present compelling options. APG, with a Zacks Rank of 1 (Strong Buy), and CRAI, with a Zacks Rank of 2 (Buy), offer attractive long-term earnings growth expectations of 17.9% and 16%, respectively.

As Aptiv continues mapping its route in the automotive sector, the road ahead appears promising. Positioned to harness evolving market dynamics and technological advancements, Aptiv’s journey is set to be one of innovation and growth.