A Steady Climb: How an ETF Became a Top Performer

Exchange-traded funds (ETFs) often remind some investors of the tortoise in Aesop’s well-known fable. Like the tortoise, ETFs can win the race through steady, consistent growth.

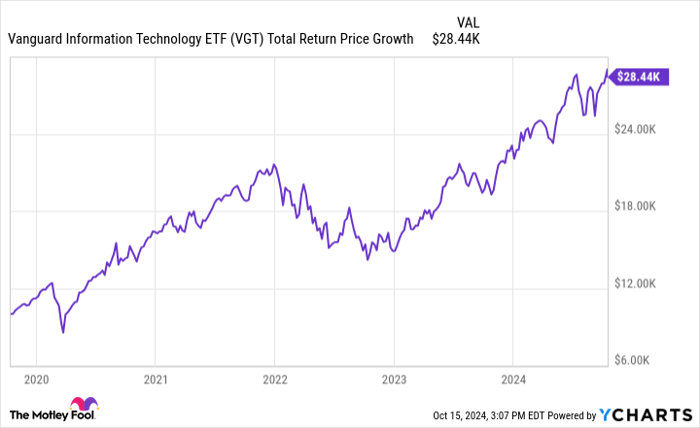

However, some ETFs also race ahead like the hare, delivering impressive returns. For instance, a Vanguard ETF turned a $10,000 investment into over $28,000 in just five years.

Image source: Getty Images.

Spotlight on Vanguard’s Leading ETF

Identifying the stocks in the Vanguard Information Technology ETF (NYSEMKT: VGT) is straightforward. This fund seeks to mirror the performance of the MSCI US Investable Market Information Technology 25/50 Index, focusing solely on U.S. technology stocks.

Currently, the ETF holds 316 stocks, one less than its benchmark. The top five holdings—Apple, Microsoft, Nvidia, Broadcom, and Oracle—comprise over half of the fund’s assets.

Since its inception in January 2004, this ETF has averaged a 13.55% annual return. Notably, in the past five years, it has experienced an impressive compounded annual growth rate of roughly 23.2%.

While many stocks in this ETF do not pay dividends, a few do. If you invested $10,000 five years ago and reinvested dividends, your investment would be worth nearly $28,440 today.

VGT Total Return Price data by YCharts

Key Factors Behind the ETF’s Success

The Vanguard Information Technology ETF has thrived mainly due to the rapid adoption of artificial intelligence (AI). All five of its leading stocks are heavily involved in AI innovation.

Nvidia stands out, with its share price rising more than 28 times over the past five years, driven by high demand for its graphics processing units (GPUs) used in AI development.

In addition, Broadcom’s stock has jumped over 520% as it has become a key player in AI infrastructure. Apple has seen its share price nearly quadruple, buoyed by excitement over new generative AI features. Stocks of Microsoft and Oracle have also tripled, bolstered by their strong positions in the AI space.

Although some market observers feared that an economic downturn could hinder such growth, the U.S. economy rebounded faster than anticipated after the COVID-19 pandemic. Predictions of a recession did not materialize, supporting continued investment in tech.

Another advantage for the Vanguard ETF is its low expense ratio of just 0.1%, well below the Lipper average of 1.303%. Lower costs mean higher returns for investors over time.

Should You Consider Investing in the Vanguard Information Technology ETF?

Despite its strong track record, the Vanguard Information Technology ETF faces potential challenges in maintaining its momentum. The average price-to-earnings ratio for its holdings is high at 35.6.

Yet, this figure should be evaluated against the growth potential of the stocks. As the AI era is still in its early stages, tech stocks focused on AI could continue providing substantial returns.

The ETF may experience volatility, especially since a few stocks dominate its assets. It might not replicate the success of turning a $10,000 investment into over $28,000 in the next five years. Nonetheless, it remains a solid option for long-term investors.

Don’t Overlook This Investment Opportunity

Have you ever felt like you missed your chance to invest in top-performing stocks? If so, here’s your opportunity.

Occasionally, our team of analysts issues a “Double Down” stock recommendation for companies they believe are on the verge of major success. If you’re concerned you’ve missed out, now could be an ideal time to consider investing again. The following figures illustrate past successes:

- Amazon: A $1,000 investment when we recommended “doubling down” in 2010 would now be worth $21,139!*

- Apple: A $1,000 investment from 2008 would be valued at $44,239!*

- Netflix: A $1,000 stake from 2004 would now yield $380,729!*

At this moment, we have “Double Down” alerts for three promising companies, and this may be a rare chance for investors.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Keith Speights has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Broadcom and has the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.