Insulet Corporation Set to Release Q3 Earnings Amid Strong Stock Performance

Insulet Corporation (PODD), based in Acton, Massachusetts, is recognized as a leading innovator in the medical device industry. The company holds a market cap of $16.6 billion and focuses on creating insulin delivery systems for individuals with insulin-dependent diabetes. The much-anticipated fiscal third-quarter earnings report for 2024 is scheduled for release after market hours on Thursday, November 7.

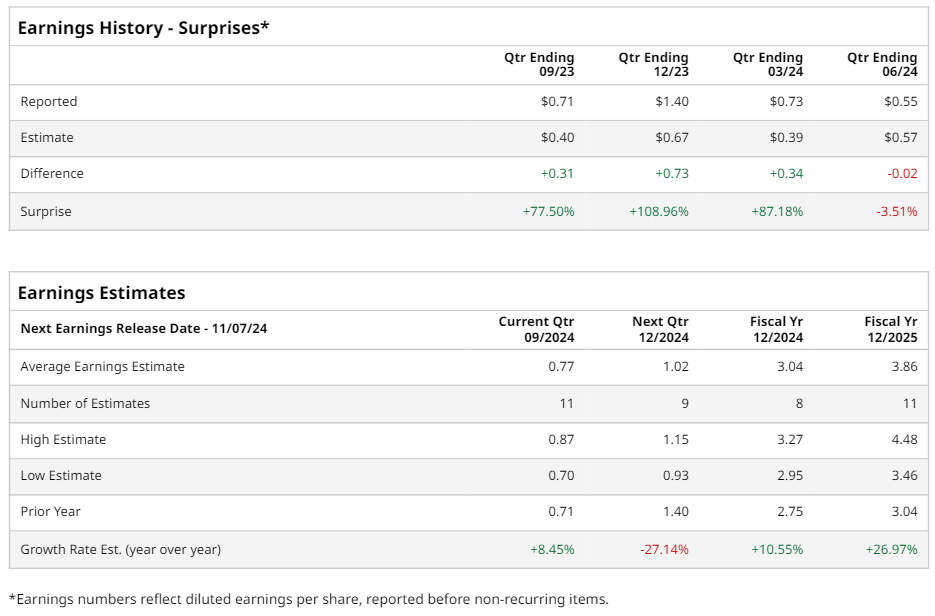

Anticipated Earnings and Historical Performance

Analysts predict that Insulet will report earnings of $0.77 per share on a diluted basis, representing an 8.5% increase from last year’s $0.71. Notably, PODD has exceeded consensus projections in three of the past four quarters, while only falling short once.

Looking Ahead: Earnings Expectations

For the entire fiscal year 2024, experts expect the company’s earnings per share (EPS) to reach $3.04, a 10.6% rise from $2.75 in fiscal 2023. Projections indicate continued growth, with EPS expected to surge 27% to $3.86 in fiscal 2025.

Stock Performance Against Market Benchmarks

PODD stock has outperformed the S&P 500, which recorded a 35.9% increase over the last year. Specifically, Insulet shares have risen by 63.3% during this period, overshadowing the Health Care Select Sector SPDR Fund (XLV), which gained 17.9%.

Key Developments Driving Growth

A significant factor behind PODD’s stock success includes the FDA’s approval of its Omnipod 5 Automated Insulin Delivery System for adults with type 2 diabetes, broadening the product line’s applications. On September 17, the stock experienced a boost of over 3% following Piper Sandler’s increase of its price target from $230 to $285.

Q2 Report Summary & Analyst Consensus

On August 8, PODD announced its Q2 results, which were met with mixed reactions. Although the adjusted EPS of $0.55 fell short of the expected $0.57, the company’s revenue of $488.5 million surpassed projections of $463.1 million. The stock declined more than 8% in the next trading session following the report.

Analyst outlook remains positive, with a consensus rating of “Strong Buy.” Out of the 20 analysts monitoring PODD, 16 endorse a “Strong Buy,” one recommends a “Moderate Buy,” and three advise a “Hold.” The average price target among analysts stands at $248.16, suggesting a potential upside of 4.9% from current price levels.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information contained in this article is intended for informational utility. For further details, please refer to the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily represent the views of Nasdaq, Inc.