RPM International Inc. RPM finds itself in troubled waters with dwindling demand in DIY and specialty OEM markets. Moreover, factors like adverse weather conditions, escalating costs, and expenses linked to restructuring, divestitures, and labor inflation are causing distress.

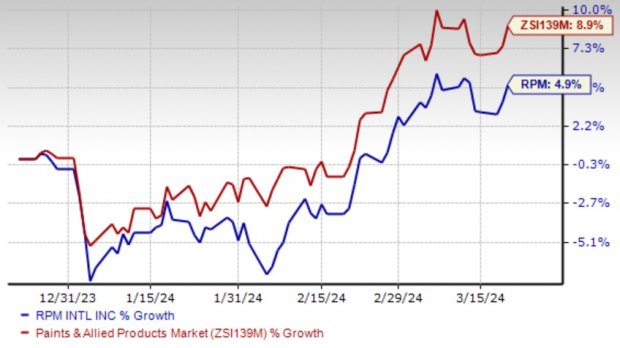

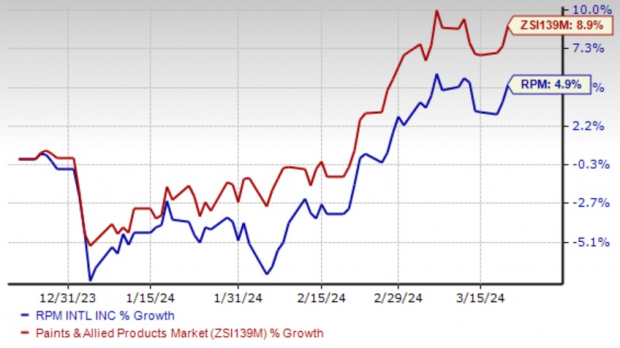

The stock has seen a modest 4.9% uptick in the last three months, trailing behind the broader Zacks Paints and Related Products industry, which recorded an 8.9% growth. For fiscal 2024, the company now foresees earnings per share shrinking to $4.97 from the previous $4.98.

Let’s delve deeper into the detrimental factors impacting this producer of performance coatings, sealants, and specialty chemicals.

Image Source: Zacks Investment Research

Looming Inflationary Pressures

RPM is grappling with escalating costs due to restructuring, acquisitions, labor, and distribution. Moreover, persistent supply chain disruptions and acquisition costs are adding to their woes. In the first six months of fiscal 2024, the company incurred $7.7 million for restructuring, significantly higher than the $2.6 million spent in the same period last year.

The company anticipates wrapping up most MAP 2025 undertakings by the conclusion of fiscal 2025, with an additional $31.8 million earmarked for future expenses tied to MAP 2025 implementation. This comprises increased severance and benefit charges of $1 million and expected facility closures, alongside other associated costs, amounting to $15.5 million. RPM also projects wage inflation to persist into early fiscal 2024.

About 31.2% of RPM International’s net sales in the second quarter of fiscal 2024 can be traced back to foreign manufacturing operations. A strengthening dollar or any global economic ambiguity may impact its financial results. In the fiscal second quarter, currency headwinds curtailed net sales in the Consumer Group by 0.1%.

Diminished Sales Prospects

Citing sluggish demand in DIY and specialty OEM markets, RPM International has downwardly revised its sales outlook for fiscal 2024. The company now anticipates low-single-digit sales growth, down from the previous mid-single-digit expectation. Additionally, third-quarter fiscal 2024 sales are projected to remain flat year over year.

Challenges of Inclement Weather & Customer Concentration

Unfavorable weather conditions have impacted the sales of paint, coatings, roofing, construction products, and related items, with extreme cold and rainy weather during the prime construction and exterior painting season posing challenges. Traditionally, the company experiences weaker sales and net income in the fiscal third quarter (December through February) compared to other quarters due to weather-related inconsistencies that adversely affect productivity.

RPM’s Consumer segment faces significant customer concentration, with a few large customers contributing a substantial portion of net sales. These customers represented about 67%, 64%, and 65% of segment net sales for fiscal 2023, 2022, and 2021, respectively. Any delays or cancellations of significant orders or challenges in placing orders could spell significant losses for the company.

Looking at Alternatives

Among the alternatives in the same sector are:

Advanced Drainage Systems, Inc. WMS presently holds a Zacks Rank #1 (Strong Buy). WMS has consistently outperformed earnings expectations over the last four quarters with an average surprise of 37.1%. For 2024, the Zacks Consensus Estimate for Advanced Drainage Systems’ EPS has risen to $6.19 from $5.88 over the past month.

Knife River Corporation KNF, also a Zacks Rank #1 company, has witnessed an upward revision in 2024 EPS estimates to $3.50 from $3.33 in the preceding 60 days.

KNF exceeded the Zacks Consensus Estimate in the last reported quarter by a solid 80%.

Armstrong World Industries, Inc. AWI currently holds a Zacks Rank of 1. AWI has exceeded earnings expectations in the trailing four quarters with an average surprise of 13.1%.

The Zacks Consensus Estimation for Armstrong World Industries’ 2024 EPS has risen to $5.74 from $5.52 in the past month.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. Previous recommendations have soared +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks in this report are flying under the Wall Street radar, providing an opportunity to enter at an early stage.

Discover These 5 Potential Home Runs Today >>

The expressed views and opinions are those of the writer and may not align with Nasdaq, Inc.