Centene Corporation has firmly established its position in the healthcare market, catering to millions of Medicaid recipients across the United States. With a strong commitment to quality healthcare services and innovative programs, Centene remains a solid choice for investors seeking stability and growth in their portfolios.

As of 2023, CNC has been serving over 14 million Medicaid beneficiaries in 30 states, solidifying its presence in the industry and paving the way for continued expansion and success.

Embracing Growth Opportunities

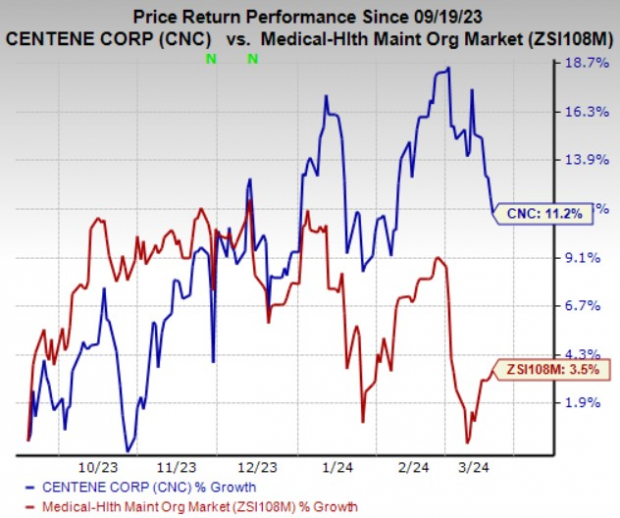

In a landscape marked by dynamic changes and market fluctuations, Centene (CNC) stands out with its remarkable financial performance and strategic initiatives. The company’s Zacks Rank #3 (Hold) status attests to its steady progress, with CNC stock gaining 11.2% in the past six months, outperforming the industry average.

The Zacks Consensus Estimate for CNC’s 2024 earnings per share (EPS) reflects a positive outlook, with projected growth and consistent performance over the years. With multiple acquisitions and a focus on expanding its Medicaid and Medicare businesses, Centene is well-positioned for sustained growth and profitability.

Driving Forces and Innovative Ventures

A key driver of Centene’s success lies in its ability to tap into emerging trends and market opportunities. The company’s focus on Medicaid and Medicare services aligns with the growing demand for healthcare solutions, offering a comprehensive range of programs to address diverse needs among beneficiaries.

Moreover, Centene’s foray into new markets and strategic partnerships highlights its dynamic approach to business expansion. By winning new contracts and enhancing its service offerings, CNC is paving the way for increased revenue generation and market outreach.

With an eye on long-term sustainability, Centene continues to invest in technology and data-driven solutions to improve operational efficiency and enhance customer experience. By leveraging its proprietary tools and strategic collaborations, the company is poised to deliver value and drive growth in the evolving healthcare landscape.

Furthermore, Centene’s focus on capital management and debt reduction indicates a prudent approach to financial stewardship, instilling confidence in shareholders and signaling strength in its operational and financial foundations.

Although challenges like rising costs and margin pressures persist, Centene’s strategic vision and market positioning bode well for its future performance and resilience amid industry shifts and regulatory changes.

Looking Ahead and Investment Outlook

For investors seeking potential growth opportunities in the medical sector, Centene (CNC) remains a compelling choice, backed by its solid financials, strategic vision, and market positioning. While industry dynamics may evolve, Centene’s commitment to innovation and operational excellence sets a strong foundation for long-term success and value creation.

With a diversified portfolio and a track record of consistent performance, Centene is poised to navigate challenges and capitalize on emerging opportunities, making it a solid addition to investment portfolios looking for stability and growth potential.

Cigna Earnings Surge Amid Infrastructure Stock Boom

Strong Financial Performance

Cigna has consistently surpassed the Zacks Consensus Estimate for earnings over the past four quarters, with an average surprise of 2.9%. Projections for the company’s 2024 earnings indicate a substantial 13% rise, while revenue estimates suggest a promising 20.4% improvement from the previous year.

Market Growth Prospects

Recent data shows that Cigna’s anticipated earnings for 2024 have trended upwards by 0.3% in the last 60 days. Furthermore, the market has responded positively with Cigna’s shares soaring by 17.6% since the beginning of the year.

Seizing Opportunities in Infrastructure

The impending nationwide push to revamp America’s deteriorating infrastructure is not just palpable but unavoidable. This revitalization initiative, rooted in bipartisan support, stands as a promising opportunity to create wealth as trillions of dollars are slated for investment in infrastructure projects.

Strategic Investment Decisions

Investors are now faced with a pivotal question: will they strategically position themselves early in stocks poised to capitalize on this forthcoming surge in infrastructure development? Anticipating substantial growth, analysts recommend focusing on companies geared to benefit the most from the extensive redevelopment of roads, bridges, buildings, transport systems, and energy infrastructure.

Expert Insights

In response to the burgeoning opportunities in the infrastructure sector, Zacks Investment Research has unveiled a Special Report to guide investors in identifying key companies that are primed to gain substantially from the enormous governmental investments projected for infrastructure overhauls.