Investors, listen up.

Outstanding Performance and Future Potential

Kirby Corporation (KEX) has been on a winning streak, and there’s every indication that this is just the beginning of its upward trajectory. If you’ve been waiting on the sidelines, now is your chance to dive into this winning stock.

An Outperformer

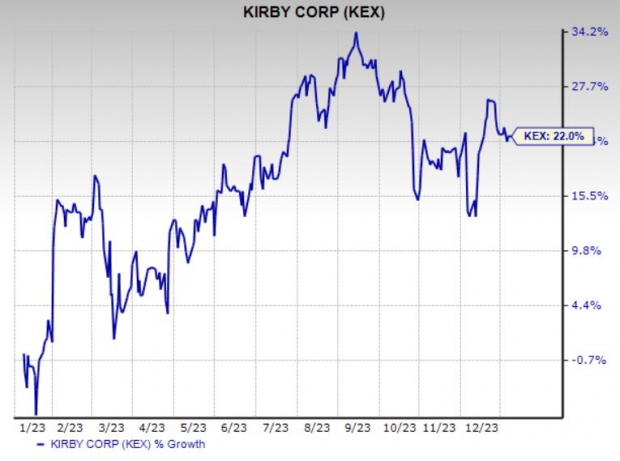

The stock’s astounding performance over the past year speaks volumes – a staggering 22% spike. It’s a visual feast, an unbridled spectacle on the bourse.

Image Source: Zacks Investment Research

Solid Zacks Rank: With a Zacks Rank #2 (Buy), Kirby stands as a shining star, beckoning investors with the promise of limitless opportunities. According to our research, stocks with a Zacks Rank #1 (Strong Buy) or 2 are the Holy Grail for investment wizards.

The Upward Estimate Revisions: If you had any doubts about Kirby’s charm, the constant upward dance of estimate revisions should dispel all uncertainties. The Zacks Consensus Estimate for first-quarter 2024 earnings has soared 5.1% in the last 90 days, while the estimate for 2024 has remained rock solid during the same period.

History of Positive Earnings Surprises: Kirby has mastered the art of positive surprises, outshining the Zacks Consensus Estimate in each of the last four quarters, with an average surprise of 6.68%. That’s a record even the most seasoned trapeze artist would envy.

Headline-Worthy Earnings Expectations

Let’s talk brass tacks. The 51.47% expected earnings growth for first-quarter 2024 and the 36.08% anticipated growth for 2024 spell out the company’s trajectory – skyward. These figures are like rare jewels, dazzling and irresistible.

Driving Factors and Fortunes Beckon

The future is bright, with improved guidance for 2023 buoying the spirits. Kirby’s anticipation of net cash generated from operating activities between $475 million and $525 million for 2023 is a beacon of hope. The distribution and services segment’s stellar performance, marked by soaring demand and impressive top-line growth, is a reminder of the company’s knack for turning adversity into opportunity. The oil and gas, commercial, and industrial markets are also playing their part, setting the stage for an epic performance.

Other Stocks to Consider

If you want to complement your investment in Kirby with other top-ranked stocks from the Transportation sector, consider Wabtec Corporation (WAB) and GATX Corporation (GATX), both carrying a Zacks Rank of 2. Each is a worthy contender in a field of thoroughbreds.

WAB has an expected earnings growth rate of 22.43% for the current year and delivered a trailing four-quarter earnings surprise of 7.11%, on average. Meanwhile, GATX boasts an expected earnings growth rate of 14.33% for the current year, with a trailing four-quarter earnings surprise of 16.49%, on average. Both have had their share of gains over the past year, adding to the allure of the sector.

Investors with a taste for adventure and a keen eye for opportunity should take a look at these names and stride confidently into the exciting world of transportation stocks.

Just Released: Zacks Top 10 Stocks for 2024

There’s no time like the present to feast your eyes on Zacks’ Top 10 Stocks for 2024, carefully curated by Sheraz Mian, Zacks’ Director of Research. From providing a thrilling trilogy of thrills to nearly tripling the S&P 500’s performance from 2012 to November 2023, this portfolio is nothing short of a symphony of success. So don’t wait. Be a part of something extraordinary. .

Be a part of history with Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.